Late payments hampers growth and job creation – yet 37% of debts in Europe remain unpaid after 30 days

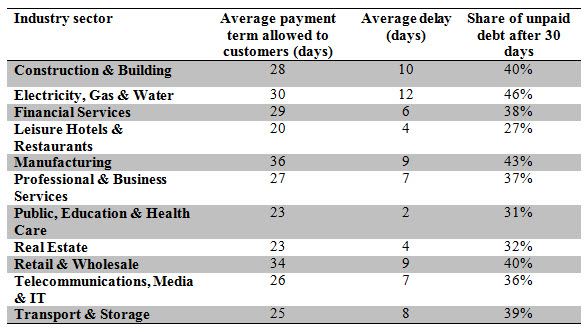

Many of Europes business owners struggle from the fact that their clients are unable to pay their debts on time, with negative effects on financial growth and job creation as a result. In business to business transactions the average payment term given is 28 days, still 37% of all outstanding debts are unsettled after 30 days.

Costs for late payments are high; all in all 3.1% of yearly revenues has to be written off because companies do not receive sufficient payment. This corresponds to EUR 289 billion, money that could have been invested in growth and job opportunities.

Industry sectors are impacted in various ways by this. Businesses in the Construction and Building Sector see 3.9 % of their revenues having to be written off and are one of the sectors that are impacted the most from late payments. The average payment term given to B2B clients is 28 days, however, 40% of all outstanding debts are paid in more than 31 days and as much as 11% of all outstanding debts in the sector take more than 90 days to settle.

Also the utility sector (Electricity, Gas & Water) face difficult challenges due to late payments. The sector sees more than 10 days of delay on average in Europe and 46% of outstanding debts are unpaid after the contracted payment term.

The consequences are severe. Being one of the worst hit, 53 % of the respondents in the Construction & Building sector sees liquidity squeeze as a consequence of late payments and 50% say that they lose income from it.

The EPR Industry White Paper 2015 also reveals that late payments are threatening jobs. In the transport and storage sector 46% of the respondents say that the fact that they do not get paid on time are hindering them from start recruiting and 42% say that would start hiring if they just got paid faster.

Another appalling example is the Leisure, Hotels & Restaurants Sector, a sector that is typically expected to take on a lot of young manpower. One fourth (25%) say that they even need to consider reducing staff because of late payments and 34% say that they are unable to recruit.

About Intrum Justitia

Intrum Justitia is Europe’s leading Credit Management Services (CMS) group, offering comprehensive services, including purchase of receivables, designed to measurably improve clients’ cash flows and long term profitability. Founded in 1923, Intrum Justitia has some 3,800 employees in 20 markets. Consolidated revenues amounted to SEK 5.2 billion in 2014. Intrum Justitia AB is listed on NASDAQ OMX Stockholm since 2002. For further information, please visit www.intrum.com

About the EPR Industry White Paper

The EPR Industry White Paper 2015 from Intrum Justitia reveals how Europe’s economic health is impacted as companies battle late payment and bad debt, a development that in the end slows job creation, business growth and technology investments and innovation. The significant difference in debt loss and payment delays being suffered by different industry sectors on a European level is highlighted in this white paper.

For more information

Annika Billberg, Group Sales, Marketing & Communications Director

Tel: 08-546 102 03

Mobile: 0702-67 97 91

Email: a.billberg@intrum.com

Intrum Justitia is Europe’s leading Credit Management Services (CMS) group, offering comprehensive services, including purchase of receivables, designed to measurably improve clients’ cash flows and long-term profitability. Founded in 1923, Intrum Justitia has some 3,800 employees in 20 markets. Consolidated revenues amounted to about SEK 5.2 billion in 2014. Intrum Justitia AB is listed on Nasdaq Stockholm since 2002. For further information, please visit www.intrum.com