Interim Report January–September 2019

JULY–SEPTEMBER 2019

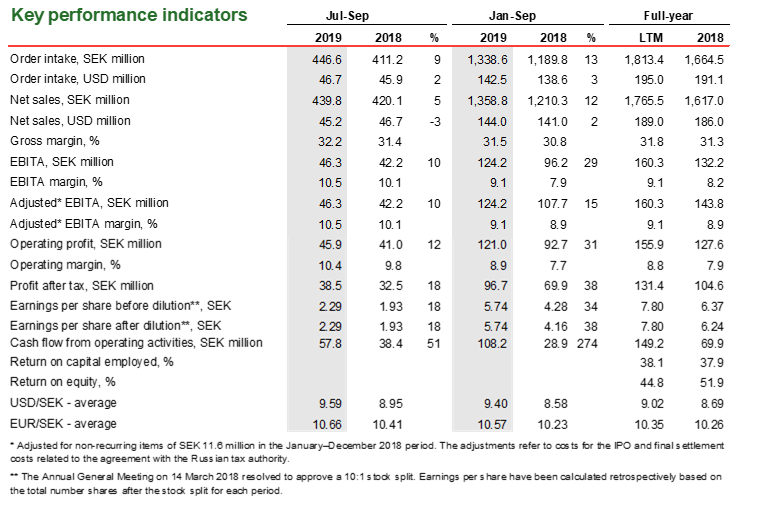

- Net sales increased 5% to SEK 439.8 million (420.1). In USD, net sales decreased 3%.

- Order intake increased 9% to SEK 446.6 million (411.2). In USD, order intake increased 2%.

- EBITA was SEK 46.3 million (42.2), representing an EBITA margin of 10.5% (10.1).

- Operating profit was SEK 45.9 million (41.0). Operating margin was 10.4% (9.8).

- Profit after tax amounted to SEK 38.5 million (32.5).

- Earnings per share before and after dilution was SEK 2.29 (1.93).

- IFRS 16 increased EBITA by SEK 0.1 million.

JANUARY–SEPTEMBER 2019

- Net sales increased by 12% to SEK 1,358.8 million (1,210.3). In USD, net sales increased 3%.

- Order intake increased 13% to SEK 1,338.6 million (1,189.8). In USD, order intake increased 3%.

- EBITA was SEK 124.2 million (96.2), representing an EBITA margin of 9.1% (7.9).

- Adjusted* EBITA was SEK 124.2 million (107.7), representing an adjusted* EBITA margin of 9.1% (8.9).

- Operating profit was SEK 121.0 million (92.7). Operating margin was 8.9% (7.7).

- Profit after tax amounted to SEK 96.7 million (69.9).

- Earnings per share was SEK 5.74 (4.28) before dilution and SEK 5.74 (4.16) after dilution**.

- IFRS 16 increased EBITA by SEK 0.4 million and increased total assets by SEK 35.7 million.

SIGNIFICANT EVENTS DURING AND AFTER THE QUARTER

- First orders received in Malaysia and Benelux.

- NCAB’s CEO Hans Ståhl has told the Board that he wishes to retire during 2020. The Board will initiate a seach process for a successor aiming to close the matter before halfyear 2020.

MESSAGE FROM THE CEO

Growth slows but earnings improve for NCAB

NCAB continued to grow even if the pace has slowed down. Order intake is still increasing at healthy levels and we noted a rise in gross margin and EBITA margin. However, the performance among our segments differs more now than in the past.

Nordic remained strong, with good contributions from Norway and Denmark in particular. It is exciting that growth in Norway is so strong, which is derived from several different electronics companies. In Denmark, it is gratifying to note the highly positive impact of our acquisition of Multiprint and that our order intake has more than doubled year-on-year. Profitability in the acquired operation increased through the implementation of NCAB’s better purchase prices and terms of payment from our factories. Furthermore, the acquisition added a new factory partner.

The East segment also performed well, with a sharp rise in order intake and stronger earnings. The improvement in order intake is largely from domestic Chinese customers, where we have secured a number of major hi-tech projects as a result of our close collaboration.

USA remains challenging. Just as we were getting our own operations in order, higher tariffs were introduced. Many customers are delaying orders and hoping for a cut in tariffs, though unfortunately this no longer seems likely. Our new approved factory in Taiwan has potential moving forward, even if it has only contributed small volumes to date.

In Europe, the general slowdown of the industrial economy continued, with negative growth in most of our larger markets, not least in Germany. Despite this, NCAB reported year-on-year growth in this segment in most countries during the quarter. Furthermore, we have not noted any adverse impact on our gross margins and we have adapted the pace of recruitment to maintain our EBITA margin.

Overall, the Nordic and East segments offset the weak North America and Europe segments but we could nevertheless report continued growth – though at a slower rate than earlier quarters. Order intake remains strong. It is also gratifying to see the good synergies from our acquisition of Multiprint in Denmark are realized and that we have improved our overall earnings compared with the strong third quarter of 2018.

At NCAB, we have learned that an economic downturn also creates opportunities for us. Following the downturn in 2009, we grew sharply in 2010. Such times make it more difficult for domestic factories in the West, which may be forced to close, and can likewise affect smaller trading companies. This is an opportunity to gain customers and carry out acquisitions, which strengthens us when the economy recovers. Moreover, it can facilitate the recruitment of specialists. Our business model – to not own any factories – proves to be particularly good in times like these.

Hans Ståhl

President and CEO, NCAB Group AB

For further information, please contact:

Anders Forsén, CFO +46 (0)8 4030 0051

Gunilla Öhman, Head of Investor Relations, +46 (0)70 763 81 25

This is a translation of the original Swedish interim report. In the event of difference between the English translation and the Swedish original, the Swedish interim report shall prevail.

This is information that NCAB Group AB is obligated to disclose pursuant to the EU Market Abuse Regulation. The information was issued for on 6 November 2019, at 7:30 a.m. CET.

About NCAB

NCAB is a worldwide leading supplier of printed circuit boards, listed on NASDAQ Stockholm.

NCAB is offering PCBs for demanding customers, on time with zero defects, produced sustainably at the lowest total cost. NCAB was founded in 1993. Since its foundation, the operations have been characterized by an entrepreneurial and cost efficient culture and have over time showed strong growth and good profitability.

Today, NCAB has local presence in 17 countries in Europe, Asia and North America and customers in approximately 45 countries worldwide. Revenues in 2017 amounted to SEK 1 400 million. Organic growth and acquisitions are part of NCAB’s strategy. For more information about NCAB Group please visit us at www.ncabgroup.com.