Third quarter interim report (05/01/2018 – 01/31/2019)

November – January 2019

Net Sales 1 845 (1 430) KSEK

Operating result before depreciation (EBITDA) -4 744 (-2 426) KSEK

Net result -6 147 (-3 724) KSEK

Earnings per share -0.45 (-0.32) SEK

May – January 2019 (Year to date)

Net Sales 3 240 (2 269) KSEK

Operating result before depreciation (EBITDA) -12 471 (-6 438) KSEK

Net result -16 700 (-10 298) KSEK

Earnings per share -1.21 (-0.88) SEK

In short

- Net sales for the third quarter increased by 29 % to 1 845 (1 430) KSEK and year to date net sales increased by 43 % to 3 240 (2 269) KSEK.

- Third quarter gross margin amounted to 71 (59) %.

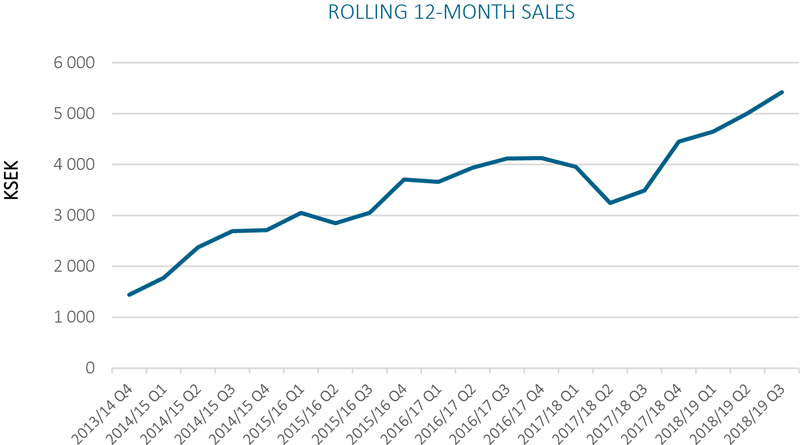

- Rolling 12-month sales reached 5.4 (3.5) MSEK.

- The increased net loss is due to increased operating development costs and increased sales and marketing activities, not least on the important North American market.

- The explicit interest from the industry means that PHI enters a new stage, focused on actively establishing collaborations with one or more leading industry players.

An extremely abnormal cancer cell. The image series was created by scientists at Northeastern University using HoloMonitor®

CEO commentary

The third quarter is characterized by strategic collaborations. After six months of scientific evaluation, the collaboration with BioSpherix moves into the next co-marketing stage, beginning at Society of Toxicology’s Annual Meeting now in March. BioSpherix develops and markets hermetically sealed cell incubators, which in contrast to the simple cell culturing cabinets commonly used today make it possible to mimic the oxygen-depleted environment inside the human body.

In parallel with BioSpherix's evaluation, researchers at QIMR Berghofer Medical Research Institute in Brisbane have used HoloMonitor to investigate how oxygen depletion stimulates cancer cells to form metastases. The results from QIMR have been worth waiting for, as they are directly applicable to the co-marketing activities with BioSpherix by scientifically showing the value of combining the companies’ products.

In order to gain access to significantly larger sales and marketing organizations than PHI can build on its own, our strategy has from the start been to attract major industry players through initial sales and academic collaborations. When the collaborations have been established, our limited market organization will serve as market support for these international sales organizations. A well-developed market support that makes it easy to sell the product in question is often decisive for a successful sales collaboration with a major industry player, where a larger number of products compete for adequate sales representation.

Our strategic efforts have resulted in that we now are actively discussing with several major suppliers of laboratory equipment. So far, these discussions have led to a technology assessment agreement with one major supplier to evaluate our HoloMonitor technology within the field of immuno-oncology.

The international attention we have created in the industry now gives us two possibilities:

- We continue to focus our resources on short-term sales to slowly grow organically on our own or

- we invest our resources to at a later stage achieve more rapid sales growth through major industry players.

The opportunities created by the received attention make the choice easy. We will stay on course and spare no resources to on key markets successfully establish partnerships with major industry players, even if it may have an adverse effect on our short-term sales over a transitional period.

Peter Egelberg, CEO

Net sales and result

Net sales for the third quarter amounted to 1 845 (1 430) KSEK and operating result before depreciation (EBITDA) to -4 774 (-2 426) KSEK. Net result amounted to -6 147 (-3 724) KSEK.

The increased net loss is due to reduced capitalization of development costs and increased sales and marketing activities, not least on the important North American market. Contrary to previous year, hardware development and improvement costs have been directly expensed on the income statement. This has resulted in lower capitalization, which year to date amounted to 2.5 (4.7) MSEK.

The gross margin amounted to 71 (59) % for the quarter and 70 (63) % year to date. Rolling 12-month sales amounted to 5.4 (3.5) MSEK:

Investments

During the third quarter, the company invested 731 (2 009) KSEK in product, production and application development. The emphasis is now on application development to further broaden the scope and efficiency of the company’s products.

Financing

Cash, cash equivalents and unutilized granted credits amounted to 27 569 (9 002) KSEK by the end of the period. The equity ratio was 83 (66) %.

Option program

An option program (TO2) was launched in connection with the recent rights issue, where each option gives the right to subscribe and purchase a new share for 28.20 SEK. TO 2 option holders may exercise their subscription right during May 23 – June 13, 2019. Fully exercised the 648 338 outstanding TO 2 options will provide the company with a capital injection of 18.2 MSEK, before expenses.

Risks

The company may be affected by various factors, described in the 2017/18 Annual Report. These factors may individually or jointly increase risks for the operation and result of the company.

Accounting principles

The accounts are prepared in accordance with the Annual Accounts Act and general advice from the Swedish Accounting Standards Board BFNAR 2012:1 Annual accounts and consolidated accounts (K3).

Review

This interim report has not been subject to review by the company’s auditor.

Statements about the future

Statements concerning the company’s business environment and the future in this report reflect the board of director’s current view of future events and financial developments. Forward-looking statements only express the judgments and assumptions made by the board of directors on the day of the report. These statements have been carefully assessed. However, it is brought to the reader’s attention that these statements are associated with uncertainty, like all statements about the future.

Calendar

June 28, 2019 Year end report 2018/19

On behalf of the Board of Directors

Peter Egelberg, CEO

For additional information, please contact:

Carolina Silvandersson

E-mail: ir@phiab.se

Web: www.phiab.se

Phase Holographic Imaging (PHI) leads the ground-breaking development of time-lapse cytometry instrumentation and software. With the first instrument introduced in 2011, the company today offers a range of products for long-term quantitative analysis of living cell dynamics that circumvent the drawbacks of traditional methods requiring toxic stains. Headquartered in Lund, Sweden, PHI trades through a network of international distributors. Committed to promoting the science and practice of time-lapse cytometry, PHI is actively expanding its customer base and scientific collaborations in cancer research, inflammatory and autoimmune diseases, stem cell biology, gene therapy, regenerative medicine and toxicological studies.