Ikano Bank AB (publ) Interim Report 30 June 2021

Results as expected, continued investments in digital solutions, and Ingka new part-owner

“The first half of 2021 has been a successful phase in our strategic renewal journey. We are on our way to become a fully digitalised, sustainable bank. In the spring, our first product was successfully launched on the new platform. In June, we brought in Ingka as part-owner. The closer partnership with Ingka makes it possible to further accelerate the transformation of the Bank. Together, we now have even more power to accelerate towards the future.”

Henrik Eklund, CEO, Ikano Bank AB (publ)

Results for the first half-year 2021

(comparative figures in brackets are as of 30 June 2020 unless otherwise stated)

- Business volume amounted to SEK 60,623 m (61,584).

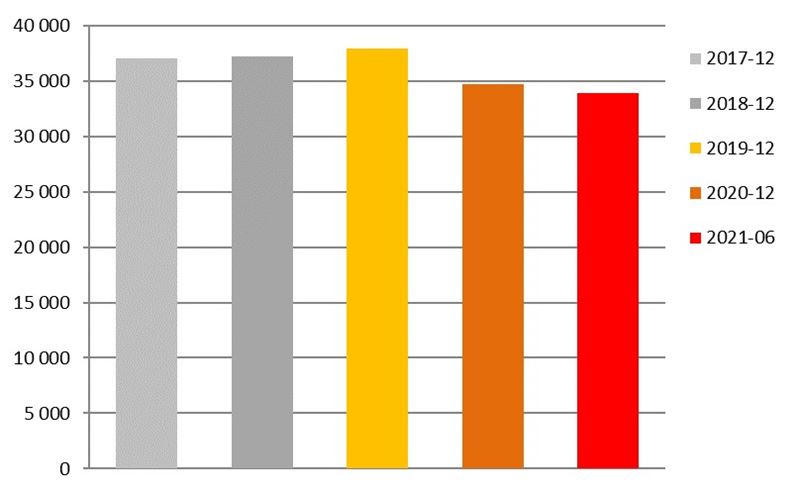

- Lending, including leasing, amounted to SEK 33,952 m (33,534)

- Deposits from the public amounted to SEK 26,671 m (26,050)

- Operating result before loan losses amounted to SEK 270 m (387)

- Net interest income amounted to SEK 855 m (936)

- The common equity Tier 1 capital ratio was 16.8 percent (17.1) and the total capital ratio was 30.9 percent (19.6) due to new share issue

- The liquidity reserve increased to SEK 3,950 m (2,788) and the total liquidity portfolio amounted to SEK 9,980 m (5,617)

- Loan losses amounted to SEK 209 m (468)

Outlook for the remainder of 2021

Extensive investments will be made and with Ingka as a part-owner we have the opportunity to further accelerate the transformation of the bank which aims to streamline and improve the bank's competitiveness. The goal is to become a fully digitalised sustainable bank for the many people.

For definitions of alternative performance measures used to describe the Bank's operations see the Bank's Annual Report for 2020, available on the Bank's website: www.ikanobank.se/om-banken/ekonomisk-information.

Lending including leasing, SEK m Deposits from the public, SEK m

This is information that Ikano Bank AB (publ) is required to disclose in accordance with the Securities Market Act. The information was submitted for publication on 27 August 2021 at 11:00 AM.

Ikano Bank’s Interim Report is available on the Bank’s website: www.ikanobank.se/om-banken/ekonomisk-information

For more information

Henrik Eklund, CEO

tel: 010-330 40 00

email: communication@ikano.se

About Ikano Bank AB (publ)

Ikano Bank creates possibilities for better living by offering simple, fair and affordable services, enabling a healthy economy for the many people. Our offer includes savings and loan products for consumers, sales support services for retailers, and leasing and factoring solutions for businesses. We conduct business in Sweden, Denmark, Finland, Norway, the UK, Poland, Germany and Austria. Ikano Bank is a part of the Ikano Group who owns 51 % of the Bank. Ingka Group, a strategic partner in the IKEA franchise system, operating 378 IKEA stores in 31 countries, owns the remaining 49 % of Ikano Bank. Ikano Bank’s head office is located in Malmö, Sweden and the company is registered in Älmhult, Sweden where the business was once founded.

Tags: