Ikano Bank AB (publ) Interim Report 30 June 2019

Work continues as planned

“The half-year result is in line with our expectations. The underlying business is stable but our ambition is to improve the key ratios. We have accelerated the improvement work where a number of activities are underway and we are already beginning to see the effects of this proactive work.

Profit before loan losses increased compared with the previous period. The growth in the period came mainly from the Swedish operations where the Corporate business is growing. Also after loan losses, the result in most markets is increasing.”

Henrik Eklund, CEO, Ikano Bank AB (publ)

Results for the first half-year 2019

(comparative figures in brackets are as of 30 June 2018 unless otherwise stated)

- Business volume amounted to SEK 63,622 m (69,272), adjusted for intermediated mortgage volumes that ceased during 2018 (5,340 mSEK) the business volume decreased marginally

- Lending, including leasing, amounted to SEK 37,369 m (37,621)

- Deposits from the public amounted to SEK 26,253 m (26,311)

- Operating profit before loan losses increased to 431 mSEK (398)

- Net interest income decreased marginally, totalling SEK 971 m (978)

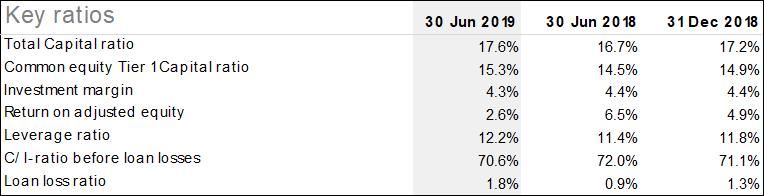

- The common equity Tier 1 capital ratio was 15.3 percent (14.5) and the total capital ratio was 17.6 percent (16.7)

- The liquidity reserve was SEK 2,352 m (2,404) and the total liquidity portfolio amounted to SEK 5,463 m (5,583)

Outlook for the remainder of 2019

We see positive effects from the improvement work and continue to work together according to plan to streamline and invest in in our business. This includes further investments in our offering and especially its digitalisation, as well as regulatory compliance. We are continuing to invest in our IT platform to secure long-term profitable growth and customer benefits. At the same time, management has a strong focus on cost control. The Bank’s strategy to act and grow in the UK market as a branch also after Brexit remains.

For definitions of alternative performance measures used to describe the Bank's operations see the Bank's Annual Report for 2018, available on the Bank's website: www.ikanobank.se/om-banken/ekonomisk-information.

| Lending including leasing, SEK m | Deposits from the public, SEK m |

|

|

This is information that Ikano Bank AB (publ) is required to disclose in accordance with the EU Market Abuse Regulation and the Securities Market Act. The information was submitted for publication on 30 August 2019 at 11:00 AM.

Ikano Bank’s Interim Report is available on the Bank’s website: www.ikanobank.se/om-banken/ekonomisk-information

For more information

Henrik Eklund, CEO tel: 010-330 40 00

About Ikano Bank

Ikano Bank offers smart and simple savings and loan products for consumers, sales support services for retailers, and leasing and factoring solutions for corporate customers. Ikano Bank has a presence in Sweden, Denmark, Finland, Norway, the UK, Poland, Germany and Austria.

About Ikano

Ikano is a multinational group with operations in banking, insurance, production, housing and retailing. The Ikano Group was founded in 1988 and is owned by the Kamprad family.

For more information, go to www.ikanobank.se

Tags: