Munters January-September 2020 interim report - "Strong order intake and profitable growth"

July-September 2020:

-

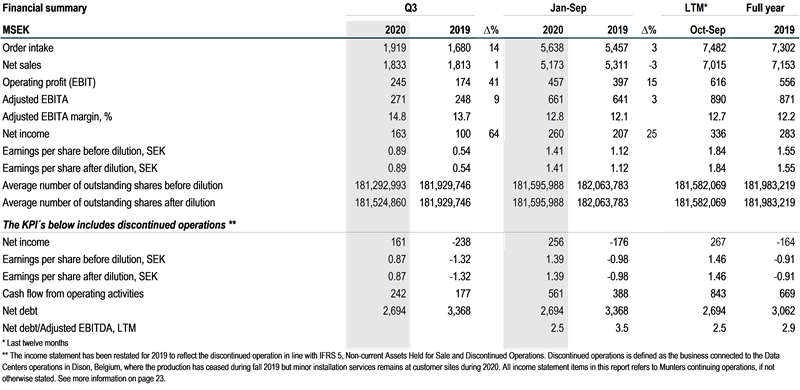

Order intake increased 14%, currency adjusted 21%. The growth was driven by pharma, lithium batteries and services for business area AirTech. Business area FoodTech had strong growth in the swine segment in China.

-

Net sales increased 1%, currency adjusted 8%, mainly driven by good growth in business area AirTech’s Data Center US operations and the swine segment in China for business area FoodTech. This was partly offset by a weak development in business area AirTech’s Mist Elimination operations.

-

The adjusted EBITA-margin improved 8% to 14.8% (13.7). Both business areas improved their profitability in the quarter through a strong focus on cost control and efficiency improvements.

-

Leverage (net debt/adjusted EBITDA, LTM*) decreased to 2.5x from 2.7x end of June 2020, reaching the mid-term financial target range of 1.5x-2.5x.

-

The measures for implementing a sharpening of the customer offering and footprint optimization is going according to plan. The main focus during the third quarter has been to prepare for execution of the measures. Costs and expenses related to the measures were estimated at MSEK 188 at the end of June. In the third quarter, MSEK 17 of these has been realized, mainly related to the exit of the non-core part of the commercial business in the US as well as the consolidation of operations in Netherlands.

January - September 2020:

-

The outbreak of Covid-19 had a mixed impact on Munters in the first nine months. All production units, except for one minor unit, have been operational throughout the period with only minor disturbances.

-

Order intake increased 3%, currency adjusted 4%. This was mainly driven by a strong order intake in the third quarter, driven by good growth in both business area AirTech and FoodTech.

-

Net sales declined -3% ,currency adjusted -2%, mainly due to Covid-19 related delays, mainly experienced in the first half year. Also, the Mist Elimination operations in business area AirTech had a weak development in the period.

-

The adjusted EBITA-margin improved to 12.8% (12.1). The improvement was mainly because of production efficiency improvements and a tight cost control. Also mitigating actions related to the Covid-19 outbreak contributed to the improvement.

-

Leverage (net debt/adjusted EBITDA, LTM*) decreased to 2.5x from 2.9x at the end of December 2019. The decrease was mainly driven by a strong cash flow development and a positive exchange rate effect on outstanding borrowings related to USD/SEK of MSEK 90.

CEO Comments:

Strong order intake, profitable growth and continued strengthening of balance sheet

We had strong order intake in the third quarter. This was mainly driven by good growth in the Industrial segment in Americas for business area AirTech as well as the swine segment in China for business area FoodTech. We experienced some delays in the market related to the Covid-19 outbreak. At the same time we continued to see a general increased demand in industries such as lithium batteries and pharma. All our production units, except one minor unit, upheld production with only minor disturbances in the first nine months.

Net sales increased in the third quarter, mainly driven by good growth in Data Centers US in business area AirTech and a continued strong increase in the swine segment for business area FoodTech in China.

The adjusted EBITA-margin improved in the third quarter. Both business area AirTech and FoodTech contributed to the results through a strong focus on strategy execution, including operational efficiency improvements and streamlining of indirect costs. Our leverage, net debt to adjusted EBITDA, was reduced to 2.5x which is in line with our mid-term financial target of reaching a level of 1.5x-2.5x.

Focus on strategy execution yields good results

At the beginning of 2020, we presented our strategic priorities. Since then we are constantly working on executing these and in the third quarter, we achieved growth in the markets we have highlighted as prioritized areas.

In July 2020 we announced measures aiming at driving a sharpening of our customer offering and optimize our footprint, in line with the strategy. These are progressing according to plan. In the quarter we have proceeded with preparing for the exit of the non-core part of the commercial business of business area AirTech in the US and the consolidation of the operations in the Netherlands. The growth in the Data Center US business has led to a need of expanding the production capacity in Texas for a standardized part of our offering.

Going forward, our work with product rationalization, increasing standardization and to modularize our offering is key to strengthen Munters. It is an important part of the strategy execution in order to be able to combine low complexity with high customization capabilities.

Market improvement but still low visibility of market demand

Market conditions improved in the third quarter. Still, the visibility of market demand is low due to the lingering Covid-19 outbreak.

I am proud of our employee’s capability to balance the management of daily challenges with a constant focus on delivering on our mid-term targets. I truly want to thank our employees for their dedication in executing a very strong performance in the third quarter.

Klas Forsström, President and CEO

On October 22, at 9:00 the President and CEO, Klas Forsström, together with the Group Vice President and CFO, Annette Kumlien will present the report in a live webcast together with a telephone conference.

Webcast: https://tv.streamfabriken.com/munters-q3-2020

Dial-in number for the telephone conference:

SE: +46 8 50558365

UK: +44 3333009031

US: +1 8335268381

This interim report, presentation material and a link to the webcast will be available on https://www.munters.com/en/investor-relations/

Contact person:

Ann-Sofi Jönsson, Vice President, Investor Relations and Enterprise Risk Management

Phone: + 46 (0)730 251 005

Email: ann-sofi.jonsson@munters.com

This information is information that Munters Group AB is obliged to make public pursuant to the EU Market Abuse Regulation and the Securities Markets Act. The information was submitted for publication, through the agency of the contact person set out above, at 08.00 CET on October 22, 2020.

Munters Group AB, Corp. Reg. No. 556819-2321

About Munters Group

Munters is a global leader in energy efficient air treatment and climate solutions. Using innovative technologies, Munters creates the perfect climate for customers in a wide range of industries. Munters has been defining the future of air treatment since 1955. Today, around 3,200 employees carry out manufacturing and sales in more than 30 countries. Munters Group AB reported annual net sales of more than SEK 7 billion in 2019 and is listed on Nasdaq Stockholm. For more information, please visit www.munters.com.

Tags: