New forecast: Global boom starting to cool

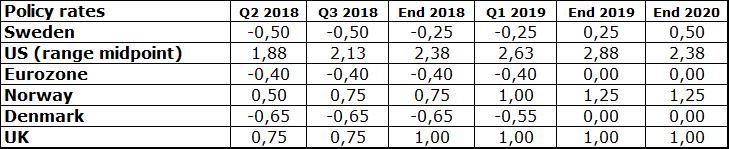

In Handelsbanken's second macro forecast for the year, we note that the Swedish economy is strong at the moment, but we expect growth to taper off ahead. Housing construction will soon slow and external support will eventually diminish. The economic upturn has contributed to exceptional jobs growth and gradually rising inflation. As a consequence, we expect the Riksbank to initiate rate hikes in December. The Swedish krona will gradually strengthen from today’s weak level.

- Swedish economy in full swing, but construction will soon slow

- The Riksbank will raise the policy rate in December

- Bottlenecks and higher interest rates slowing global growth

We expect 2018 to be another strong year for global growth, but the rate of growth is close to a peak. Capacity constraints are becoming more pronounced and monetary policy is beginning to tighten. We are still more pessimistic about growth than consensus for 2019 and 2020. Even though we have raised our forecasts for the US economy and hence also for global growth, we expect a slowdown to begin next year in the US, where the business cycle is most mature. The risks to our forecast come mainly from escalating protectionism and spiralling inflation, with the latter being even more noticeable due to US fiscal stimulus.

The Swedish economy has been in full swing lately. Due to external support, export market production is firing on all cylinders. Much indicates that the favourable setting will last a while yet, with particularly strong optimism among businesses. However, despite the global economic boom, several leading indicators signal weaker GDP growth later this year. In particular, the slowdown in Swedish housing construction will cause growth to decline, though not drastically. Despite the upswing, wage increases have been moderate and underlying inflation lower than expected. Inflation has, however, been on a rising trend and will be maintained in the near future by higher energy prices and a weak krona. The Riksbank has the inflation target within reach, but we think it will delay the first interest rate increase to December. Market expectations of higher interest rates will gradually lead to a stronger krona.

For further information, please contact:

Ann Öberg, Chief Economist, +46 8–701 2837, +46 76–135 5815

Christina Nyman, Head of Forecasting, +46 8–701 5158, +46 70–778 7765

For more information about Handelsbanken, see www.handelsbanken.com

For the full report in Swedish see Makroprognos

For the full report in English, see Global Macro Forecast

*Calendar-adjusted

Source: Handelsbanken Capital Markets

Source: Handelsbanken Capital Markets

Source: Handelsbanken Capital Markets

Tags: