SEK 11 billion into investment funds in May

[2017-06-09] In May total net sales of investment funds amounted to SEK 11 billion. The largest deposits were made into bond funds with a net inflow of over SEK 7 billion followed by net inflows in equity funds of 3 billion. More than SEK 5 billion of the net saving came from repayments of fees (rebates) in the premium pension system. The total fund assets in Sweden increased during May by SEK 40 billion and amounted at the end of the month to a new record-high level, SEK 3 869 billion.

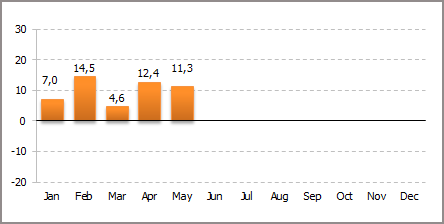

Investment funds recorded a total net inflow of SEK 11.3 billion in May. Bond funds recorded net deposits of SEK 7.4 billion, equity funds had a net inflow of SEK 3.0 billion and balanced funds SEK 2.4 billion while money market funds on the other hand recorded net outflows of SEK 1.2 billion in May.

So far in 2017, total net sales of investment funds amounts to SEK 49.7 billion, of which 26.6 billion have been invested in equity funds.

“Characteristic for fund savings in May was that bond funds accounted for the largest inflow, which could be interpreted as a willingness of the active savers to decrease risk before the summer. For equity funds savers chose mostly European funds and sold US funds, a behavior we also noticed in April”, says Fredrik Pettersson, Chief Analyst of the Swedish Investment Fund Association.

The value of the Stockholm Stock exchange (including dividends) rose by almost 2 percent. Equity funds had a total net inflow of SEK 3.0 billion during the month. The largest net deposits were made in European funds followed by global funds, whereas North America funds and emerging market funds (other markets) recorded net withdrawals during the month. So far this year, equity funds have shown a total net inflow of SEK 26.6 billion, of which over 22 billion have been allocated to index funds.

Bond funds had a total net inflow of SEK 7.4 billion in May. One part of this were made in corporate bond funds, with a recorded net inflow of SEK 2.9 billion.

The total fund assets in Sweden increased in May by SEK 43 billion and amounted at the end of the month to a record-high SEK 3 869 billion. Of the total fund assets, SEK 2 261 billion (equivalent to 58 percent) was invested in equity funds.

For information about the statistics:

Fredrik Pettersson, Chief Analyst, the Swedish Investment Fund Association

+46 (0)8 506 988 03, +46 (0)733-12 55 77, fredrik.pettersson@fondbolagen.se

Net sales of investment funds 2017, SEK billion

Tags: