GoldMoney customers find reasons to buy

GoldMoney weekly market report and customer metrics

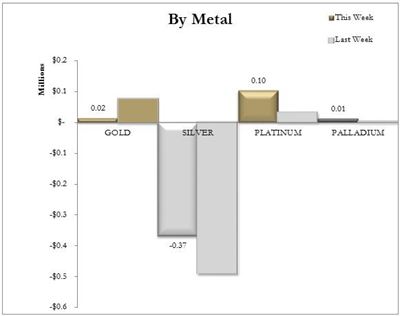

GoldMoney customers have been bucking the general market trend and buying up the yellow metal this week.

Kelly-Ann Kearsey, Dealing Manager at the online precious metals dealer, says the trend came from a combination of reasons, both in-house and external, ‘On Friday it was announced that BitGold Inc. is to acquire GoldMoney. To celebrate the merger a promotion was launched for the long weekend. This incentivised customers who shared a very positive response to the merger. This reaction, coupled with the below the psychological support level prices we have seen in the last few days, has meant we have seen plenty of gold buying this week, while silver has been the loser.’

The week’s buying saw a continuation of the trend for gold to flow out of the UK and Switzerland and into the Singapore vaults. Kelly-Ann also noted, ‘We have seen some interest in platinum and palladium this week, which weren’t on offer. Perhaps the positive data coming out of the US has supported these more industrial metals. The better than expected durable goods orders boosted the dollar and US economic recovery hopes. Meanwhile the Pending Home Sales figures out today are also better than anticipated with a nine year high, but this appears to have ignited some inflationary fears which weighed on the dollar and boosted gold’s inflation hedge attraction, bringing prices up from their earlier lows.’

Week on week price performances

28/05/15 16:00. Gold down 2.8% to $1,186.76, Silver off 4.4% to $16.62, Platinum dropped 3.9% to $1,112.00 and Palladium up 0.6% at $781.50. Gold/Silver ratio: 71.41

For further information or interviews please contact Gwyn Garfield-Bennett at Direct Input. Telephone 44 (0)1534 715411 or email gwyn@directinput.je

GoldMoney

GoldMoney is one of the world’s leading providers of physical gold, silver, platinum and palladium for private and corporate customers, allowing users to buy precious metals online. The easy to use website makes investing in gold and other precious metals accessible 24/7.

Through GoldMoney’s non-bank vault operators, physical precious metals can be stored worldwide, outside of the banking system in the UK, Switzerland, Hong Kong, Singapore and Canada. GoldMoney partners with Brink’s, Loomis International (formerly Via Mat), Malca-Amit, G4S and Rhenus Logistics. Storage fees are highly competitive and there is also the option of having metal delivered.

GoldMoney currently has over 20,000 customers worldwide and holds over $1billion of precious metals in its partner vaults.

GoldMoney is regulated by the Jersey Financial Services Commission and complies with Jersey's anti-money laundering laws and regulations. GoldMoney has established industry-leading governance policies and procedures to protect customers' assets with independent audit reporting every 3 months by two leading audit firms.

Further information:

Visit: Goldmoney.com