Fall is Here and So are Deer

Insurers say make sure you have adequate auto coverage

It’s that time of year when deer are more active and more likely to dash across a road or highway. While sometimes it’s impossible to avoid hitting a deer, according to the Property Casualty Insurers Association of America (PCI), motorists can take simple steps to prevent deer crashes and hopefully prevent injuries and thousands of dollars in vehicle damage.

“While we all try our best to avoid deer-related crashes, the good news is that they are covered by automobile insurance if you have comprehensive coverage, and insurers will be there to help you through the claims process,” said Robert Passmore, PCI’s assistant vice president of personal lines policy. “Deer-related auto crashes can happen anytime of the year, however, we generally see a spike in the number of claims during the fall. One moment the road is clear and the next instant you encounter a deer. At best, you avoid a collision and are merely shaken up. But when you collide, the accident can be extremely serious causing injuries and sometimes death. It’s important to be aware of your surroundings, especially during dawn and dusk hours, when deer tend to be more active.”

“It is important to recognize that collision and comprehensive insurance coverage are both optional, which means you should contact your agent or company to make sure you’re adequately covered,” said Passmore.

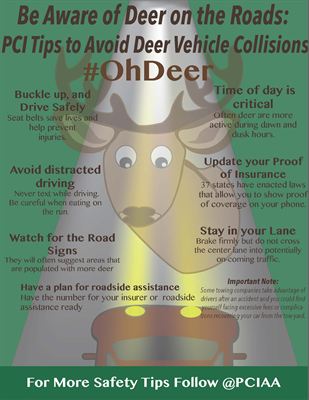

Be Aware of Deer on the Roads: PCI’s Tips for Motorists

- Buckle up, and drive safely. Seat belts save lives and help prevent injuries. Also, make sure kids are in the proper car or booster seats.

- Time of day is critical. Often deer are more active during dawn and dusk hours, so make sure you are paying attention to your surroundings and stay alert.

- Avoid distracted driving. Remember to put the phone down, and never text while driving.

- Have a plan for roadside assistance. If an accident occurs, be wary of unscrupulous towing companies. Have the phone number for your insurer or a roadside assistance program ready so you know who to call. Some towing companies take advantage of drivers after an accident and you could find yourself facing excessive fees or complications recovering your car from the tow yard.

- Update your proof of insurance. Before hitting the road, make sure to replace any expired insurance identification cards in the event you need to prove you have insurance after an accident. Though it is always the best practice to have a hard copy, don’t panic if you have misplaced yours - 37 states have enacted laws that allow you to show proof of coverage on your smartphone. Call your insurer today to see if they offer this feature.

- Watch for road signs that alert you to areas that are populated with more deer.

- Stay in your lane. If you see a deer, brake firmly but do not cross the center lane into potentially on-coming traffic.

For more fall auto safety tips, follow PCI on twitter @PCIAA and use #ohdeer #FallSafety #HeadsUp