New global macro forecast: Global economy slowing

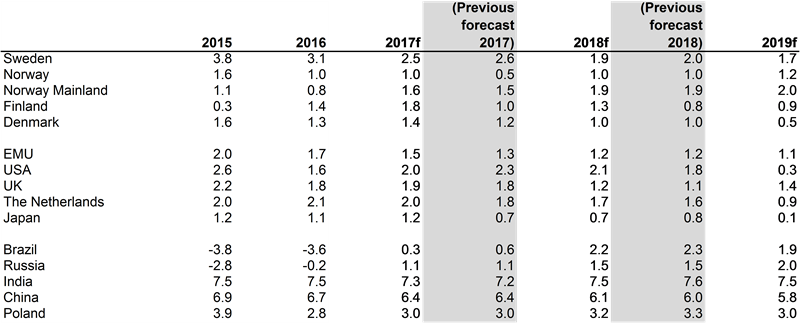

The global business cycle is gradually weakening. The US will slow next year. Subsequently, real GDP is expected to fall during several quarters, while the unemployment rate will rise. The Swedish economy has performed quite well for some time but will slow down during the coming years, according to Chief Economist Ann Öberg.

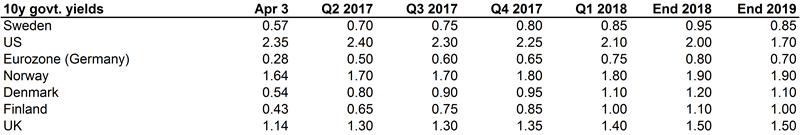

- Interest rates peak at low levels

- US toward recession

- Europe pressured by structural problems

- Low growth in the Nordics

In the US, the economy will continue to expand for a while yet. But we are starting to glimpse the end of the long recovery which has marked the period since the global financial crisis. Growth will slow throughout 2018 and we now expect a recession during 2019. The force behind this turnaround is high capacity utilisation which is putting pressure on company profits.

In the eurozone, the economy has recently picked up a little. Judging from available business tendency surveys, sentiment in the economy is better than for many years. Obviously, we are now also seeing an effect of growing global trade. Unfortunately, we do not think there will be a permanent improvement. Due to the structural problems and continued political uncertainty, we expect growth in the eurozone to remain low.

The UK economy has been surprisingly robust given Brexit. But now it seems that the fair wind is subsiding. A positive agreement between the UK and the EU would be good for both sides, but this does not seem to be politically possible. Nevertheless, we think that the UK will avoid recession.

For a long time, growth in Sweden has been higher than in many comparable countries. This is mainly due to the high population growth. We now expect declining growth in the next few years. Nevertheless, the Riksbank is expected to want to tighten monetary policy with an initial rate hike in April 2018.

In the other Nordic countries, we expect low growth during the period of our forecast. In Norway, the mainland economy has turned upward. Despite this, interest rate cuts from Norges Bank cannot be ruled out as a result of the low inflation rate.

For further information, please contact:

Ann Öberg, Chief Economist, +46 8 701 2837, +46 76 135 5815

Jimmy Boumediene, Head of Forecasting, +46 8 701 3068, +46 70 532 5187

For more information about Handelsbanken, see: www.handelsbanken.com

A summary in Swedish is available at at Makroprognos

For the full report in English, see Global Macro Forecast

Forecasts for real GDP growth

Source: Handelsbanken Capital Markets

Interest rate forecasts

Source: Handelsbanken Capital Markets

Currency forecasts

Source: Handelsbanken Capital Markets

Tags: