Ikano Bank AB (publ) Year End Report 2018

“During the year, we have worked closely with our customers and partners in our various business segments. Total lending was in line with previous year where we saw good growth in the leasing business. We also saw increased deposits in the Bank. The result for the year is in line with our expectations, but now we are increasing the speed of our on-going improvement work. Together, we continue the work that began during the autumn, where we, among other things, have a clearer commercial focus, improving both efficiency and digitalisation of our offering.”

Henrik Eklund, CEO, Ikano Bank AB (publ)

Results for the full year 2018

- Lending, including leasing, increased to SEK 37,187 m (37,082)

- Deposits from the public grew with 2 percent to SEK 26,206 m (25,617)

- Business volume amounted to SEK 63,394 m (67,863). The cooperation with SBAB regarding mediated mortgage loans was terminated during the year, which gave a decrease in the business volume of SEK 5.2 bn. Without this effect, the total business volume increased with 1 percent

- Operating result decreased by 18 percent to SEK 359 m (435). Operating result for 2018 is affected by increased depreciation on leasing assets due to increase in volume, and by costs for long term IT-investments

- The result for 2018 is positively impacted by an increased net leasing and net commission income

- Net interest income decreased by 1 percent to SEK 1,935 m (1,960)

- Net result for the year amounted to SEK 541 m (284) and was affected by dissolution of untaxed reserves

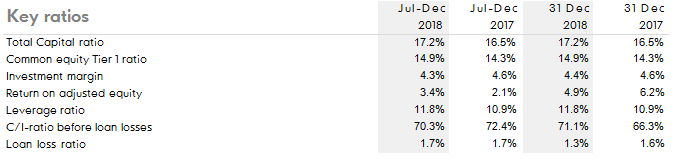

- Return on equity decreased to 4.9 percent compared with 2017 (6.2)

- Common equity Tier 1 ratio totalled 14.9 percent (14.3) and the total capital ratio was 17.2 percent (16.5).

- The liquidity reserve totalled SEK 2,508 m (2,445) and the total liquidity portfolio amounted to SEK 5,640 m (5,058)

- Håkan Nyberg left as CEO of the Bank in September 2018 following which Mats Håkansson assumed the role as working chairperson of the Board for the remainder of 2018. Henrik Eklund was appointed interim CEO after the end of the year.

Results for the second half year 2018

- Operating result increased by 66 percent to SEK 123 m (74). This is mainly explained by an increased net commission

- Net interest income decreased by 2 percent to SEK 957 m (978)

- Return on equity for the second half of the year amounted to 3.4 percent (2.1)

Outlook for 2019: Ikano Bank expects growth in 2019. The Bank operates in a challenging industry but is financially strong with a favourable market position. The work to further develop and improve our digital experience, efficiency and customer offer continues.

This is information that Ikano Bank AB (publ) is required to disclose in accordance with the EU Market Abuse Regulation and the Securities Market Act. The information was submitted for publication on 28 February 2019 at 11:00 AM.

For more information

Henrik Eklund, CEO or Henrik Jensen, CFO

tel: 010-330 40 00

About Ikano Bank

Ikano Bank offers smart and simple savings and loan products for consumers, sales support services for retailers, and leasing and factoring solutions for corporate customers. Ikano Bank has a presence in Sweden, Denmark, Finland, Norway, the UK, Poland, Germany and Austria.

About Ikano

Ikano is a multinational group with operations in banking, insurance, production, housing and retailing. The Ikano Group was founded in 1988 and is owned by the Kamprad family.

For more information, go to www.ikanogroup.com

Tags: