The IPCC Summary Report on Climate Change: What it Means for Impact Investing

On 27 September 2013, the United Nations Intergovernmental Panel on Climate Change (IPCC) published the first of three volumes of its fifth Assessment Report (AR5). The long-awaited report summary emerged amid a flurry of media coverage and a volley of commentary, both pro and contra. Its main conclusions were clear, however: climate change is real, its effects are already measurable, and it is being caused by human activity.

AR5 Summary Highlights

- Human influence on the climate system is clear. This is evident in most regions of the globe.

- Warming in the climate system is unequivocal.

- Global surface temperature change for the end of the 21st century is projected to be likely to exceed 1.5°C relative to 1850 to 1900 in all but the lowest scenario considered, and likely to exceed 2°C for the two high scenarios

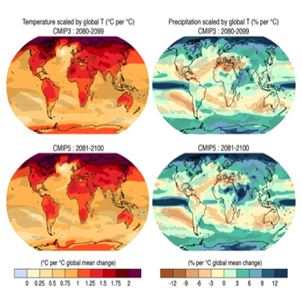

- Projections of climate change are based on a new set of four scenarios of future greenhouse gas concentrations and aerosols, spanning a wide range of possible futures. The Working Group I report assessed global and regional-scale climate change for the early, mid-, and later 21st century.

The summary report has sparked controversy worldwide. Some rushed to embrace the findings while others immediately set out to disprove the science and question the motives behind it. The world’s reaction is a measure of how emotive—and divisive—the issue of anthropogenic (human-caused) climate change has become for governments, businesses and individuals in the years since the first IPCC report in 1990. With passionate feelings on both sides, the controversy is set to continue.

Challenging times for believers

The report’s publication follows a rough period for those who believe that climate change poses a threat to life on earth. In 2001, the US, under the administration of George W. Bush, rejected the Kyoto agreement on global warming. Flaws in the AR4, IPCC’s 2007 report—among them the apparent claim that Himalayan glaciers would disappear by 2035— drew intense fire from critics and distracted attention away from AR4’s core findings. They provided more fuel for the so-called climate change deniers—those who hold that global warming is a hoax or a conspiracy to slow progress.

From 2008, the economic crisis prompted world leaders to put economic growth ahead of environmental protection, with many governments backing away from previous emission-lowering commitments. The worldwide carbon market, including the EU’s cap-and-trade scheme, essentially collapsed in 2012, leaving questions about its efficacy as a means to control emissions.

Against this background the summary report comes as a wakeup call from the most respected source of climate science the world has. The new report has been widely accepted as the most convincing body of evidence of climate change and the human role in it so far. For impact investors, it could have profound importance on many levels.

What does it mean for the impact investing sector?

It’s fairly safe to say that most of those involved in the impact investing sector are already convinced of the reality of climate change. Many already focus their investing activity on areas relating to climate change such as agriculture and agribusiness, food security, forestry, land and water use, waste management and reduction, clean and renewable energy, energy efficiency and cleantech. For this reason, it’s likely that impact intermediaries, impact investing funds and social entrepreneurs will take the IPCC report as a renewed call to action.

However, the new IPCC report will change the impact investing landscape for everyone. Impact investors will see the effects of changes in government policy, the attitude of big business and international public opinion. What will be some of the main currents affecting our impact investing strategies?

Governments respond with policy

The release of the summary report was a huge event, but it’s only the tip of the iceberg when it comes to the IPCC findings. The 19th annual meeting of the UN Climate Change Convention will be held in Warsaw from 11-22 November. At this meeting, the IPCC will deliver further scientific evidence to diplomats in order to facilitate policy decisions. A new legal commitment with respect to carbon emission will then be drawn up, replacing the 1994 accord. This is scheduled to take effect by 2015.

In preparation for these events, governments across the world are already formulating their policy stances. There are questions about how individual governments will react in the face of the new evidence. Climate change remains highly controversial in some developed countries, notably the US and Australia where it has become an issue that divides the political left and right. India, China and other rapidly industrializing countries are also wary: they have so far been unprepared to agree emissions cuts unless more developed countries do the same. Meanwhile island nations like Tuvalu, and South Asian countries like Bangladesh, both highly vulnerable to the effects of climate change, argue for a robust international response.

For impact investors, one thing is certain: there will be a new legal framework guiding climate change policy worldwide in 2015. Whatever the shape of this framework, it will change the investing landscape in many countries and have far-reaching effects for impact investors in many parts of the world. Much will depend on the structure and extent of the new laws, which will be hotly debated by governments. Regardless of the outcome, things will change for impact investors. The direct effects will be felt through the policies, programs and incentives governments create in response.

Where governments take a lead…

In places where government policy supports pro-climate investing there are likely to be more opportunities for collaborative investments working across government agencies, impact intermediaries, impact funds and private investors.

Collaborative cross-sectoral arrangements are already a characteristic of the impact investing world. In the UK, Sustainable Development Capital was awarded £50 million by the UK government’s Department of Business, Innovation and Skills to invest in energy efficiency infrastructure projects. Big Society Capital, an independent fund created by the government, invests in many climate-friendly initiatives, especially in cleantech, energy efficiency, and sustainable energy for disadvantaged communities in Britain.

The UK provides what is probably the best current example of a dynamic government-lead approach to market-based social investing. As other governments take action to meet new policy commitments, they will be looking for solutions and partners.

Seasoned impact intermediaries and funds—of which there are a growing number—can bring specialist skills and knowledge to collaborative cross-sectoral arrangements for financing impactful businesses. They are also in position to benefit from government subsidies and tax incentives focused on meeting carbon reduction targets. For these reasons, the ability to work for and with government could prove essential for impact investors and the businesses they finance.

…and where they don’t

Where government leadership is lacking— and incentives such as tax breaks, subsidies and government co-investment are not forthcoming—global development agencies, philanthropic organizations, activists and impact investors will have to take the initiative in catalyzing the response to climate change. This may not be a bad thing: some commentators believe that private action, not government intervention, will be the key front in the fight against human-caused climate change. There’s already evidence that governments have been scaling back their commitments to climate change action and pushing responsibility onto NGOs and private companies, while private investors have been picking up the slack.

Many organizations and activists have been operating this way for decades and will continue to do so regardless of what governments do in response to the IPCC findings. The US provides many examples. The same country that rejected the Kyoto Protocol—and produced some of the most virulent and well-funded examples of climate change denial—has also given the world some of the most progressive models of local and state support for climate-friendly businesses and approaches.

This independence has made parts of the US leaders in areas like clean energy, energy efficiency, renewables, organic and sustainable agriculture and sustainable forestry. The States boasts some of the most mature markets in these new kinds of businesses, proving that federal government policy needn’t be an obstacle to progress.

The new markets remain volatile and, despite everything, still subject to the effects of government policy and subsidy (the rollercoaster of cleantech provides one example). Yet it looks as though these market areas will grow as communities and values-driven businesses, if not governments, look for new ways to react to climate change. This could be a growth area for impact investors and businesses.

Mainstream businesses go greener

Large multinational corporations and mainstream business will also feel the effect of the new climate change policies at ground level—and this will have a knock-on effect for impact investors and the businesses they capitalize.

All businesses will need to respond to the international regulations that grow out of the new IPCC report findings. More directly, they will need to meet national and regional standards set locally, and these too will be affected by the report. There also seems to be a feeling in the corporate sector that an upturn in the economy will leave them freer to take steps toward carbon emissions reduction. Many see a “green” profile as key to their corporate image. A growing number of organizations in the developed world are making sustainability a core value in their operations and employing sustainability professionals to help them achieve it.

All this will drive the market for services that support sustainability and carbon emission reduction in companies—for example, consultancies that help organizations shrink their carbon footprint and conserve resources. This will create a possible growth area for impact business-to-business providers, offering services that embed sustainability and carbon-thrift into corporate operations practice.

CSR, now a norm for business, will continue to play a key role in the business/government/climate change triangle. Already an important factor, CSR will become more central as the need for businesses to meet emissions targets increases under new regulations—and new, very real resource pressures anticipated by the IPCC report. A closer relationship between CSR and impact investing could open new avenues for corporations to use their considerable resources for good. Supports like the impact business CSR Hub, which helps track the effectiveness of CSR efforts, will help businesses hone their choices and give the public information about the real effect of corporate claims.

Beyond this, there’s a trend toward mainstreaming businesses that once were considered alternative. Words like sustainability, clean or green technology, renewable and clean energy —all important areas for lowering carbon emissions—already feature prominently in the reports of large multinational companies. General Electric invests in renewable energy projects, while ExxonMobile has programs for reducing its greenhouse emissions and innovating carbon capture technologies and biofuels made from algae. This is largely an effect of earlier government regulation on emissions. But it’s partly due to public pressure and, for some of the companies, canny strategic positioning for a future where business will have to be energy efficient to be successful.

The fact that these companies continue non-climate friendly business practices alongside these progressive ones leaves them open to the accusation of greenwashing from some quarters. Nonetheless, these examples are evidence of a mainstreaming of climate-friendly technologies and approaches in business. This trend suggests that the demand for them will continue and increase, especially as resources, such as fossil fuels, arable land and water become more scarce, as the IPCC findings seem to indicate they will.

This “greening” trend among multinationals could create opportunities for impact intermediaries, dynamic impact enterprises and engaged impact investors. Those who successfully bridge what’s been called the “pioneer gap” and manage to scale up socially and environmentally beneficial businesses to the point where they can join the mainstream, will be able to attract investment by multinationals and a wider pool of “neutral” investors—those for whom positive impact goals are not a motive for investment. This could increase the flow of capital into beneficial enterprises exponentially—and finally establish impact investing as a normal way to do finance.

Reducing Carbon Emissions: Key sectors for impact investment

Agriculture

Agribusiness

Cleantech

Biotech

Renewable Energy

Energy Efficiency

Forestry

Waste Reduction

Land Remediation

Water

Sanitation

The public demands change

Another important consequence of the IPCC report will be its influence on public attitudes toward climate change—this too will have consequences for impact businesses and for the practice of impact investing.

Some recent surveys of public attitudes in developed countries have recorded a shift toward a more skeptical view of human-generated climate change. Pro-climate-change commentators put this down to the success of a well-organized media campaigns by special interest groups opposed to more government regulation.

But there is also a common-sense issue: people doubt the science when they don’t perceive significant climate change around them. Extreme weather events, such as the last year’s heavy snowfall in the US and the high temperatures in Australia, have been shown to produce large swings in public opinion in favor of belief in climate change. As events such as these become more common, as the IPCC report suggests they will, it’s likely that the climate will make its own case for action.

Still, there’s plenty of evidence that suggests that the public already accepts the idea of anthropogenic climate change and wants to see governments, businesses and individuals do something about it. The IPCC report will strengthen the convictions of many who already feel that we need to change tack. As impact investing becomes more accepted as a means of effecting positive change, this group will be supportive, buying products and services from impact businesses and providing funding, through micro-lending and crowdfunding platforms. The popular movement for divestment from fossil fuels could create a whole generation of small investors looking for more climate-friendly ways to deploy their capital.

People in developing countries—some of whom will be the worst hit by the effects of climate change—may need more convincing. As mentioned before, the governments of countries like China and India look on moves to limit carbon emissions as curbs to their growth by developed nations. Similarly, people in the developing world focus on the need for economic growth and view the talk of controlling emissions and resource consumption with suspicion.

There is some evidence that this is beginning to change. As in the developed world, people in economically emerging countries are beginning to see the effects of climate change for themselves—often in disastrous forms. Extreme weather events such as droughts and floods have the power to change opinions there, too. And there is anecdotal evidence that those who work on the land, farmers, are seeing the changes firsthand. These local observations, plus the hard lessons of extreme natural forces, may shift world opinion in time to make a difference.

For people in the developing world, the impact investing model could offer a middle way between economic development and climate stewardship. Its market-based approach encourages economic growth, while its commitment to positive impact has the power to channel that growth in climate-friendly directions. In this sense, the multiple bottom line of impact investing holds out hope for developed countries, too, who also need to find new ways to thrive economically without further damaging the planet.

Impact: a powerful tool to counter climate change

It looks likely that the IPCC report will generate a new groundswell of activity around the issue of climate change and this could be a boon for the growing, diversifying impact investing sector.

Impact investing’s pragmatic approach to finance, and its commitment to capitalizing impactful businesses, make it a powerful weapon in the fight to save the planet from the effects of global warming. Its market methods translate across borders and geographies, providing solutions for developed and developing countries alike. Its flexible techniques can be used in many contexts to support the kind of businesses, processes and technologies that can help minimize climate damage while supporting economic development.

All this means that it’s time to for the impact sector to get to work. There are still market infrastructure issues that need to be solved: impact metrics and the lack of exits are two important examples. More research is needed; investment models need to be tested, honed and replicated. Education for impact professionals, now in its early days, still needs to be developed as the sector expands, professionalizes and becomes, in time, part of mainstream finance.

However, if some of these limitations can be overcome, impact investing could play a key role in helping mankind develop an effective response to the threat of climate change. Let’s all hope the warning has come in time—and we are up to the job.

Tags: