Interim Report First Quarter 2020

Good Growth and Profitability Increase from Q4 2019

FIRST QUARTER AND APRIL

Numbers in brackets refer to Q1 2019 unless other stated.

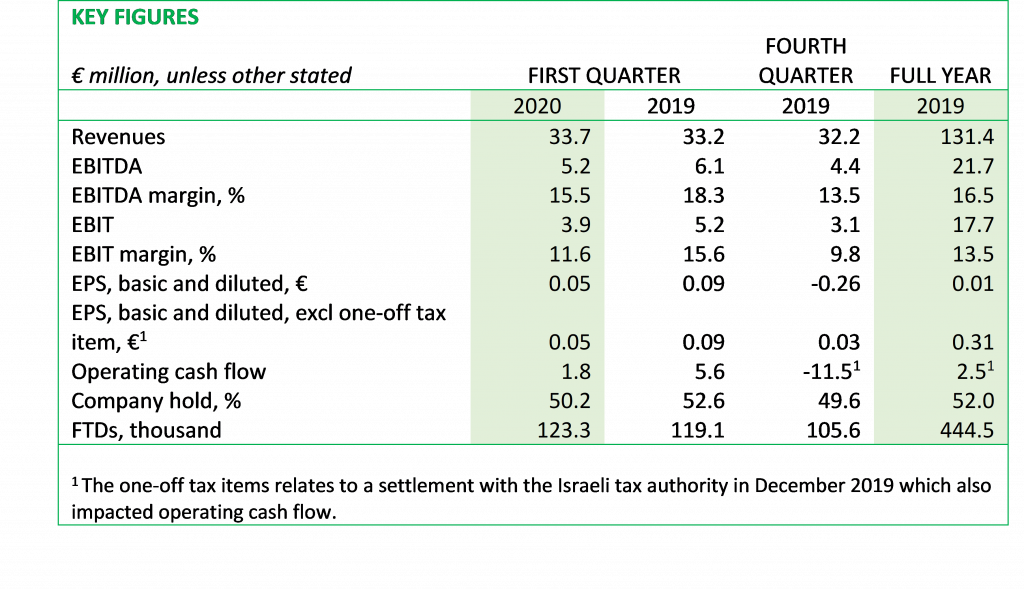

• Revenues increased by 1.5% to €33.7 million (33.2) and increased by 4.6% from Q4 2019.

• EBITDA decreased by 14.2% to €5.2 million (6.1) and increased by 19.7% from Q4 2019.

• The EBITDA margin amounted to 15.5% (18.3%) and increased two percentage points from Q4 2019.

• EBIT decreased by 24.4% to €3.9 million (5.2) and increased by 24.7% from Q4 2019.

• Earnings after tax amounted to €2.4 million (4.1).

• Earnings per share, basic and diluted, amounted to €0.05 (0.09).

• First time depositors (FTDs) increased by 4% to 123,300 (119,100).

• In April total trading volumes increased to about €13.5 million, which is about 20% higher than the average monthly trading volume in Q1 2020.

SIGNIFICANT EVENTS IN THE QUARTER AND AFTER THE END OF THE QUARTER

• Proactive measures taken in relation to the spread of COVID-19 in order to reduce health risks for employees and to ensure business continuity.

• Growth of 4.6% from Q4 2019 driven by robust underlying business with limited impact from the COVID-19 pandemic. As a consequence of the pandemic, players choose online entertainment over landbased and in April total trading volumes increased to about €13.5 million, which is about 20% higher than the average monthly trading volume in Q1 2020.

• Swift adaption to new regulatory requirements in regulated markets such as the UK in Q4 2019 revenues increased by 35% in the UK and Ireland from Q4 2019.

• Good business momentum – in B2B core platform three new partner deals signed and two new brands launched, a sport vertical has been added to an existing partner and a successful migration was completed. In B2B games business line six proprietary games were released and two new markets entered – Portugal and Romania through new deals for games.

• In B2C EBITDA was positively impacted by successful marketing optimizations and the EBITDA margin increased significantly by 4.6 percentage points from Q4 2019 to 13.0%.

• As of 1 January 2020, a new sub-segment is reported in segment B2B which includes the games business line.

• Jesper Kärrbrink, former CEO of e.g. Mr Green and Svenska Spel, appointed Chairman of Aspire Global’s subsidiary Pariplay.

COMMENTS FROM THE CEO

The good growth and improved profitability in Q1 2020 from Q4 2019 are encouraging and prove our business model to be efficient with a strong offering. Revenues increased by 4.6% from Q4 2019 with a substantial profitability increase as the EBITDA margin grow from 13.5% to 15.5%. In the quarter we saw limited impact from the pandemic. However, as a consequence of the pandemic, players choose online entertainment over landbased, and in April total trading volumes increased to about €13.5 million, which is about 20% higher than the average monthly trading volume in Q1 2020.

The world is going through challenging times during the pandemic. Early in the quarter we took proactive measures to reduce the health risks for the employees and to ensure business continuity. Thanks to a robust underlying business and dedicated employees, service levels remained high. The impact from the cancellation of sports events was insignificant due to a limited exposure to sports and in Q4 2019 sports betting represented about 5% of total revenues. The sequential improvement is mainly due to a strong business momentum.

It is encouraging to see that we have mitigated the impact in Q4 2019 from new regulatory requirements in markets such as the UK and from Q4 2019 revenues in the UK and Ireland increased by 35%. Compliance is on top of our agenda and we know that this is a key competitive advantage.

INCREASED PROFITABILITY

EBITDA increased by 19.7% to €5.2 million from Q4 2019 and the EBITDA margin improved from 13.5% to 15.5%, mainly due to higher volumes. Compared to Q1 2019 the lower EBITDA margin is reflecting our strategy to focus on locally regulated and taxed markets where the margin on partner deals are lower. On the other hand, revenues from locally regulated and taxed markets are over time more sustainable with less political risks. The revenue share from taxed, locally regulated or soon to become regulated markets increased from 69% in Q1 2019 to 75%, proving our ability to grow in locally regulated markets with good profitability.

With the acquisition of the game aggregator and game studio Pariplay last year, we became the complete iGaming supplier for operators. We clearly see the synergies we get from the integration of Pariplay when its powerful game offering is combined with our leading iGaming platform. We are targeting tier 1 and 2 iGaming operators and have today significant customers and partners such as 888, GVC, Codere and Mr.play. In the quarter, we could see that our recently added partners to our core platform are performing better than they expected, making us confident in the strategy to focus on bigger brands.

NEW PARTNER DEALS

During the quarter we have successfully continued the execution of our growth strategy and we have managed to settle a number of new deals and expand our platform and games to new markets, partners and clients. For example, we signed three new partners for our platform and two new brands went live on the platform. We signed two new major deals for our game offering and the games were launched in two new European markets; Portugal and Romania. In addition, six proprietary games were launched in the quarter and a French version of the platform was finalized, targeting selected francophone markets. One should note though, that we do not have the intention to apply for a license in France.

PLATFORM OFFERED AS STAND-ALONE SERVICE

Our B2B offering has been adjusted to be even more competitive and the platform is now being offered stand-alone or together with the choice of a wide range of services, making the full turnkey solution optional. The adjusted offering is better suited to target large and mid-sized iGaming operators who lack a proprietary platform, or land-based operators who aim to go online – an untapped and important market so far. The interest from potential clients is good and we look forward to progressing these dialogues during the year.

SIGNIFICANT GEOGRAPHIC EXPANSION

A key part of our growth strategy is geographic expansion. We are preparing ourselves for license applications in the Netherlands Q1 2021 and in Germany Q3 2021. We are also preparing to launch our games and aggregation platform in four new markets in 2020. We will be targeting Italy and Spain in Q2 2020 and New Jersey and Switzerland in Q3 or Q4 2020. I am of course especially excited by the opportunities in the huge US market.

GROWTH THROUGH M&A

We continue our active search for acquisitions and new projects that could broaden the offering for players, enhance the scale benefits of the platform or accelerate the B2B growth. It is our clear target to control more parts of the value chain in order to enable our partners to achieve their full potential. M&A processes have been impacted by the pandemic and slowed down temporarily. Though, we are ready to start these processes again as soon as the society is back to more normal routines.

SUSTAINABILITY IN FOCUS

A few weeks ago, we presented our first report according to the GRI Standard. To us, sustainability is mainly about responsibility: actively and credibly ensuring that our business does not attract a vulnerable audience, promotes unhealthy gaming behaviour or condones criminal activity. It is through correct segmentation, balanced marketing, effective gaming tools and proactive support that we can best help players to maintain sustainable consumption patterns based on their original intentions. We are convinced that this is the sustainable way forward, both operationally and financially.

OUTLOOK

We have been successful in securing business continuity during the pandemic and continue the execution of our growth strategy, capitalizing on our complete iGaming offering. As a consequence of the pandemic, players choose online entertainment over landbased, and in April total trading volumes increased to about €13.5 million, which is about 20% higher than the average monthly trading volume in Q1 2020. It is not possible for us to say how sustainable or long this effect will be, but thanks to our competitive offering and strong business momentum we are confident in our ability to continue to deliver profitable growth.

Tsachi Maimon

CEO

FOR MORE INFORMATION, PLEASE CONTACT

Tsachi Maimon, CEO, Tel: +356-7977 7898 or email: tsachi@aspireglobal.com

Motti Gil, CFO, Tel: +356- 9924 0646 or email: mottigi@aspireglobal.com

This is information that Aspire Global is obliged to make public pursuant to the EU Market Abuse Regulation (MAR). The information was submitted for publication by the contact person above at 8.15am CEST on 5 May 2020.

WEBCASTED PRESENTATION OF Q1 RESULTS

CEO Tsachi Maimon and CFO Motti Gil are presenting the Q1 2020 results at 5 May, 10:00am CEST, at Redeye.se. There is also an opportunity for viewers to ask questions after the presentation.

The complete interim report is available at: https://www.aspireglobal.com/wp-content/uploads/2020/05/Aspire-Global-Q120-Report.pdf

ANNUAL GENERAL MEETING

The Annual General Meeting 2020 takes place Wednesday 6 May 2020, 02.00pm CEST at the company’s head office in Malta. Shareholders can follow the meeting by joining Zoom Meeting. Meeting ID: 965 8385 5250. Password: 485641. The agenda and other documents are found on the company’s website.

ABOUT ASPIRE GLOBAL

Aspire Global is a B2B-provider for iGaming, offering companies everything they need to operate a successful iGaming brand for casino, sports and bingo. The B2B-offering comprises a robust technical platform and games. The platform is offered solely or combined with a range of services. The games include supply of proprietary titles and a hub for third-party games. In addition to the B2B-offering, Aspire Global operates several B2C-brands, including Karamba, the best showcase for the strength of the B2B-offering. The Group operates in several regulated markets including Denmark, Gibraltar, Ireland, Malta, Portugal, Romania, Sweden, the UK and the US. Offices are located in Malta, Israel, Bulgaria, Kiev, India and Gibraltar. Aspire Global is listed on Nasdaq First North Premier Growth Market under ASPIRE. Certified Advisor: FNCA Sweden AB, info@fnca.se, +46-8-528 00 399.

Please visit www.aspireglobal.com.