Year-end Report 2012 Axel Johnson AB

Growth initiatives in a challenging business environment

The Axel Johnson group developed well in 2012, despite the challenging market situation. Six out of seven group companies increased their sales and several gained market shares. A number of the companies’ earnings were affected by nonrecurring costs and ongoing IT and integration projects. The focus on fast adjustment of cost levels to changed conditions contributed to retained profitability.

Consolidated sales amounted to SEK 62,638 million (29,615), an increase of 7 percent after adjustment for the full-year effect of Axfood’s sales in the previous year, which were consolidated starting in November 2011. Consolidated operating profit, excluding amortization of intangible assets, amounted to SEK 2,320 million (1,814). Profit after net financial items amounted to SEK 1,623 million (1,451). Adjusted for the full-year effect of Axfood’s earnings in 2011, earnings decreased by 14 percent.

There are many indications that 2013 will also be a challenging year with significant economic uncertainty in our business environment. At Axel Johnson we will continue our efforts to create sustainable value for our customers, employees and owner. We will focus our energies on what we can influence – providing our customers with the best possible service and experiences.

Stockholm, 22 March 2013

![]()

Fredrik Persson, President and CEO

Highlights in the group companies 2012

- Axel Johnson International, through the AxLoad business area’s acquisition of the Mennens Group, became the European leader within lifting and lashing products.

- Axfood achieved its target that private label goods should account for 25 percent of sales. This was, among other things, attributable to the successful focus on the Garant brand.

- In Axstores, both Åhléns and Kicks increased their sales and gained market shares. Kicks launched its own beauty series and the Åhléns Club exceeded 1.5 million members in Sweden alone.

- Martin & Servera increased its sales and gained market shares. Grönsakshallen Sorunda opened four new units and the group’s specialist wholesalers within fruit and vegetables are now established in eight locations in Sweden.

- Mekonomen strengthened its position as the Nordic region’s leading car parts chain through the acquisition of Meca. At year-end, Mekonomen had a total of 2,302 affiliated workshops.

- Novax acquired a majority stock of shares in the security company RCO Security and nearly 20 percent of the shares in Json Handels, a company within workwear and promotional products.

- Svensk Bevakningstjänst delivered a total of 2.2 million surveillance hours during the year and, despite tough market conditions, the company succeeded in increasing its sales volumes to new customers by approximately 20 percent.

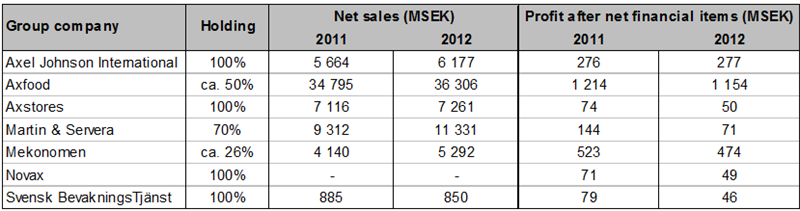

Group companies’ sales and earnings

More information about Axel Johnson’s performance in 2012 can be found in the Annual Review 2012.

Axel Johnson AB is one of the Nordic region’s leading trading groups which builds and develops businesses within trade and services in the European market, with the main focus on the Nordic region.

Group companies currently comprise Axel Johnson International, Axstores, Martin & Servera (70%), Novax, Svensk Bevakningstjänst as well as partly owned listed companies Axfood (approx. 50%) and Mekonomen (approx. 26%). The wholly and partly owned companies within the Axel Johnson group have a total annual sale of approximately SEK 69 billion and about 20,000 employees (2012). Axel Johnson is a family-owned company in the fourth and fifth generation and is owned by Antonia Ax:son Johnson and her family. www.axeljohnson.se

The Axel Johnson AB group is one of four separate groups within the Axel Johnson Group together with the property company AxFast, the U.S. company Axel Johnson Inc. and the asset management company AltoCumulus.