Interim Report January – September 2018

Significant events during the third quarter 2018

- A rights issue raises SEK 32.4 million after issue costs.

- The board of directors is extended by one person at an EGM.

- The management team is restructured and extended.

- An application for listing of the shares submitted to Nasdaq First North.

- DFS work continues with inter alia hydrogeology field work.

Third quarter, 1 July – 30 September 2018

- Income amounted to SEK 0 million (0)

- Earnings after tax amounted to SEK – 2.5 million (–2.2)

- Investments in the period July - September totalled SEK 4.6 million (3.6)

- Basic earnings per share were SEK –0.13 (–0. 02)

Interim period, 1 January – 30 September 2018

- Income amounted to SEK 0 million (0)

- Earnings after tax amounted to SEK –7.5 million (–7.1)

- Investments in the period July - September totalled SEK 8.3 million (7.6)

- Basic earnings per share were SEK –0.55 (–0.80)

- Cash and cash equivalents on 30 September 2018 amounted to SEK 21.2 million (5.7)

Significant events after the end of the period

- First day of trading for the share was on 1 October.

Comments from the Managing Director

The last few months have been eventful. In June, we conducted a successful preferential rights issue and on the first of October, the stock was listed on NASDAQ First North. In addition, iron ore prices are developing in the right direction.

No one can question the fact that Nordic Iron Ore is developing in the right direction, and as I summarise our position, the future looks bright. Firstly, demand for the ore products we produce is increasing, thus driving up prices – high-quality “fines”.

Secondly, we know that Blötberget contains mineral resources that enable a production of 1.4 million tonnes per year for 12 to 13 years. Thirdly, we have a very substantial advantage in that the infrastructure needed to transport iron ore products cost-efficiently, that is, rail and harbour, are in place. In addition, we already possess the necessary permits for mining Blötberget.

Thanks to these four advantages, I am optimistic about the future of Nordic Iron Ore. Looking to the iron ore market, the price for the standard quality has been moderately stable and the clear market division of high-grade ore and medium-grade ore (Fe 62%) has received increasing attention from analysts and the media.

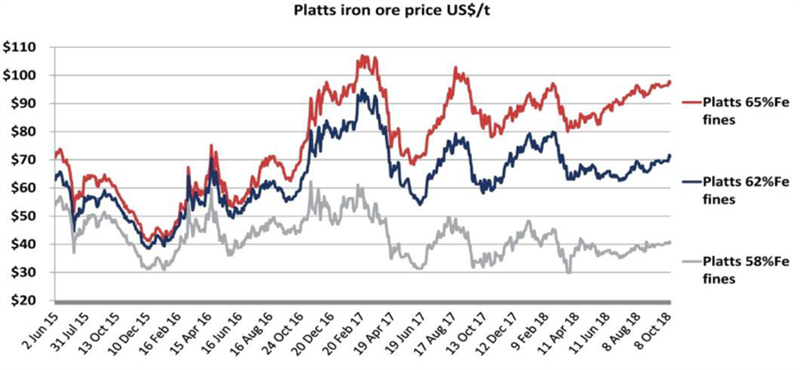

The world market price for 62% iron ore has exceeded 70 dollars per tonne while the price for 65% ore has risen to closer to 100 dollars per tonne (see the graph below).

This development is good news for NIO as we exclusively focus on the high-grade niche with grades surpassing 65%. The fact that the driving force behind this development is environmental concerns speaks for it not being of a temporary nature.

Third quarter of the year

The company's third quarter was eventful. The issue, which generated MSEK 32.4 after issue costs, was closed in the beginning of July, after which, the stocks were merged on 8 August.

In August, an extraordinary general meeting was held and the Board gained Gösta Bergman as a member. He is a solicitor with experience in the early stages of mining projects and is fully independent of the company and large owners. And with this, the requirements for listing on NASDAQ First North were met and we could submit a formal application.

On the first of September, the management team was reorganised and increased in number. Paul Marsden handed over the CEO title to me, but continues to actively support Nordic Iron Ore within his specialist areas. At the same time, Markus Karlsson was appointed project manager and site manager for the local mining operations. Markus has been involved in the projects for an extended period of time, particularly as an expert in the area of mining and mining-related issues. Personally, I have held the positions of CFO since 2011 and Vice President since 2015. These years have given me insight into the mining industry and an understanding of how important it is to involve experienced employees and advisers, something I think our current team line up lives up to.

In the spring 2019, we will present the results of the feasibility study currently being conducted. The study will be extensive and provide a technical description of the mine development, the basis of design and the associated mine developments costs in the economic analysis. Included in the details will be the selection of equipment, plans for construction, staffing and production.

The positive market situation, the abundance of high-grade ore at Blötberget, that we have logistics in place and that all permits have been obtained and, not least, that we are beginning to see the finish line with regards to the feasibility study, are all factors that make us eager to start building the mine and start operations.

For further information please contact:

Lennart Eliasson Managing Director

phone: +46 70 640 5177

lennart.eliasson@nordicironore.se

Nordic Iron Ore Group is a mining company with the ambition to revive and develop the iron ore production of Ludvika Mines in Blötberget and Håksberg. The company also intends to expand its mineral resources, and upgrade them to ore reserves, primarily through exploration and other studies of the connecting Väsman field. The Company has all the necessary permits in place for the mine in Blötberget and will be able to produce iron ore of extremely high quality.

For more information, see www.nordicironore.se.

Nordic Iron Ore’s shares and warrants are listed at Nasdaq First North Stockholm. Wildeco is the company’s Certified Adviser.

This information is required and provided by Nordic Iron Ore AB (publ) under the EU Market Abuse Regulation. The information was provided by Cision for publication at the date and time set above.