SEK 60 billion into investment funds during first half of 2017

[2017-07-10] In June, investment funds recorded a total net inflow of SEK 9.8 billion. Net deposits were primarily made in fixed-income funds and balanced funds. So far in 2017, SEK 59.5 billion have been invested in investment funds. Equity funds accounts for the largest part, with net inflows of almost SEK 26 billion. The total fund assets in Sweden decreased during the month with SEK 56 billion and amounted at the end of June to SEK 3 817 billion.

Investment funds recorded a total net inflow of SEK 9.8 billion in June. Money market funds had net deposits of SEK 4.4 billion and bond funds had net deposits of SEK 3.8 billion. Also balanced funds recorded a net inflow of SEK 1.9 billion. Equity funds, on the other hand, had a net outflow of SEK 1 billion during the month.

During the first half of 2017, total net sales of investment funds amounts to SEK 59.5 billion. Equity funds have recorded a total net inflow of SEK 25.6 billion. Net sales in balanced funds and money market funds amounts to SEK 17.8 and 13.4 billion respectively.

"Net sales of funds have been very large during the first half of 2017. Positive stock market development has probably contributed to net deposits of nearly SEK 60 billion, mainly into equity funds", says Fredrik Hård, the Swedish Investment Fund Association.

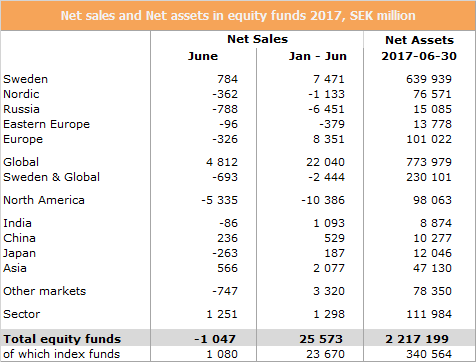

In June, the value of the Stockholm Stock exchange (including dividends) fell by around 2 percent and equity funds recorded a total net outflow of SEK 1 billion during the month. The largest withdrawals were made from North America funds, whereas global funds recorded net inflows.

So far in 2016, equity funds have recorded a total net inflow of SEK 25.6 billion. Global funds accounts for net inflows of SEK 22 billion. Also European funds and Sweden funds have had net deposits of SEK 8.4 and 7.5 billion, whereas net withdrawals primarily have been made from North America funds. It is also notable that index funds have recorded net inflows of SEK 23.7 billion so far this year.

Bond funds recorded, in June, a total net inflow of SEK 3.8 billion, of which over half accounted for net deposits in corporate bond funds. So far in 2017, SEK 13.4 billion has been invested in bond funds, and of which 8.4 billion have been allocated to corporate bond funds.

The total fund assets in Sweden decreased in June with SEK 56 billion and amounted at the end of the month to SEK 3 817 billion, of which 2 217 billion (equivalent to 58 per cent) were invested in equity funds. Since year-end 2016, the total fund assets in Sweden have increased by nearly SEK 250 billion.

For information about the statistics:

Fredrik Hård, the Swedish Investment Fund Association

+46 (0)8 506 988 08, fredrik.hard@fondbolagen.se

Net sales of investment funds in 2017, SEK billion

Tags: