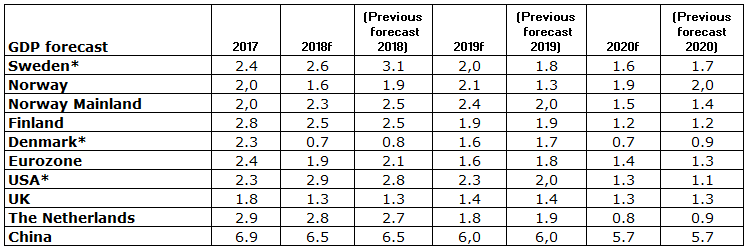

New forecast: Rate hikes despite lower growth

The Swedish economy remains strong, but geopolitical worries persist, and there is a great deal of uncertainty. Among other things, this is evident in the global industrial cycle, which is starting to cool off. However, as long as employment figures and inflationary pressure are increasing, we expect to see rising interest rates in Sweden.

“The Riksbank seems to have made up its mind, and we believe it’s highly unlikely that it won’t hike the repo rate by February at the latest,” says Chief Economist Ann Öberg.

As before, Handelsbanken’s economists believe that growth in Sweden is heading for a slowdown, with lower construction investments and a cooler external environment next year, but that the period of prosperity will still continue for a while longer.

This autumn, three main issues are dominating discussions about the Swedish economy: the uncertain parliamentary situation, the housing market, and whether the Riksbank will hike the repo rate. Just as we expected, the financial markets have stayed calm concerning the political situation in Sweden. The decline in house prices has stabilised, and the number of housing starts has slowed. At its latest meeting, the Riksbank’s Executive Board repeated that it intended to hike the repo rate in December or February, unless the inflation outlook were to change. We believe the rate hike will come in February.

We have long had a scenario of a more distinct slowdown at the international level and, as before, we believe a weaker business cycle and rising interest rates may fuel uncertainty on the financial markets. This in turn may lead to lower corporate investments and tighter credit conditions. But for the time being, our view is that the stock market unrest will not be sufficient to jeopardise the economy. We expect global growth to peak this year, and foresee a general slowdown in the economic cycle in the coming years. Next year, we believe that the US economy, which currently looks strong, will decelerate, reinforcing the global slowdown.

There are many factors that could cause the global – and thus the Swedish – economy to develop differently: the trade war, Brexit and the Italian budget are all causes for concern. There is also a risk that the problems in emerging markets could be exacerbated – which is the subject of a theme article in this forecast. Our second theme article concerns the US. The length of the economic upturn there is set to break historical records, and unemployment is at its lowest for nearly 50 years. It raises the question of how long the upturn can continue.

For further information, please contact:

Ann Öberg, Chief Economist, +46 8 701 2837, +46 76 135 5815

Christina Nyman, Head of Forecasting, +46 8 701 5158, +46 70 778 7765

For more information about Handelsbanken, see: www.handelsbanken.com

For the full report in Swedish, see Konjunkturprognos

For the full report in English, see Global Macro Forecast

*Calendar-adjusted

Source: Handelsbanken Capital Markets

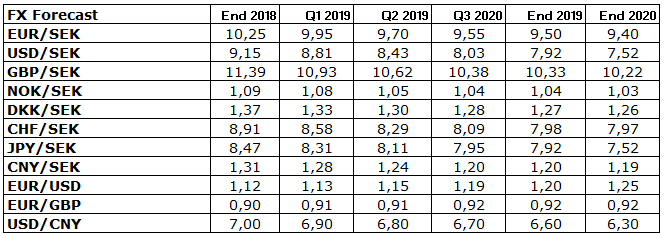

Source: Handelsbanken Capital Markets

Source: Handelsbanken Capital Markets

Tags: