Fund assets at record high

[2017-10-10] In September, investment funds recorded a total net inflow of SEK 4.8 billion. The largest deposits were made in equity funds with a net inflow of SEK 4.9 billion. The total fund assets in Sweden increased during the month and amounted at the end of September to the new record high level of SEK 3 874 billion.

Investment funds recorded a total net inflow of SEK 4.8 billion in September. Equity funds had net inflows of SEK 4.9 billion. Balanced funds and money market funds on the other hand recorded net outflows of 0.2 and 1.2 billion respectively.

“The strong development of the equity market in September made active fund investors buy equity funds again, after three months of net withdrawals. They mostly bought Sweden and global funds, whereas they continued to shift from North America to European funds. The large inflows in equity funds together with the strong performance of most of the world's equity markets, made total fund assets in Sweden rise to a new all-time high level", says Johanna Kull, Financial Savings Economist at the Swedish Investment Fund Association.

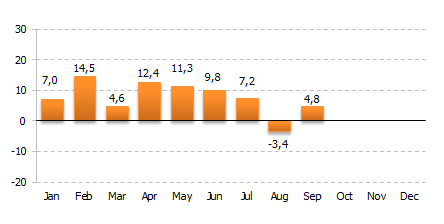

So far in 2017, total net sales of investment funds amounts to SEK 68.1 billion. Equity funds have recorded a total net inflow of SEK 25.1 billion and net sales in balanced funds and bond funds amounts to SEK 19.0 and 17.7 billion respectively.

In September the value of the Stockholm Stock exchange (including dividends) rose by almost 6 percent. Equity funds recorded a total net inflow of SEK 4.9 billion during the month. The largest deposits were made in Sweden funds and Global funds, whereas net outflows where made from North America funds.

So far in 2017, equity funds have recorded a total net inflow of SEK 25.1 billion. Global funds have had net inflows of SEK 25.2 billion. Also European funds and Sweden funds have recorded net deposits of SEK 9.3 and 5.5 billion. On the other hand, large withdrawals have been made from North America funds and Russia funds so far during the year. It is also notable that index funds have recorded net inflows of SEK 29 billion so far this year.

Bond funds recorded, in September, a total net inflow of SEK 1 billion and almost the entire amount went to corporate bond funds. So far in 2017, SEK 17.7 billion has been invested in bond funds, and of which 13.4 billion have been allocated to corporate bond funds.

The total fund assets in Sweden increased in September with SEK 127 billion and amounted at the end of the month to SEK 3 874 billion, of which 2 255 billion (equivalent to 58 per cent) were invested in equity funds. Since year-end 2016, the total fund assets in Sweden have increased by SEK 307 billion.

For further comments please contact:

Johanna Kull, the Swedish Investment Fund Association

+46 (0)8 506 988 07 / +46 (0)704 52 48 34, johanna.kull@fondbolagen.se

For information about the statistics:

Fredrik Pettersson, the Swedish Investment Fund Association

+46 (0)8 506 988 03, fredrik.pettersson@fondbolagen.se

Fredrik Hård, Fondbolagens förening

+46 (0)8-506 988 08, fredrik.hard@fondbolagen.se

Net sales of investment funds in 2017, SEK billion

Tags: