Munters third quarter 2019

Stable demand, strong organic net sales growth and improved profitability

In September 2019, the closure of the Data Center Factory in Dison, Belgium, was decided. This business is reported as discontinued operations in this interim report and the income statement for 2019 and 2018 has been restated to reflect this change. The CEO comments and business comments in this report focus on the continuing operations, unless otherwise stated.

CEO comments

Market conditions stable

Overall, markets in the third quarter were characterized by stable demand. Demand remained strong in some areas of the industrial market, Services as well as for Data Centers and Mist Elimination solutions. We also saw increased demand for digitalized solutions for the food industry. Order intake in Asia improved driven by high demand from the poultry industry and investments in swine production, coming back from low levels due to the African Swine Fever. The order intake was solid in the US due to strong order intake from Data Centers in the US and a few orders from the lithium battery industry, despite a continued weak commercial market. In the third quarter, selected parts of the European industrial market saw lower demand, impacted by a weaker economic climate and lower investment rate in the region. We still anticipate softer Group order intake development during the second half of the year versus the first half year 2019.

Continued strong organic sales growth

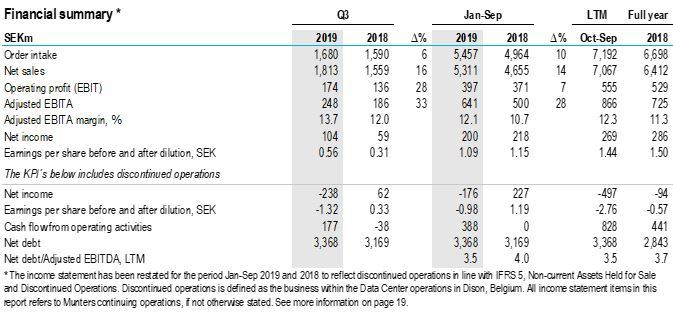

Munters net sales grew 11% organically in the quarter, resulting in an organic growth of 8% for the first nine months. Growth was partly driven by the strong growth in the Data Centers business in the US, where the business delivered on the strategic direction set last year. We also saw good net sales increase in several sub-segments in the industrial areas. Our focus on growing the area of Services is continuing to deliver strong increase in net sales.

Adjusted EBITA-improved

Early 2019 Munters launched a three-phase program, the Munters Full Potential Program, FPP, to reach our mid-term financial targets. The total run-rate overhead cost savings from the FPP are estimated to SEKm 160, of which savings of SEKm 155, on an annual basis, have been achieved at the end of September, in line with the targeted level. We are confident we will reach targeted run-rate savings for 2019 and onwards. Since I joined as CEO, a review has been made of the initiatives in the FPP program. This has resulted in a change in the estimate for non-recurring costs for the full year 2019 from, as previously communicated SEKm 350 to SEKm 375, due to depreciation of assets related to the closure of the Data Center factory in Dison, Belgium. The closure of this factory was decided in the third quarter and this operation is now reported as discountinued operations. At September 30, SEKm 326 had been recorded as non-recurring charges for the FPP. In addition, and as previously communicated, in connection with the closure of the factory in Dison, a provision has been made for an estimated non-recurring charge of SEKm 116. This was related to certain specified components, for a previously sold customized Munters solution, having to be replaced at a specific customer’s sites.

In the first nine months, net sales growth and good progress in savings from the FPP led to an improved adjusted EBITA margin. Adjusted EBITA amounted to SEKm 248, and adjusted EBITA-margin was 13.7% in the third quarter. Discontinued operations reported EBITA of SEKm -19 in the quarter.

Towards a more profitable company

In the coming quarters I will focus on driving steady, continuous improvements in order to solidify a stable base for Munters. Operational excellence is key for us and imperative in order to create room for continued investments in future growth initiatives. I am very happy that Peter Gisel-Ekdal, after 12 years at the helm of the business area FoodTech has accepted to head up the business area AirTech. Over the coming months I, together with the organization, will focus on setting the strategic priorities that will guide us over the years to come, including a finalization of the strategic evaluation of the Data Center and Mist Elimination businesses.

Klas Forsström, President and CEO

At 9:00 the President and CEO, Klas Forsström, together with the Group Vice President and CFO, Annette Kumlien will present the report in an audiocast with telephone conference.

Audiocast:

http://www.financialhearings.com/event/11800

Dial-in number for the telephone conference:

SE: +46850558365

UK: +443333009032

US: +18335268395

The interim report, presentation material and a link to the audiocast will be available on https://www.munters.com/en/investor-relations/

For more information, please contact:

Ann-Sofi Jönsson, Head of Investor Relations

Phone: + 46 (0)730 251 005

Email: ann-sofi.jonsson@munters.se

This information is information that Munters Group AB is obliged to make public pursuant to the EU Market Abuse Regulation and the Securities Markets Act. The information was submitted for publication, through the agency of the contact person set out above, at 08.00 CET on October 24, 2019

About Munters Group

Munters is a global leader in energy efficient air treatment and climate solutions. Using innovative technologies, Munters creates the perfect climate for customers in a wide range of industries. Munters has been defining the future of air treatment since 1955. Today, around 3,600 employees carry out manufacturing and sales in more than 30 countries. Munters Group AB reports annual net sales of about SEK 7 billion and is listed on Nasdaq Stockholm. For more information, please visit www.munters.com.

Tags: