Smarter charging of mobile internet boosting consumer experience

-

Ericsson ConsumerLab releases Smarter Mobile Broadband report showing that smarter management and charging of mobile internet can enhance the consumer experience at the same time as securing operator revenue

-

Study focused on internet usage via mobile phones and conducted in four countries covering more than 2,300 interviews in US, UK, Indonesia and Brazil

-

40-45% of respondents said they would use internet on their mobile phones more if they had access to better speed

-

Most important reasons for a mobile internet user to choose a specific plan: network quality and coverage; data service pricing; how easy it is to understand the data plan

Ericsson (NASDAQ:ERIC) ConsumerLab have studied whether smarter traffic charging and management of mobile internet could improve the consumer experience, at the same time as securing operator revenue. The 'Smarter Mobile Broadband' study is based on interviews with 2,300 mobile internet users aged between 16-59 years old in the US, UK, Indonesia and Brazil.

The study found that the most important reasons for a mobile internet user to choose a specific plan are: the network quality and coverage, the price for using data service, and how easy it is to understand the data plan. It also reveals differences in how respondents react about traffic management and charging concepts. Some elements were deemed attractive in all markets, while some had appeal only in certain markets showing that offers and plans attractiveness vary among all countries in the world.

Cecilia Atterwall, Head of Ericsson ConsumerLab, says: "Users' previous experiences affect the way they rate the more personalized and dynamic offerings that smarter traffic management and charging allows. Users from the UK and US who have experience with unlimited plans are more cautious about moving to differentiated plans. This is because they are not used to having to think about their online habits. However, in the primarily prepaid markets of Brazil and Indonesia, the concepts were viewed more positively. People in those markets are used to paying for what they use and topping up when necessary, and therefore they don't perceive it as much of a restriction to their current plan".

How to attract new customers

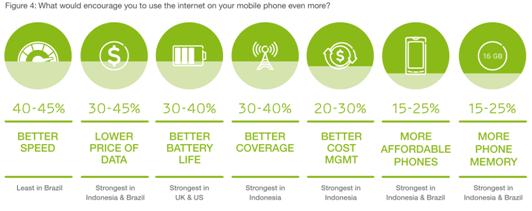

The question facing many operators is how to go about attracting new users, as well as increasing usage among basic existing users. The study identified a number of ways to address this: 40-45% of respondents said they would use their mobile phones more if they had access to better internet speed; 30-45% said that lower price of data is a key element to increase usage; 30-40% said that a better battery life for the mobile phone is also important; 30-40% said that having a better network coverage also influences usage. Many consumers also express frustrations about paying for a plan that is not fully used, this would in turn favor more personalized price plans.

Local differences

The study also revealed differences in how respondents from the four countries face different charging concepts. In Brazil, users were most in favor of selecting and paying for specific services, while in Indonesia users were more concerned with boosting speed. In the US and UK, one of the two most appealing concepts was the ability to control user data cost while roaming.

"It is clear that more advanced handsets encourage heavier usage of mobile internet. With a rapid uptake of smartphones in all markets, we expect to see a growing number of people to develop more advanced data habits, as internet usage on the go becomes a natural part of daily life", Atterwall says.

Finally, the study indicates that one way of making the charging smarter from a consumer perspective, and at the same time encourage heavier usage and improve the user experience, is to create value step by step. By allowing users to have a truly unlimited plan for the specific services that are greatly incorporated in their everyday life, they will not feel restricted in their usage of these services. Relevant services to be included in the unlimited plans vary for different user groups: Users from US and UK focus on general internet browsing, email, social networking, Wi-Fi access and map services. In Brazil people very much use it for internet browsing, social networking and instant messaging, while social networking in particular is the primary service in Indonesia.

The full report can be read here.

Ericsson ConsumerLab has more than 15 years' experience of studying people's behaviors and values, including the way they act and think about ICT products and services. Ericsson ConsumerLab provides unique insights on market and consumer trends.

Ericsson ConsumerLab gains its knowledge through a global consumer research program based on interviews with 100,000 individuals each year, in more than 40 countries and 10 megacities - statistically representing the views of 1.1 billion people. Both quantitative and qualitative methods are used, and hundreds of hours are spent with consumers from different cultures.

To be close to the market and consumers, Ericsson ConsumerLab has analysts in most of the regions where Ericsson is present, which gives a thorough global understanding of the ICT market and business models.

All ConsumerLab reports can be found at www.ericsson.com/consumerlab.

NOTES TO EDITORS