Reporting changes in first quarter 2017 - no impact on reported profit for Swedbank Group

Swedbank has during the first quarter of 2017 made three changes, which impact how certain income statement and balance sheet items are reported in the business segments and on Group level. None of the changes have an impact on reported profit for the Group.

1) Change to the reporting of the Savings banks compensation

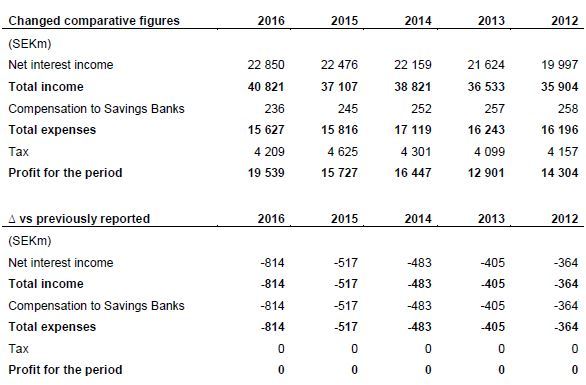

Swedbank and the Savings banks, as of 1 January 2017, changed their bilateral contract regarding how the compensation will be divided between brokerage services and on-going administrative services for mortgages. Brokerage services costs will be reported as a reduction to interest income, while costs for administrative services will be reported as an expense. Restatement of the historical comparative figures has been made, which impacts the Swedish Banking business segment.

Change in presentation of revenues and expenses on Group level for the full years from 2012 to 2016.

2) Transfer of clients between business segments

A number of larger corporate clients within Swedish Banking, which have developed more complex needs will from now on be serviced by account managers in Large Corporates & Institutions. Business volumes and the income relating to these clients will be moved between the business segments from the first quarter 2017. There will be no restatement of historical comparative figures.

Illustration of how the income statement for the impacted business segments would have been impacted if the change had been applied for the full year 2016.

3) Change regarding the allocation of resolution fund and deposit guarantee fees between business segments

As of the 1 January 2017, we apply a new internal allocation principle regarding the fees for the resolution fund and the deposit guarantee. According to the new principles, the fees are aggregated and distributed, primarily based on the lending volumes of the business segments. With the change, Swedish Banking and LC&I will take a slightly larger share of the fees, while Baltic Banking and Group Treasury will take a lower share. The fees will continue to be reported in net interest income and as separate items on Group level in the Factbook. There will be no restatement of historical comparative figures.

Approximate percentage distribution between business segments for 2016 and according to the new distribution principle from 1 January 2017.

For further information please contact:

Gregori Karamouzis, Head of Investor Relations, Swedbank, gregori.karamouzis@swedbank.com, phone +46 727 40 63 38

Swedbank promotes a sound and sustainable financial situation for the many people, households and companies. Our vision is to contribute to development “Beyond Financial Growth”. As a leading bank in the home markets of Sweden, Estonia, Latvia and Lithuania, Swedbank offers a wide range of financial services and products. Swedbank has over 7 million retail customers and around 640 000 corporate customers and organisations with 266 branches in Sweden and 143 branches in the Baltic countries. The group is also present in other Nordic countries, the US and China. As of 31 December 2016 the group had total assets of SEK 2 154 billion.

Read more at www.swedbank.com

Tags: