Patchy recovery with bright spots

The recovery in the world economy is patchy with bright spots. We expect a gradual economic slowdown in the US to likely end in recession within a year or two. The legacy of high debt in parts of the eurozone still holds back growth. There is hardly any room to cut rates in developed economies, so central banks are focusing on exchange rates as a means of boosting growth. For commodity-driven economies, the end of the supercycle is likely to take time to overcome. In the Nordics, Sweden remains at the top of the growth league.

Growth in the US, which will primarily be driven by domestic demand, is likely to slow as monetary policy is tightened. The Fed will only increase interest rates cautiously in 2016, but it is likely to increase the pace of rate hikes in 2017 once inflation picks up. The economy is likely to be hit by recession within one or two years’ time.

In weaker eurozone economies, deflationary tendencies are likely to persist. A high degree of labour market slack is pushing wages and prices down, thereby hurting indebted countries in particular. The ECB’s main channel of boosting inflation and growth is the exchange rate; however, additional expansionary measures are required to weaken the euro. We anticipate that it will take at least three years before policy rates can be lifted.

China has room for fiscal policy measures to handle problems associated with industries shutting down and bad loans. Several economies in Asia are likely to enjoy high growth, including some fairly closed economies relying on domestic demand and some low-cost producers benefiting from continued production shifts away from China or other higher-cost producers.

In the UK, heightened fears about ‘Brexit’ have weakened sterling significantly. As a result, inflationary pressures are now increasing. But the rising risk of Brexit and the subsequent dent in growth have led market participants to push rate hike expectations by the BoE far into the future. Big currency and interest rate movements are therefore likely, whatever the outcome of June’s Brexit referendum. At present, opinion polls are evenly balanced between Stay and Leave, but we lean toward no Brexit as the more likely outcome.

Growth in Sweden is broad-based and strong, while growth in the other Nordic countries is much weaker. In Denmark, the bursting of the housing bubble and high household debt have pressed private consumption down, while uncertain economic prospects hamper business investment. The Finnish economy is still hurting from the collapse of its IT sector and paper industry alongside the loss of the Russian export market. Finally, Norwegian growth has been hard hit by the sharp fall in oil prices. Exports of investment goods for oil exploration and domestic investment in the oil sector have declined sharply.

For further information, please contact:

Jan Häggström, Chief economist, +46-8 701 10 97, +46 70 761 43 66

For more information on Handelsbanken, see: www.handelsbanken.se

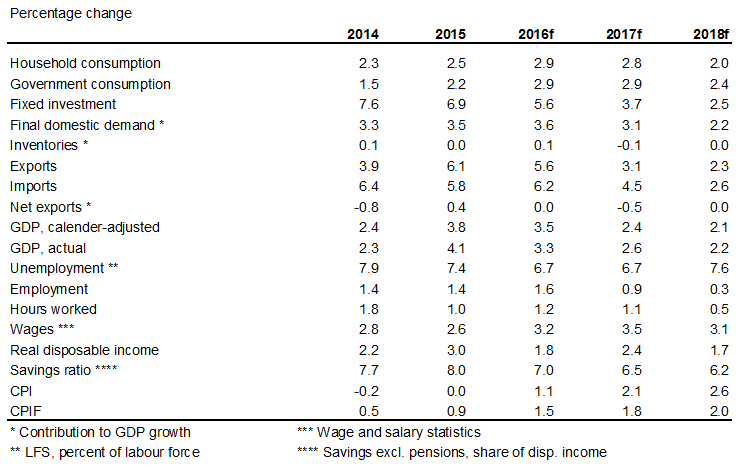

Forecast for Sweden

Handelsbanken Capital Markets

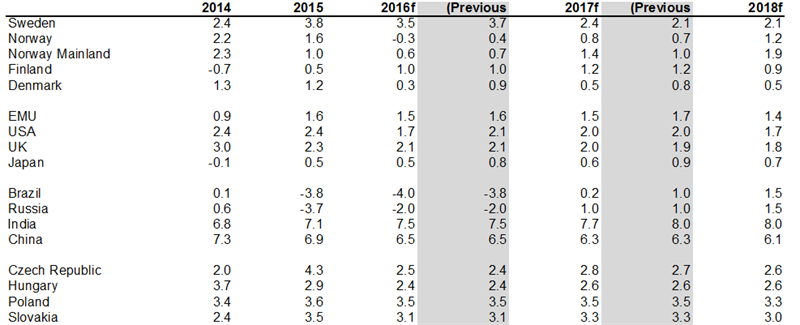

Real GDP forecasts

Source: Handelsbanken Capital Markets

Interest rate forecasts

Source: Handelsbanken Capital Markets

Currency forecasts

Source: Handelsbanken Capital Markets

Tags: