Lendio Answers Washington’s Call; Helps Banks Increase Business Loans

Washington continues to help spur small business lending. Now, banks have money to lend, and demand for business loans are up, but total loans across the country are dropping. Lendio provides solution to help banks find qualified borrowers.

SALT LAKE CITY – Demand for business loans is rising and banks and credit unions have plenty of money to lend, but small business lending is still decreasing nationwide.

“Small businesses are telling us that access to capital remains a hurdle in the current economy, despite rallies on Wall Street and government efforts to loosen credit,” said Sam Graves, the House Small Business Committee Chairman, in a recent hearing titled, “Access to Capital: Can Small Businesses Access the Credit Necessary to Grow and Create Jobs?”

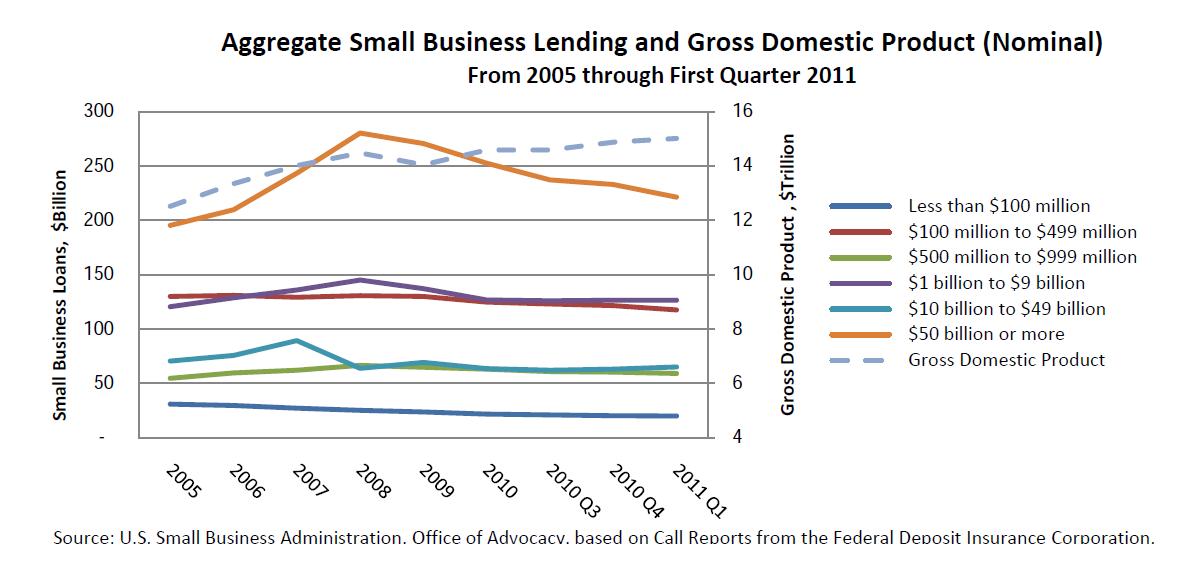

The numbers also prove those points. The Small Business Administration reported that total loan and lease balances dropped $126.6 billion, or nearly 2 percent, in the first quarter of 2011. Many lenders across the country say the problem is with unqualified borrowers in this economy.

“On the other side of the equation are lenders who say they have capital available,” Graves said, “but businesses are not as credit-worthy as they were just a few years ago. Banks claim that today’s borrowers have lower credit scores and lower collateral values.”

This situation particularly concerns those in Washington depending on small business growth to help create jobs and turn the economy around. Brock Blake, the CEO of Lendio, an online service the helps businesses find viable loans, offers a simple solution to increase the number of small business loans:

“Banks need to find the right borrowers, and business owners need to find the right loans,” Blake said. “It’s not that there aren’t any qualified borrowers, it’s just that banks are having a hard time finding them. That’s what Lendio does, it finds those qualified borrowers for each specific lender.”

So far the results are significant since Lendio was launched in March this year, including nearly $1 billion requested in business loans, and a loan approval rate that’s nearly five to seven times better than the national average. Inc. Magazine recently talked about those results, saying Lendio is “one (company) Congress might want to pay attention to.” And American Banker said Lendio was one of the “6 best ideas for banks.”

“Our lender partners are definitely finding more qualified borrowers, and in turn, business owners are getting more of the capital they need to grow and create jobs,” Blake said.

About Lendio

Lendio makes small business loans simple simple by matching qualified small business owners with active banks, credit unions, and other lending sources. Through a proprietary matching technology, Lendio assists a business owner to identify the business loan category and specific lenders that offer the highest probability for that business owner to prepare for and secure a business loan approval. For more information, contact Lendio at press(at)lendio(dot)com.

Tags: