SEK 4 billion into investment funds in November

In November, investment funds recorded a total net inflow of SEK 4.2 billion. Net deposits were primarily made in bond funds and balanced funds, whereas money market funds and equity funds recorded net withdrawals. The total fund assets in Sweden decreased during the month with SEK 3 billion and amounted at the end of November to SEK 3 993 billion.

Investment funds recorded a total net inflow of SEK 4.2 billion in November. Bond funds had net deposits of SEK 3.5 billion and balanced funds had net deposits of SEK 2.9 billion. Money market funds and equity funds, on the other hand, recorded net outflows of SEK 2.1 and 0.9 billion respectively during the month.

"Shaky stock markets in November triggered active fund savers to reduce the risk in their portfolios by selling equity funds", says Johanna Kull, Financial Savings Economist at the Swedish Investment Fund Association.

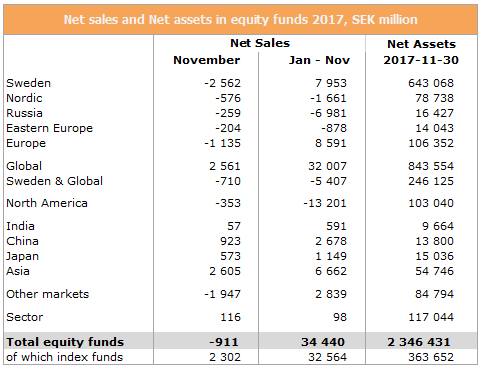

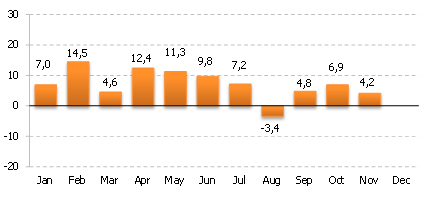

So far in 2017, total net sales of investment funds amounts to SEK 79.2 billion. Equity funds have recorded a total net inflow of SEK 34.4 billion and net inflows in balanced funds and bond funds amounts to SEK 18.1 and 25.7 billion respectively.

In November the value of the Stockholm Stock exchange (including dividends) fell by 3.5 percent and equity funds recorded a total net outflow of SEK 0.9 billion during the month. The largest withdrawals were made from Sweden funds, whereas Asia funds and Global funds recorded continued net inflows.

So far in 2017, equity funds have recorded a total net inflow of SEK 34.4 billion. Global funds have had net inflows of SEK 32 billion. Also Sweden funds and European funds have recorded net deposits of SEK 8 and 8.6 billion. On the other hand, large withdrawals have been made from North America funds and Russia funds so far during the year. It is also notable that index funds have recorded net inflows of SEK 32.6 billion in 2017.

Bond funds recorded, in November, a total net inflow of SEK 3.5 billion, of which 1.1 billion was invested corporate bond funds. So far in 2017, SEK 25.7 billion has been invested in bond funds, and of which 16.9 billion have been allocated to corporate bond funds.

The total fund assets in Sweden decreased in November with SEK 3 billion and amounted at the end of the month to SEK 3 993 billion, of which 2 346 billion (equivalent to 59 per cent) were invested in equity funds. Since year-end 2016, the total fund assets in Sweden have increased by SEK 425 billion.

For further comments please contact:

Johanna Kull, the Swedish Investment Fund Association

+46 (0)8 506 988 07 / +46 (0)704 52 48 34, johanna.kull@fondbolagen.se

You can find the statistics on our website: http://fondbolagen.se/en/Statistics/New-saving-in-funds/

For information about the statistics:

Fredrik Pettersson, the Swedish Investment Fund Association

+46 (0)8 506 988 03, fredrik.pettersson@fondbolagen.se

Fredrik Hård, Fondbolagens förening

+46 (0)8-506 988 08, fredrik.hard@fondbolagen.se

Net sales of investment funds in 2017, SEK billion

Members of the Swedish Investment Fund Association:

Aktie-Ansvar, Alfred Berg Fonder, Amenea, AMF Fonder, Avanza Fonder, Aviva Investors, BMO Global Asset Management, Carnegie Fonder, Catella Fonder, Danske Invest, Didner & Gerge Fonder, DNB Asset Management, East Capital, Enter Fonder, FCG Fonder, Fidelity International, FIM Fonder, First State Investments, Franklin Templeton Investments, Granit Fonder, Handelsbanken Fonder, Healthinvest Partners, Holberg Fonder, HSBC Global Asset Management, ISEC Services, J.P. Morgan Asset Management, Lannebo Fonder, Länsförsäkringar Fondförvaltning, Monyx, Movestic Kapitalförvaltning, Naventi Fonder, Navigera, Nordea Fonder, Odin Fonder, SEB Investment Management, Simplicity, Skagen Fonder, Skandia Fonder, Solidar Fonder, SPP Fonder, Swedbank Robur Fonder, Söderberg & Partners Asset Management, Tundra Fonder, Xact Kapitalförvaltning, Ålandsbanken Fondbolag, Öhman Fonder.

Associate members

Advokatfirman Evander, Apriori Advokatbyrå, Bloomberg LP, Citi, Deloitte, EY, Gernandt & Danielsson Advokatbyrå, Harvest Advokatbyrå, KPMG, MFEX, Morningstar, PwC, SEB Fund Services, Wesslau Söderqvist Advokatbyrå.

Tags: