AGREEMENT TO ACQUIRE MANOR FARM – THE LEADING CHICKEN PROCESSOR IN IRELAND

Scandi Standard AB (publ.) (SCST SS) is pleased to announce that it has entered into an agreement to acquire Manor Farm, the largest chicken processor, and market leader, in the Republic of Ireland (Ireland). The business had net revenues of EUR 164 million and EBITDA of EUR 13 million in 2016. The agreement values Manor Farm at an enterprise value, based on the closing price for the Scandi Standard shares on 26 June 2017, of EUR 94 million. Settlement will be a combination of 6 million Scandi Standard shares (“Consideration Shares”), an earn-out mechanism, cash and the assumption of outstanding interest-bearing debt. Completion of the transaction is subject to customary conditions, including approval of the issuance of the Consideration Shares at an Extraordinary General Meeting of Scandi Standard. The four largest shareholders, representing approximately 29% of Scandi Standard’s share capital, support the transaction.

Transaction rationale

- Profitable and well-run operations

- Clear market leader in a market with strong preference for local produce

- Capable and experienced management team with a strong track record

- Tangible best practice opportunities identified

- Significant EPS accretion

- Attractive EV/EBITDA acquisition multiple

- Post transaction leverage ratio unchanged

- Risk diversification through a new geographical presence

About Manor Farm

Manor Farm sources and processes approximately 50% of all fresh chicken sold in the Irish retail market and approximately 25% of all chicken consumed in Ireland. The business focuses on fresh products for the retail market, selling to a diversified customer base. The business has its processing plant in Shercock in County Cavan. It has approximately 130 farmers contracted as growers and approximately 43 farmers contracted as breeders. It owns and operates a feed mill, which has revenues of approximately EUR 80 million and produces solely for its contracted growers. In the accounts, feed revenues will be eliminated from Manor Farm’s net revenues. The combined entity generated an EBITDA of EUR 13 million in 2016. Manor Farm employs approximately 850 people.

Manor Farm is one of the oldest family businesses in Ireland, tracing its origin to 1775 when the founder, Peter Carton, set up a business in Dublin’s fruit and vegetable markets. Recognising the opportunity for a poultry market, he began trading in all forms of poultry. Since then, the Carton family have continued the business. In 1956, they opened a chicken processing plant in Dublin, introducing modern chicken products to the Irish market, and in 1970 they moved their business to a new custom-built processing plant, which has been expanded and upgraded continually since then.

Vincent Carton and Justin Carton are the eighth generation of the family in the business. They succeeded their father, Thomas P. Carton, who was involved in the business for 69 years. Over the past generation, Vincent and Justin and their management team have worked closely with Irish retailers and farmers to create a stable and sustainable supply of Irish produced chicken that meets an increasingly discerning consumer demand.

About the Irish poultry market

The dynamics of the Irish poultry processing market are very similar to those in the Nordic markets. The market is well consolidated with three domestic players of scale. Manor Farm has a market share of about 50% for fresh chicken products sold through retail in Ireland. As in Scandi Standard’s existing markets, there is a strong preference for domestic produce in the retail channel, and the fresh segment is well developed. Importers distribute mainly to food service, butchers and industrial segments. The consumer market in Ireland is similar to the Nordic markets in terms of size, population and GDP.

Leif Bergvall Hansen, CEO of Scandi Standard, states: “I am enthusiastic about the deal as Manor Farm satisfies all of our acquisition criteria. The company has profitability in line with our existing operations, is well run and is the clear market leader in chicken in the Irish retail market. With its capable and experienced management team, the business can be run with a high degree of autonomy whilst additional steps, which have been identified, can be taken to capture the benefits of best practice. As many of our risks are country specific, the acquisition is also likely to reduce our earnings volatility through diversification.”

The transaction

The deal values Manor Farm at EUR 94 million (Enterprise Value) based on Scandi Standard’s closing share price as of 26 June 2017 (SEK 52.5). Settlement is agreed to consist of the Consideration Shares, equivalent to 9.99% of the current share capital of Scandi Standard; four earn-out tranches with payments calculated on the basis of the EBITDA achieved by Manor Farm in 2017, 2018, 2019 and 2020 respectively, which have a nominal aggregate base amount of EUR 25.4 million; and the balance, EUR 36.3 million, in the form of cash payments and assumption of outstanding interest-bearing debt. Completion of the transaction is subject to customary conditions, including approval of the issuance of the Consideration Shares at an Extraordinary General Meeting of shareholders of Scandi Standard. The transaction is expected to close during the second half of Q3.

The vendors of Manor Farm have agreed to a 12-month lock-up on the Consideration Shares commencing from their first day of trading.

The first earn-out tranche of EUR 0.4 million will be paid if 2017 EBITDA exceeds EUR 13 million. The three later earn-out tranches, which have a nominal aggregate base amount of EUR 25 million, are subject to adjustment based on the actual EBITDA performance in each of the earn-out years 2018, 2019 and 2020 as compared to the 2016 EBITDA. For the calculation of each earn-out payment, a sliding EV/EBITDA multiple scale is applied, ranging from a minimum multiple of zero to a maximum multiple of 9. The earn-out tranches will be paid upon availability of audited accounts for the relevant year, verifying EBITDA. The agreement includes a provision whereby the vendors of Manor Farm would be eligible for a minimum of the base earn-out amount at maturity of each of the remaining earn-out tranches if there is a change of control in Scandi Standard.

Manor Farm has a very experienced management team with a strong track record. Five members of the management team currently own 100% of Manor Farm, and as shareholders in Scandi Standard they will continue to lead and develop the business in alignment with the rest of the Scandi Standard group. Vincent Carton and Justin Carton, who currently hold 85% of the financial interest in Manor Farm, intend to remain as Scandi Standard shareholders over the longer term, and Vincent Carton has agreed to join the Board of Directors of Scandi Standard if proposed by the Nomination Committee and elected by the General Meeting.

Leif Bergvall Hansen states: “We are also pleased that the financial criteria are met in terms of expected EPS accretion and an attractive acquisition multiple. Furthermore, the limited upfront cash consideration leaves our leverage ratio largely unaffected by the transaction, which is an important criterion in terms of allowing a competitive direct yield going forward. Finally, the transaction structure secures alignment of interests and clear incentives for management to further develop the business. We look forward very much to being part of the Irish food processing industry and to building on the strong relationships of Manor Farm in that market.”

Vincent Carton, CEO of Manor Farm, states:

“In considering a succession of ownership for our family business, my brother Justin and I have been determined to find a partner that can continue to build on our strong relationships with customers, employees, suppliers and the broader communities in which we operate. As the next generation of Cartons have chosen to pursue other business interests, we set out to find a partner with high standards, a culture similar to our own and the capability to develop the business to its fullest potential.

We believe that Scandi Standard is the ideal partner, and we are delighted to have agreed a transaction structure that allows the current management to remain fully in place and that also allows the Carton family to become shareholders in Scandi Standard. We believe that this arrangement will serve our customers, employees, and suppliers well, and we look forward very much to the next chapter in the history of Manor Farm.”

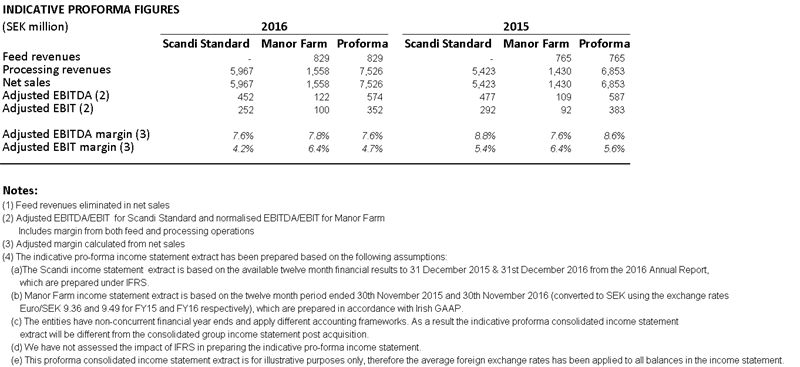

Preliminary proforma figures and accounting matters

Transaction costs are estimated at a little over 2% of EV, including stamp duty of 1% of the purchase price. The identified improvement potential is partly reliant on capital expenditures and certain measures to align operations with industry best practice. The phasing of such investments and measures will be resolved on a case by case basis within the general planning framework of the Scandi Standard group, and be communicated and accounted for accordingly.

Financing

The payment of the purchase price will be financed by an issuance of six million shares in Scandi Standard and the cash payment and transaction costs will be financed by a combination of available cash and existing bank facilities.

Extraordinary General Meeting (EGM)

Scandi Standard’s Board of Directors will shortly call an EGM to seek approval for the transaction through a proposal to authorise the board to issue the Consideration Shares. The date for the EGM is planned to be on or about 15 August 2017. Scandi Standard has approached its four largest shareholders, representing a total of approximately 29% of the current share capital, who support the authorisation for the board to issue the Consideration Shares at the EGM. The EGM resolution will require approval from 2/3 of the votes cast and shares represented at the EGM.

Issuance of the Consideration Shares

The Board of Directors will resolve to issue the 6 million Consideration Shares following the EGM’s authorisation. The purpose of the issuance is to pay in part for the acquisition of Manor Farm and the shares will be subscribed for by the sellers of Manor Farm. The issuance will result in a share capital increase of approx. SEK 60,000. The issue price for the shares will be approx. EUR 36 million. The Consideration Shares are expected to be issued in connection with closing of the acquisition, i.e. in the second half of Q3.

Presentation of the acquisition

Scandi Standard will hold a presentation about the acquisition of Manor Farm on Tuesday 27 June 2017 at 09.30 CET. The presentation will be hosted by Leif Bergvall Hansen, CEO and Henrik Heiberg, Head of M&A, Financing and IR.

Dial In numbers:

Sweden 0850 510 036

United Kingdom 0800 368 0649

All other locations + 44 20 3059 8125

The presentation used in the conference call will be published at http://www.scandistandard.com prior to the call.

The conference call will also be audio webcasted in “listen-only” mode at the Scandi Standard website.

For further information please contact:

Leif Bergvall Hansen, CEO of Scandi Standard (+45 22 10 05 44)

Henrik Heiberg, Head of M&A, Financing and IR, Scandi Standard (+47 917 47 724)

This information is information that Scandi Standard AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 0730 CET on 27 June 2017.

ABOUT SCANDI STANDARD AB (publ.)

Scandi Standard is the largest producer of chicken-based food products in the Nordic region with leading positions in Sweden, Denmark, Norway and Finland. The company produces, markets and sells ready to eat, chilled and frozen products under the strong brands Kronfågel, Danpo, Den Stolte Hane and Naapurin Maalaiskana.

In 2016 Scandi Standard produced approximately 130 million chickens, had net sales of 6,000 MSEK and 1.700 employees.

In 2014 Scandi Standard was introduced on the Stockholm stock market.

OECD (http://www.fao.org/3/a-i3818e.pdf) has forecasted that half of the world's protein intake will come from chicken in the year of 2023. Several trends drive the demand, such as:

- Increased health consciousness

- Superior environmental profile

- Convenient and easy-made

- Lower production costs than red meat

Scandi Standards strategy for profitable growth is to drive organic growth, increase the cost effectiveness and make strategic acquisitions and partnerships.

IMPORTANT INFORMATION

This press release does not contain or constitute an invitation or an offer to acquire, sell, subscribe for or otherwise trade in shares or other securities in Scandi Standard. This press release has not been approved by any regulatory authority and is not a prospectus.

This press release contains forward-looking statements which reflect Scandi Standard’s current view on future events and financial and operational development. Words such as "intend", "will", "expect", "anticipate", "may", "plan", "estimate" and other expressions than historical facts which imply indications or predictions of future development or trends, constitute forward-looking statements. Forward-looking statements inherently involve both known and unknown risks and uncertainties as they depend on future events and circumstances. Forward-looking statements do not guarantee future results or development and the actual outcome could differ materially from the forward-looking statements.

The information, opinions and forward-looking statements concluded in this announcement speak only as of its date and are subject to change without notice.

Tags: