Nordea Economic Outlook: The US ripple effect

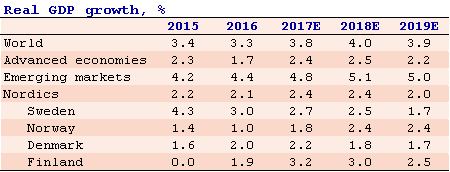

The world economy got off to a good start to 2018 and there is every reason to be optimistic about growth in the short term. However, trade tensions between the US and the rest of the world pose a risk to the growth outlook.

- Though not imminent, a potential US slowdown will also affect the Nordic economies. Especially Sweden and Finland are vulnerable to a US downturn, while Norway and Denmark are less sensitive to economic swings in the US, says Helge J. Pedersen, Nordea’s Group Chief Economist.

Swedish GDP rose sharply in 2017 and the upswing was broadly based. Growth is expected to slow slightly during the coming years despite the loose monetary policy and an expansionary budget. Developments on the housing market will make households tighten their purse strings slightly. Employment continues to rise, but strong labour supply growth will make unemployment fall only marginally, while wage increases will not accelerate much. CPIF inflation is expected to remain below the 2% target during the forecast period. The Riksbank is therefore expected to postpone its first rate hike until 2019.

Last year the housing market slowdown created some uncertainty about the outlook for the Norwegian economy, but recent indicators clearly signal that the housing market correction is over. A sharp pick-up in employment and a return to real wage growth point to a decent increase in consumption. This, coupled with renewed momentum in oil investment activity, fast-growing mainland exports and rising corporate capex, suggests strong growth in the mainland economy going forward. The labour market looks set to tighten further and wage growth will increase. Norges Bank will react by hiking rates, which will underpin the NOK.

For the fifth consecutive year the Danish economy will grow at a pace strong enough to drive down unemployment. The upswing is broadly based with both households and businesses benefiting from very low interest rates and good confidence in the future. We see a good chance that the economy will continue to expand at a healthy clip in the coming years.

Growth prospects for the Finnish economy continue to be favourable. Household consumption will take over the role of key growth engine from exports and investment, thanks to positive labour market developments. However, the economy is vulnerable to a significant escalation of trade tensions, and even an increase in uncertainty may be enough to cut international investment growth, which would mean slower export growth for Finland, a well-known producer of investment goods.

Read the full report Economic Outlook here

For further information:

Helge J. Pedersen, Group Chief Economist, Tel: +45 55471532 | Mob: +45 22697912

E-mail: helge.pedersen@nordea.com

Tags: