Akobo Minerals receives very positive results from its metallurgical testwork with potential for greater than previously expected revenue generation

Akobo Minerals has received the testwork results from the Peacocke and Simpson Laboratory. The positive results of these gold extraction tests give potential for greater than expected revenue generation to that proposed in the Scoping Study (27.09.2021), at similar operating costs.

The metallurgical testwork gives an indication of how much gold is expected to be recovered as if the cores/bulk samples had been treated with conventional gravity recovery and cyanide leaching unit operations. Samples were taken from a total of 3 holes drilled at Segele to generate 248kg for testwork purposes.

- Better than expected gold recovery of up to 97.2% achieved, as compared to 90% assumed in the Segele Scoping Study – directly improving expected future revenue

- The testwork confirms that good recovery is possible from a very simple processing operations

- The grade of the bulk sample was found to be 31.01g/t*, significantly higher than the 20.9g/t average grade for the Segele Mineral Resource estimate

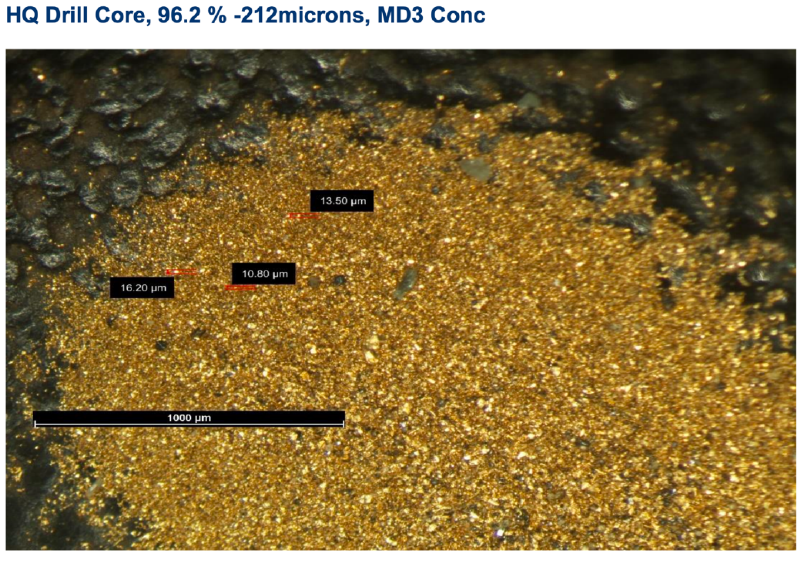

Gold concentrate produced from the metallurgical testwork (scalebar 1000µm = 1millimeter)

The testwork shows a good gravity gold recovery of 76.0% with an additional recovery of up to 21.3% with cyanide leaching of the gravity tailings. Also grindability results indicated a slightly softer ore than expected, with the possibility to install a smaller mill than assumed in the scoping study. These results can be considered to be unoptimized and hence improvements are still possible.

Now that the first stage of metallurgical testwork is complete, Akobo Minerals will advance to plant design. For that purpose Peacocke and Simpson has a strong partnership with Appropriate Process Technologies (Johannesburg, South Africa). APT have provided over 200 small and medium scale plants to over 23 countries since 2007. Recent projects delivered by APT include:

- Scotgold, United Kingdom (7.5t/hr crushing, grinding, gravity plant)

- Yaron, Zimbabwe (20t/hr Combo gold plant)

- CATA, Tanzania (40t/hr, Tritank CIL)

- And many more

Akobo Minerals intends to investigate alternatives for building and operating its Segele mine – especially for underground mining activities. For example, in order to reduce the risk of delayed production start and other operational risks, it is realistic to look at using contract mining. Outsourcing such activities is possible given the excellent project economics and will allow the company to focus on processing plant operation and reaching the company objectives of defining 1.5 to 2 million ounces.

For more information contact

Jørgen Evjen, CEO

Mob.: (+47) 92 80 40 14

Mail: jorgen@akobominerals.com

*The calculated built up head grade of 31.01g/t was obtained in metallurgical testwork by gold extraction and assay the extracted gold to extinction for the entire 248Kg bulk sample, a process which closely simulates the real-world commercial extraction of gold. The head grade reported here is greater than that expected from the Mineral Resource Estimate (20.9g/t, SRK 6th April 2021). This increased grade is possibly due to the interaction of two factors: Firstly, the minimisation of nugget effect, and secondly the spatial variation of grade through the deposit. At the present time it is not possible to determine which factor has the largest influence and the reader is warned against assuming an increase in expected grade.

About Akobo Minerals:

Akobo Minerals, is a Norway-based gold exploration company, currently with ongoing exploration and small-scale mine development in the Gambela region and Dima Woreda, southwest Ethiopia. The operations were established in 2009 by people with long experience from the public mining sector in Ethiopia and from the Norwegian oil service industry. Akobo Minerals holds a mining licence and an exploration license over key targets in the area. Economic mineralisation was discovered and the company is engaged in mining studies to advance the project to production, alongside exploration core drilling. Akobo Minerals is transforming its organisation to support an increased pace of core drilling. At both the key targets Segele and Joru the company has so far released exceptionally high-grade gold results including the Segele deposit with an Inferred Mineral Resource of 78ktons at 20.9g/t. A scoping study for Segele includes an up-front capital expenditure of USD $8m and all-in sustaining cost of USD $243 per ounce of gold produced. Core-drilling and trenching at Joru have intersected both high-grade gold zones and large wide zones near surface. The company has an excellent partnership with national authorities and places ESG at the heart of its activities - a ground-breaking community program is being planned.

About Peacocke and Simpson:

Peacocke & Simpson is an industry leading minerals processing company, with over 30 years of experience in relevant mineral testwork and plant design. Established in 1985, Peacocke & Simpson has vast experience in the minerals processing industry, providing relevant and meaningful mineral testwork on nearly all hydrometallurgical processes for nearly all minerals. Based in mineral-rich yet underdeveloped and logistically challenging Africa, they understand that their clients require practical solutions and results.

Important information:

This release is not for publication or distribution, directly or indirectly, in or into Australia, Canada, Japan, the United States or any other jurisdictions where it would be illegal. It is issued for information purposes only and does not constitute or form part of any offer or solicitation to purchase or subscribe for securities, in the United States or in any other jurisdiction. The securities referred to herein have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), and may not be offered or sold in the United States absent registration or pursuant to an exemption from registration under the U.S. Securities Act. Akobo Minerals does not intend to register any portion of the offering of the securities in the United States or to conduct a public offering of the securities in the United States. Copies of this publication are not being, and may not be, distributed or sent into Australia, Canada, Japan or the United States.