TELE2 AND COM HEM COMBINING TO CREATE LEADING INTEGRATED CONNECTIVITY PROVIDER

Important Information

For the purposes of this disclaimer, “this press release” means this document, its contents or any part of them, any oral presentation, any question and answer session and any written or oral materials discussed or distributed therein. This communication does not constitute notice to an extraordinary general meeting or a merger document, nor shall it constitute an offer to sell or the solicitation or invitation of any offer to buy, acquire or subscribe for, any securities or an inducement to enter into investment activity, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any decision with respect to the proposed statutory merger of Tele2 AB (publ) (“Tele2”) and Com Hem Holding AB (publ) (“Com Hem”) in accordance with the Swedish Companies Act (the “Merger”) should be made solely on the basis of information to be contained in the actual notices to the extraordinary general meetings of Tele2 and Com Hem, as applicable, and the merger document related to the Merger as well as on an independent analysis of the information contained therein. You should consult the merger document, which will be available prior to the extraordinary general meeting of shareholders at which the matters set out herein will be subject to vote, for more complete information about the Merger. You should also perform an independent analysis of the information contained therein and the merger document when making any investment decision.

This press release contains forward-looking statements. By their nature, forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors because they relate to events and depend on circumstances that will occur in the future whether or not outside the control of each respective company or the combined company. Such factors may cause actual results, performance or developments to differ materially from those expressed or implied by such forward-looking statements. Although managements of each respective company believe that their expectations reflected in the forward-looking statements are reasonable based on information currently available to them, no assurance is given that such forward-looking statements will prove to have been correct. You should not place undue reliance on forward-looking statements. They speak only as at the date of this press release and neither Tele2 nor Com Hem undertakes any obligation to update these forward-looking statements. Past performance of Tele2 and Com Hem does not guarantee or predict future performance of the combined company. Moreover, Tele2, Com Hem and their respective affiliates and their respective officers, employees and agents do not undertake any obligation to review, update or confirm expectations or estimates or to release any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of the presentation. Additionally, there can be no certainty that the Merger will be completed in the manner and timeframe described in this press release, or at all.

Note about preliminary combined financial information and basis of preparation

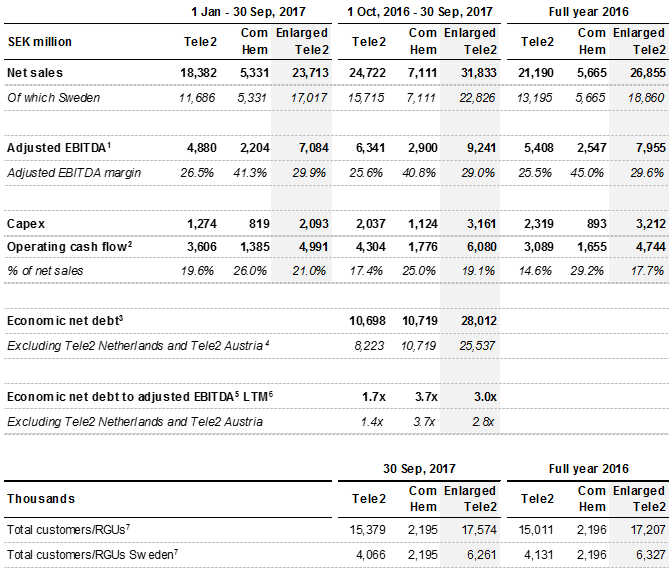

The preliminary combined financial information presented in this press release is for illustrative purposes only. The preliminary combined financial information has not been prepared in accordance with IFRS and is not financial pro forma information, and has not been audited or otherwise reviewed by the companies’ auditors. Differences in accounting policies or definitions of non-IFRS measures have not been taken into account. Financial information for Tele2 and Com Hem have been based on unaudited reported financial information. Financial information for Tele2 is based on unaudited figures restated in order to reflect the sale of Tele2 Austria in October 2017 and the transaction between Tele2 Netherlands and Deutsche Telekom announced in December 2017 (re-classified as discontinued operations in December 2017). Tele2 Netherlands historical financial information has been adjusted by certain intercompany items. Adjusted EBITDA refers to Tele2’s EBITDA and Com Hem’s underlying EBITDA. OCF defined as adjusted EBITDA - capex.

The preliminary combined income statement information has been calculated assuming the activities had been included in one entity from the beginning of each period. The net sales, adjusted EBITDA, capex and operating cash flow of the combined company have been calculated as a sum of combined financial information for the twelve months ended December 31, 2016, for the twelve months ended September 30, 2017 and for the nine months ended September 30, 2017. The preliminary combined financial information is based on hypothetical estimates and should not be viewed as pro forma financial information.

EBITDA, adjusted EBITDA, underlying EBITDA, capex, opex, standalone economic net debt, combined economic net debt and operating cashflow (“OCF”) are financial performance measures that are not defined under IFRS. Additional information about these performance measures is available in the companies’ financial reports which are available at: http://www.Tele2.com/investors/ and http://www.Com Hemgroup.se/en/investors/, respectively.

Notice to shareholders in the United States

This press release is provided for informational purposes only and is neither an offer to sell nor a solicitation of an offer to buy shares of Tele2 or Com Hem. Tele2 intends to file a registration statement on Form F-4 with the Securities and Exchange Commission (the “SEC”) in connection with the transaction. Tele2 and Com Hem expect to mail a merger document, which is part of the registration statement on Form F-4, to security holders of Com Hem in connection with the transaction. This press release is not a substitute for the registration statement, merger document or any other offering materials or other documents that Tele2 and Com Hem plan to file with the SEC or send to security holders of Com Hem in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF Com Hem ARE URGED TO READ THE MERGER DOCUMENT CAREFULLY WHEN IT BECOMES AVAILABLE. THE MERGER DOCUMENT CONTAINS IMPORTANT INFORMATION ABOUT THE TRANSACTION INCLUDING CERTAIN RISKS RELATED TO THE TRANSACTION AND SHOULD BE READ BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TRANSACTION. When the merger document becomes available, investors and security holders will be able to obtain free copies of it through the website maintained by the SEC at www.sec.gov. Free copies of the merger document may also be obtained from Tele2, by directing such request to Mr. Erik Strandin Pers, Head of Investor Relations, e-mail: erik.pers@tele2.com, phone: +46 733 41 41 88, or from Com Hem, by directing a request to Ms. Petra von Rohr, Director of IR and Corporate Communications, e-mail: petra.vonrohr@comhem.com, phone: +46 734 39 06 54.

In addition to the registration statement and merger document, Tele2 and Com Hem file annual, quarterly and special reports and other information with the Swedish Financial Supervisory Authority. You may read and copy any reports, statements or other information filed by Tele2 or Com Hem at: http://www.tele2.com/investors/ and http://www.comhemgroup.se/en/investors/, respectively.

Stockholm – Tele2 Group, (Nasdaq Stockholm: TEL2 A and TEL2 B) and Com Hem Holding AB, (Nasdaq Stockholm: COMH) today jointly announced that the Board of Directors of Tele2 AB (publ) (“Tele2”) and the Board of Directors of Com Hem Holding AB (publ) (“Com Hem”) have agreed on a combination of Tele2 and Com Hem through a statutory merger in accordance with the Swedish Companies Act (the “Merger”), creating a leading integrated connectivity provider referred to below as the “Combined Company” or “Enlarged Tele2”. The Merger will be implemented by Tele2 absorbing Com Hem.

On January 9, 2018, the Board of Directors of Tele2 and the Board of Directors of Com Hem (together the “Boards”) have entered into a merger agreement and agreed on a joint merger plan (respectively the “Merger Agreement” and the “Merger Plan”)[1], pursuant to which Tele2 and Com Hem have agreed to combine their business operations through the Merger.

Combination of two highly complementary businesses

- Creating a leading integrated operator by combining an award-winning mobile network with the fastest national fixed network and the widest range of content in the market

Superior customer offering meeting the demands of tomorrow

- Enhanced growth capitalizing on increased fixed and mobile data consumption, underpinned by accelerated video demand, by offering a full range of complementary and ubiquitous high-quality connectivity and digital services

- Well positioned to act as a customer champion in an integrated world to further improve customer satisfaction and loyalty

Beneficial for Tele2 and Com Hem shareholders

- Expected total annual opex, capex and revenue synergies of around SEK 900 million to be achieved within five years and free cash flow per share accretive for Tele2 from the first year after completion

- Enhanced revenue growth and realization of synergies creates significant capacity for attractive shareholder remuneration and strong cash conversion

Summary of the transaction

- Com Hem’s shareholders will receive as merger consideration SEK 37.02 in cash plus 1.0374x B shares in Tele2 for each share in Com Hem outstanding as at completion of the Merger. Hence, Com Hem’s shareholders will receive approximately 26.9 percent economic ownership in Enlarged Tele2 and a total cash consideration of SEK 6.6 billion[2]

- Based on the latest thirty trading days volume-weighted average share price of the Tele2 B share, the offer values Com Hem at SEK 146.00 per share, representing a premium of 15.9 percent compared to the last thirty trading days volume-weighted average price and a premium of 11.8 percent compared to the last closing price of SEK 130.60 on January 9, 2018

- At completion of the Merger, Anders Nilsson will become the CEO of Enlarged Tele2 to drive the Combined Company through its next phase of growth

- Tele2 and Com Hem will distribute stated ordinary dividends for 2017 to their respective shareholders in the amount of SEK 4 per share for Tele2 shareholders and SEK 6 per share for Com Hem shareholders. In addition, Com Hem has an existing share buyback program which ends no later than March 20, 2018

- The completion of the Merger is subject to, inter alia, approval by the shareholders of each of Tele2 and Com Hem at their respective Extraordinary General Meetings (each, an “EGM”), which are currently expected to be held in H2 2018 as well as approval from the relevant competition authorities

- Tele2’s and Com Hem’s largest shareholder[3], Kinnevik AB (publ) (“Kinnevik”), has undertaken to vote in favor of the Merger at the respective EGMs and not to sell any shares in Tele2 or Com Hem (or in the Enlarged Tele2) up until six months after completion of the Merger, subject to customary conditions. In addition, Kinnevik has committed to participate in the European Commission merger control procedure and is prepared to effect pro-competitive measures if required to complete the Merger

Over the last few years, Tele2 and Com Hem have undertaken a period of active strategic development and continued long-term investment in their networks with the goal of better positioning the respective companies for the future, while simultaneously generating substantial value creation for their respective shareholder bases.

The combination of Tele2 and Com Hem is a natural next step for both companies and will create a leading integrated connectivity provider in the Swedish telecommunications market by combining an award-winning mobile network with the fastest national fixed network and the widest range of content in the market. Therefore, Enlarged Tele2 will be well equipped to meet the evolving customer needs for seamless connectivity and digital services. Digitalization affects nearly every aspect of society and the Merger will further contribute to a better digital quality of life for Swedish individuals, households and businesses through a full range of complementary and ubiquitous high-quality connectivity and digital services.

Enlarged Tele2 will be the second largest mobile telephony and fixed broadband provider in Sweden and the market leader in digital TV with the ability to offer powerful customer solutions and capitalize on the increasing fixed and mobile data consumption underpinned by accelerated video demand. This will not only lead to improved customer experience and loyalty but also position the company for enhanced growth by meeting untapped customer demand for a full range of digital services and high-quality connectivity, no matter where or when the customer needs it.

This combination will strengthen and broaden the Swedish operations, for the Combined Company, vis-à-vis the two companies separately. This is in line with both Tele2’s purpose to fearlessly liberate people to live a more connected life as well as Com Hem’s overarching strategy of unleashing the power of Swedish homes and small businesses for the best possible digital quality of life.

Furthermore, the combination is expected to create significant value for all stakeholders with total annual opex, capex and revenue synergies estimated at around SEK 900 million to be achieved within five years, of which approximately half are opex and capex synergies and the other half are revenue synergies. The transaction is expected to be free cash flow per share accretive for Tele2 from the first year after completion.

Anders Nilsson will become CEO of Tele2 following completion of the Merger and will assume leadership of the Tele2 management team at this point in order to deliver on integrating the two companies and to deliver on the strategic objectives. It is expected that upon completion of the Merger, Andrew Barron currently Chairman of Com Hem along with at least one additional Com Hem Board Director will join the Board of Directors of Tele2, which will be chaired by Tele2’s proposed new Chairman Georgi Ganev.

Enlarged Tele2 will have an attractive financial profile. The Merger will build strength through increased scale and product diversification, enabling a more diversified revenue base and resilient cash flow generation. The Combined Company is expected to have significant capacity to both support Enlarged Tele2’s strategic ambitions, drive growth and to allow for attractive shareholder remuneration and returns.

Enlarged Tele2 will remain committed to covering shareholder remuneration with equity free cash flow and to returning excess capital to shareholders. It is envisaged that Enlarged Tele2 will increase shareholder remuneration relative to Tele2’s level today and grow it over time, enabled by strong cash flow generation. Furthermore, Enlarged Tele2 will be committed to retaining a credit profile consistent with an investment grade credit rating and to maintain the current leverage target of 2.0-2.5x over the medium term.

The preliminary combined net sales for the twelve months ended September 30, 2017 are approximately SEK 31.8 billion with an adjusted EBITDA of SEK 9.2 billion and OCF of SEK 6.1 billion, of which Sweden accounted for approximately SEK 22.8 billion of net sales, SEK 7.2 billion of adjusted EBITDA and SEK 5.2 billion of OCF. On a preliminary combined basis, Sweden accounted for approximately 72 percent of Enlarged Tele2’s net sales and 78 percent of Enlarged Tele2’s adjusted EBITDA for the twelve months ended September 30, 2017.

Tele2 has obtained committed financing for the Merger in the form of a bridge facility from a group of three banks with conditions to drawdown that are usual and customary for this type of facility.

The Boards are of the opinion that the Merger is beneficial to the companies and the shareholders. The Board of Directors of Tele2 considers the merger consideration to be fair from a financial point of view to Tele2 and has obtained a fairness opinion dated January 9, 2018 from N M Rothschild & Sons Limited reflecting their opinion as of that date that, on the basis of the considerations stated therein, the merger consideration to be paid by Tele2 is fair, from a financial point of view, to Tele2. The Board of Directors of Com Hem considers the merger consideration to be fair, from a financial point of view, to the holders of Com Hem common stock (other than Tele2 and its affiliates) and this view is supported by a fairness opinion from Bank of America Merrill Lynch, acting as financial advisor to the Board of Directors of Com Hem, dated as of January 9, 2018, to the effect that, as of such date and based upon and subject to the assumptions and limitations set forth therein, the merger consideration to be received in the Merger by holders of shares of Com Hem common stock (other than Tele2 and its affiliates) is fair, from a financial point of view, to such holders.

Taking into consideration the time required for the regulatory approval process and the statutory period of notification for the known and unknown creditors, the Merger is expected to be completed during H2 2018.

Comments from Mike Parton, Chairman of the Board of Directors of Tele2

“We are delighted to have reached agreement to combine two great Nordic companies to create a leading integrated connectivity provider in the Swedish market. I take great pride in the outstanding returns Tele2 has delivered to its shareholders over the past years and the value we have delivered to our customers. I am excited for the future of the Combined Company which we are confident will create significant value for Swedish individuals, households, businesses and of course our investors.”

Mike Parton continues:

Allison Kirkby has led Tele2 through a challenging period with great energy and commitment. She has successfully reshaped the business and the strategy of the group and prepared it for the Merger which we announce today. The financial performance and shareholder returns generated have been outstanding and speak volumes for the quality of her leadership. We as a Board would like to thank her for everything she has done for the Tele2 group and especially for her pivotal role in laying solid foundations from which Enlarged Tele2 can prosper.”

Mike Parton continues:

In this exciting new chapter for Tele2, the Board would like to welcome Anders Nilsson as the incoming CEO at completion. His broad and deep operational experience in the Nordic media and connectivity market makes him extremely well suited to lead Tele2 to drive integration and delivery of the significant value creation potential that this transaction enables.”

Comments from Allison Kirkby, CEO of Tele2

“This transaction will strengthen and diversify the Combined Company’s Swedish operations while increasing the long-term cash flow resilience. Enlarged Tele2 will be able to provide a wide range of complementary connectivity and digital services; a base that makes us well positioned to act as a customer champion in an increasingly integrated world. This transaction will make Tele2 stronger, more diversified in its home market, and better equipped to fearlessly liberate people to live a more connected life.”

Allison Kirkby continues:

“When I began my leadership role at Tele2 I had three overarching objectives: to drive returns through disciplined capital allocation; to focus the group on those markets where we knew we could win; and to become the leading connectivity provider in the Baltic Sea region with a strong emphasis on the consumer. With today’s announcement all of these objectives have now been achieved and I am incredibly proud of the Tele2 team and all we have accomplished over the past four years. I am confident that, at completion, I will hand over a company in very good shape and with Anders Nilsson and the current Tele2 management team leading the organization, it is in great hands to be even more successful going forward.”

Comments from Anders Nilsson, CEO of Com Hem

“Merging is the best possible next step for both companies as it will enable us to meet the demands of tomorrow and unleash the power for the best possible digital quality of life in Sweden. I am proud of the progress we have made during the last few years in improving our products and services leading to increased customer satisfaction, expanding our footprint while delivering on all our financial targets. The transaction will create significant benefits to Swedish individuals, households, businesses and to the shareholders of Tele2 and Com Hem.

Anders Nilsson continues:

I am humbled by the responsibility and enormously excited by the opportunity to lead Enlarged Tele2 as Group CEO. The Combined Company will be very well-positioned for the future to meet the expectations of our shareholders, customers and employees. I’m looking forward to working with the Tele2 Board and colleagues of the Enlarged Tele2 to make these two great companies stronger together.”

Background to the Merger

Following a number of strategic actions including transactions in Kazakhstan, Austria and the recently announced transaction in the Netherlands, Tele2 is now a clear leader and customer champion in the Baltic Sea region. As part of these strategic efforts, Sweden has become an increasingly important market for Tele2, with its position as a true Swedish customer champion in both the B2C and B2B segment. The acquisition of TDC Sweden further accelerated and strengthened Tele2’s B2B strategy, in particular in the Swedish large enterprise segments.

Com Hem has significantly strengthened its position on the Swedish market through a consistent focus on improving customer satisfaction, substantial investments in infrastructure and services and a successful single dwelling unit (“SDU”) expansion program. This has been strongly boosted by the acquisition of Boxer in September, 2016, with Com Hem becoming a true national operator.

The combination of Tele2 and Com Hem is a natural next step for both companies and will create a leading integrated connectivity provider in the Swedish telecommunications market which is equipped to meet the evolving customer needs for seamless connectivity and digital services.

Rationale of the Merger

The Boards each see a compelling strategic fit between Tele2 and Com Hem and the Merger is expected to be significantly value accretive for all stakeholders through:

Combination of two highly complementary businesses: Creating a leading integrated connectivity provider in the Swedish telecommunications market by merging an award-winning mobile network with the fastest national fixed network and the widest range of content in the market, with a combined customer base including 3.9 million mobile customers, 0.8 million broadband customers and 1.1 million digital TV customers in Sweden.[4] Within both mobile and fixed broadband, the Combined Company will have a strong position in the Swedish market, complemented by a leading position within digital TV.[5] Enlarged Tele2 will have a 4G network population coverage in Sweden of 99.9 percent and its broadband network will cover almost 60 percent of Sweden’s households.

Enabling a superior customer offering meeting the demands of tomorrow: Enlarged Tele2 will be positioned for enhanced growth capitalising on increased fixed and mobile data consumption underpinned by accelerated video demand, by offering a full range of complementary and ubiquitous high-quality connectivity and digital services. This will provide a seamless experience for the entire household and give customers the power to connect whatever they want, wherever they want and whenever they want. Enlarged Tele2 will have an even more complete and simplified customer proposition which will support the Combined Company to further improve customer satisfaction and loyalty and enhance its digital consumer brands in Sweden.

Greater scale and diversification: The Merger will build strength through increased scale and product diversification. Enlarged Tele2’s preliminary combined net sales in Sweden were SEK 22.8 billion with an adjusted EBITDA of SEK 7.2 billion and an OCF of SEK 5.2 billion for the twelve months ended 30 September, 2017. Through the Merger, Enlarged Tele2 will have the opportunity to provide a broader mix of fixed and mobile offerings.

Unlocking significant synergies: Tele2 and Com Hem see potential to unlock meaningful long-term value through opex, capex and revenue synergies. In total, annual synergies are expected to be around SEK 900 million to be achieved within five years; approximately half of them relate to opex and capex synergies and the other half relate to revenue synergies in terms of impact on adjusted EBITDA.

Attractive financial profile: Enlarged Tele2 will have a more diversified revenue and cash flow base through its broader and complementary product offering and is expected to have significant capacity for attractive shareholder remuneration and returns. The Combined Company is expected to maintain its financial strength and flexibility with a preliminary combined Q3 2017 economic net debt to Q3 2017 adjusted LTM EBITDA of 2.8x, and strong cash flow generation to support Enlarged Tele2’s strategic growth ambitions.

The Merger

On January 9, 2018, the Boards have entered into the Merger Agreement and agreed the Merger Plan,[6] pursuant to which Tele2 and Com Hem have decided to combine their business operations through a statutory merger in accordance with the Swedish Companies Act. The Merger will be implemented by Tele2 absorbing Com Hem.

Choice of transaction method

The Boards are of the opinion that the combination of Tele2 and Com Hem should be implemented by means of a statutory merger in accordance with the Swedish Companies Act, whereby the companies’ shareholders are given the opportunity to approve the Merger at their respective EGMs.

The Boards propose that the Merger is implemented with Tele2 as the absorbing company and Com Hem as the transferring company.

Merger consideration

Com Hem’s shareholders will receive as merger consideration SEK 37.02 in cash plus 1.0374x new B shares in Tele2 for each share in Com Hem (i.e., new shares in Tele2 will be issued to Com Hem’s shareholders in proportion to their existing shareholdings in Com Hem in the ratio of 1.0374:1).[7] Hence, the shareholders of Com Hem will receive an approximate 26.9 percent economic ownership in the Enlarged Tele2 and a total cash consideration of SEK 6.6 billion. [8]

Based on the latest thirty trading days volume-weighted average share price of the Tele2 B share, the merger consideration represents a premium of approximately:

- 15.9 percent compared to the thirty trading days volume-weighted average share price of SEK 125.95 per Com Hem share;[9] and

- 11.8 percent compared to the closing share price of SEK 130.60 per Com Hem share.[10]

Number of shares in Tele2 following the Merger

The number of B shares issued to Com Hem shareholders as part of the merger consideration will be based on the number of Com Hem shares outstanding at the time of completion of the Merger, excluding any shares held in treasury. Under the assumption that the number of shares outstanding as of January 9, 2018, is the same as at completion, the aggregate number of newly issued B shares in Tele2 would be 184.8 million. On this basis, the total outstanding shares in Tele2 following completion of the Merger would be 687.6 million, consisting of 22.8 million A shares, 664.8 million B shares.

Overview of Enlarged Tele2

Business overview

Enlarged Tele2 will be a European telecom operator, with a clear focus on the Nordic region. Enlarged Tele2 will offer mobile services, fixed broadband, digital TV, fixed telephony, data network services, global Internet of Things (“IoT”) solutions and network operator services to more than 17 million customers.[11]

Enlarged Tele2’s preliminary combined net sales for the twelve months ended September 30, 2017 were approximately SEK 31.8 billion, with an adjusted EBITDA of SEK 9.2 billion, and OCF of SEK 6.1 billion. The Combined Company will operate with the geographically split operating segments of Sweden, Lithuania, Latvia, Estonia, Kazakhstan, Croatia, and Germany, as well as the operating segment Other which will mainly include IoT, the parent company Tele2 AB and central functions, and other minor operations.[12] In addition, the Enlarged Tele2 will, following the expected successful completion during 2018 of the merger between Tele2 Netherlands and T-Mobile Netherlands announced on December 15, 2017, hold a 25 percent equity stake in the combined Dutch entity. Following the Merger, Sweden will be Enlarged Tele2’s largest operating segment in terms of net sales and adjusted EBITDA. On a preliminary combined basis, Sweden accounted for approximately 72 percent of Enlarged Tele2’s net sales and 78 percent of Enlarged Tele2’s adjusted EBITDA for the twelve months ended September 30, 2017.[13]

Synergies

The Merger is expected to create substantial value for the shareholders of Enlarged Tele2 through synergies resulting from the coordination of the operations of the two companies and through the significant expansion of Enlarged Tele2’s addressable customer segments in Sweden compared to Tele2’s and Com Hem’s standalone. In total, annual synergies are estimated to be around SEK 900 million to be achieved within five years.

Opex and capex synergies: Total opex and capex synergies resulting from the Merger are estimated to be approximately half of total annual synergies, with the bulk generated from opex synergies. The majority of Enlarged Tele2’s expected opex synergies are anticipated to arise from network, IT and infrastructure efficiencies, optimization of customer care, sales and marketing as well as management and administrative function cost reductions. Expected capex synergies include optimization of investments in IT and network. It is projected that the full effect of the opex and capex synergies will be achieved five years after completion of the transaction, with approximately 65 percent of the run-rate opex and capex synergies being realized within three years and 80 percent within four years.

Revenue synergies: Total revenue synergies, in terms of impact on adjusted EBITDA, resulting from the Merger are estimated to be approximately half of total annual synergies. The majority of the expected revenue synergies are anticipated to arise as a result of accelerated growth for Enlarged Tele2 driven by, inter alia, the opportunity to offer a full range of complementary connectivity and digital services to the Swedish market and by cross-selling to each company’s customer base. It is projected that the full effect of the revenue synergies will be achieved five years after completion of the transaction.

Integration costs: The integration of operations will commence immediately after the Merger is completed, and it is expected that Enlarged Tele2 will start to achieve synergies from the first year following the transaction completion. Integration costs to realize the synergies have been estimated at around SEK 600 million in total, of which the vast majority are expected to be incurred during the first three years post completion of the transaction.

Board of Directors, management and employees

Upon completion of the Merger, Anders Nilsson will become the CEO of Enlarged Tele2 and assume leadership of the Tele2 management team. Allison Kirkby will step down from her position as CEO at that time.

This management transition is in line with the next chapter of Tele2’s strategic development. In particular, Enlarged Tele2 will focus on driving integration within media and connectivity in Sweden, which requires a leadership with deep experience in this sector and region. Accordingly, with more than 25 years of experience across the media, communications and digital services sectors, Anders Nilsson, current CEO of Com Hem, represents the ideal candidate to lead Enlarged Tele2 to deliver on strategic objectives and the synergies identified.

Anders Nilsson has extensive experience of Scandinavian and international media, communications and digital services markets, developed over a 25-year career in senior leadership positions at Modern Times Group AB, Millicom International Cellular AB and since 2014, as the CEO of Com Hem Holding AB. Under Anders Nilsson’s direction, Com Hem has developed into a leading Swedish communications and media provider, having made substantial investments in improving customer satisfaction, infrastructure and services, and in addition expanding its position in the SDU market, accelerated through the acquisition of Boxer in June 2016.

The Tele2 Board of Directors is delighted that Anders Nilsson has agreed to take the helm of Enlarged Tele2 in order to drive the integration of Com Hem and deliver on both companies’ belief of the substantial value for all stakeholders, which this transaction enables.

Allison Kirkby will continue as CEO of Tele2 until the completion of the Merger and will ensure a smooth transition. In addition to her normal CEO duties, she will supervise the initial integration planning and oversee the regulatory approval process. If the Merger does not close, Allison Kirkby will remain CEO of Tele2.

Under Allison Kirkby’s direction as Tele2 CEO, the Tele2 group leadership team has undertaken a period of active strategic development and continued long-term investment in the network to position the company for the future. This has encompassed:

- a strong emphasis on the consumer and a purpose to fearlessly liberate people to live a more connected life;

- refining the corporate culture and building a stronger Tele2 team;

- driving operational performance;

- rigorous capital allocation; and

- a geographical refocusing, including transactions in Kazakhstan, Austria and the recently announced transaction in the Netherlands.

Together, these actions have:

- generated substantial value creation for Tele2 shareholders with a total shareholder return of approximately 52% since Allison Kirkby’s appointment compared to Tele2 peers of approximately 6%;[14] and

- led to the establishment of Tele2 as a clear leader and customer champion in the Baltic Sea region.

With this achievement, a new strategic chapter for Tele2 and its equity story commences. The merger between Tele2 and Com Hem will build upon the foundations laid, creating a leading integrated connectivity provider in Sweden. This deal reinforces Tele2’s position as a customer champion with an enhanced customer proposition, fulfilling Allison Kirkby’s objectives for Tele2 since the start of her tenure as CEO.

Management and key employees of Tele2 and Com Hem are entitled to receive, subject to certain performance conditions, an integration and retention incentive corresponding to 12 – 24 months base salary in connection with the completion of the Merger and first phase of integration. Except as outlined above, there are currently no decisions on any material changes to Tele2’s or Com Hem’s employees or to the existing organization and operations, including the terms of employment and locations of the business.

It is expected that upon completion of the Merger, Andrew Barron currently Chairman of Com Hem along with at least one additional Com Hem Board Director will join the Board of Directors of Tele2, which will be chaired by Tele2’s proposed new Chairman Georgi Ganev.

Ownership structure

Pursuant to the Merger Plan, Com Hem’s shareholders will receive approximately 26.9 percent economic ownership in Enlarged Tele2.

The illustrative table below shows the ownership of the Combined Company as if the Merger had been completed based on the latest available shareholding information.

Source: Company information, Holdings Modular Finance.

Note: Illustrative post transaction shareholder structure based on information from Holdings Modular Finance database as of January 9, 2018 and the number of shares outstanding in Tele2 and Com Hem as of January 9, 2018 (excluding any shares held in treasury by the respective companies).

Following the Merger, Tele2 will continue to be listed on Nasdaq Stockholm and be domiciled and headquartered in Stockholm. Tele2 will continue to follow those rules and regulations for corporate governance being applicable for a company listed on Nasdaq Stockholm.

Preliminary combined financial information

The preliminary combined financial information presented in this press release and in the table below is for illustrative purposes only. The preliminary combined financial information has not been prepared in accordance with IFRS and is not financial pro forma information, and has not been audited or otherwise reviewed by the companies’ auditors. Differences in accounting policies or definitions of non-IFRS measures have not been taken into account. Financial information for Tele2 and Com Hem have been based on unaudited reported financial information. Financial information for Tele2 is based on unaudited figures restated in order to reflect the sale of Tele2 Austria in October 2017 and the transaction between Tele2 Netherlands and Deutsche Telekom announced in December 2017 (re-classified as discontinued operations in December 2017). Tele2 Netherlands historical financial information has been adjusted by certain intercompany items. The preliminary combined financial information is based on hypothetical estimates and should not be viewed as pro forma financial information.

For additional information, please refer to the disclaimer on the first page of this press release.

Preliminary combined key figures (continuing operations)

1 Adjusted EBITDA refers to Tele2’s EBITDA and Com Hem’s underlying EBITDA.

2 Defined as adjusted EBITDA - capex.

3 Standalone economic net debt refer to Tele2’s standalone economic net debt and Com Hem’s standalone net debt as reported by the respective companies, combined economic net debt includes SEK 6.6 billion cash consideration in relation to the merger.

4 Tele2 standalone economic net debt and combined economic net debt adjusted for the cash consideration expected to be received from the announced transaction between Tele2 Netherlands and Deutsche Telekom announced in December 2017 of approximately SEK 1.8 billion and the cash consideration from the divestment of Tele2 Austria of approximately SEK 0.7 billion.

5 Adjusted EBITDA for Tele2 used in leverage calculation includes adjusted EBITDA Q3 2017 LTM contribution from the Netherlands and Austria and pro forma TDC Sweden but only includes Tele2’s share (49 percent) of adjusted EBITDA in Kazakhstan.

6 LTM refers to the period 1 Oct 2016 – 30 Sep 2017.

7 Number of combined customers/RGUs calculated as the sum of Tele2 customers, Com Hem consumer and Boxer RGUs and Com Hem unique B2B customers as per the respective companies’ Q3 2017 reports.

Financial targets

The Board of Directors of Tele2, together with Tele2 management, have considered appropriate financial targets for Enlarged Tele2 and agreed on the following framework. Subsequent to the completion of the Merger, the Tele2 management team will together with the Tele2 Board of Directors refine and possibly adapt these targets.

The preliminary long-term financial targets of Enlarged Tele2 are outlined below:

- Shareholder remuneration: Following completion of the Merger, Enlarged Tele2 will remain committed to covering shareholder remuneration with equity free cash flow and to returning excess capital to shareholders. It is envisaged that Enlarged Tele2 will increase shareholder remuneration relative to Tele2’s level today and grow it over time, enabled by strong cash flow generation. More specific guidance will be provided after completion

- Capital structure: Enlarged Tele2 will be committed to a credit profile consistent with an investment grade credit rating and to maintain the current leverage target of 2.0-2.5x over the medium term

Recommendation from the Board of Directors of Tele2

The Board of Directors of Tele2 is of the opinion that the Merger is beneficial to Tele2 and its shareholders. The Board also considers the merger consideration to be fair from a financial point of view to Tele2 and has obtained a fairness opinion dated January 9, 2018 issued by N M Rothschild & Sons Limited reflecting their opinion as of that date that, on the basis of the considerations therein, the merger consideration to be paid by Tele2 is fair, from a financial point of view, to Tele2.

Recommendation from the Board of Directors of Com Hem

The Board of Directors of Com Hem is of the opinion that the Merger is beneficial to Com Hem and its shareholders. The Board also considers the merger consideration to be fair, from a financial point of view, to the holders of Com Hem common stock (other than Tele2 and its affiliates) and this view is supported by a fairness opinion from Bank of America Merrill Lynch, acting as financial advisor to the Board of Directors of Com Hem, dated as of January 9, 2018, to the effect that, as of such date and based upon and subject to the assumptions and limitations set forth therein, the merger consideration to be received in the Merger by holders of shares of Com Hem common stock (other than Tele2 and its affiliates) is fair, from a financial point of view, to such holders. The Board of Directors of Com Hem has issued a statement pursuant to Section II.19 of the Takeover Rules, in which the shareholders of Com Hem are recommended to vote in favor of the Merger.

Voting commitment

Tele2’s and Com Hem’s major shareholder, Kinnevik, holding 30.1 percent of the shares and 47.6 percent of the votes in Tele2[15] and 18.7 percent of the shares and votes in Com Hem[16], has undertaken to vote in favor of the Merger at the respective EGMs.

Shareholdings between Tele2 and Com Hem

Tele2 does not hold or control any shares in Com Hem or any other financial instruments, which give Tele2 a financial exposure equivalent to a shareholding in Com Hem. Tele2 has not acquired any shares in Com Hem during the last six months prior to the announcement of the Merger.

Com Hem does not hold or control any shares in Tele2 or any other financial instruments which give Com Hem a financial exposure equivalent to a shareholding in Tele2. Com Hem has not acquired any shares in Tele2 during the last six months prior to the announcement of the Merger. Tele2 has agreed not to acquire any shares in Com Hem, and Com Hem has agreed not to acquire any shares in Tele2, until the completion of the Merger.

Pre-merger undertakings

Tele2 and Com Hem each shall, during the period from this day and until the day of the registration of the Merger with the Swedish Companies Registration Office, carry on the business of the respective company in the ordinary course of business and shall not, without the prior written consent of the other party, take any of the following actions:

(a) declare or pay any dividend or other distribution to shareholders, except that (i) Tele2 may pay cash dividends of SEK 4 per share to Tele2’s shareholders, (ii) Com Hem may pay cash dividends of SEK 6 per share to Com Hem’s shareholders, (iii) Com Hem may buy back shares in Com Hem for a total amount of up to SEK 186,000,000 up until March 20, 2018 in accordance with the resolution of the Board of Directors of Com Hem on October 17, 2017, and (iv) Com Hem may buy back the Executive Warrants (as defined under section 11 “Holders of securities with special rights in Com Hem” in the Merger Plan) in Com Hem in accordance with the resolution of the annual general meeting of Com Hem on March 23, 2017;

(b) issue or create shares or other securities, except for (i) Tele2’s directed issues of class C shares carried out in the ordinary course of business consistent with past practices in order to secure Tele2’s undertakings to deliver shares to the participants in its long term incentive plans and (ii) except for any debt securities issued by Com Hem in connection with the refinancing of its existing debt;

(c) acquire, sell or agree to acquire or sell, material shareholdings, businesses or assets;

(d) enter into or amend any material contracts or arrangements, or incur any material additional indebtedness other than in the ordinary course of operating its business, except that Com Hem may refinance its existing debt; or

(e) amend the articles of association or any other constitutional documents.

The parties undertake to take all necessary actions in order to complete the Merger on the terms set out herein.

Conditions for the Merger

Completion of the Merger is conditional upon:

- that at a general meeting in Tele2, the shareholders of Tele2 approve the Merger Plan and resolve upon the Non-Cash Consideration (as defined in the Merger Plan) shares for the Merger;

- that at a general meeting in Com Hem, the shareholders of Com Hem approve the Merger Plan;

- that Tele2’s Registration Statement on Form F-4 in the United States becomes effective under the U.S. Securities Act of 1933, as amended, and not being the subject of any stop order or proceeding seeking a stop order by the Securities and Exchange Commission (the “SEC”);

- that Nasdaq Stockholm has admitted the Non-Cash Consideration shares to trading on Nasdaq Stockholm;

- that all permits and approvals of the competition authorities that are necessary for the Merger have been obtained on terms containing no remedies, conditions or undertakings which in the opinion of the Boards, acting in good faith, would have a material adverse effect on the business, competitive or financial position of Enlarged Tele2 following Completion (as defined in the Merger Plan);

- that the Merger is not in whole or in part made impossible or materially impeded as a result of legislation, court rulings, decisions by public authorities or anything similar;

- that the pre-merger undertakings made by Tele2 and Com Hem as set out in section 5 “Pre-merger undertakings” in the Merger Plan are not breached before the day of the registration of the Merger with the Swedish Companies Registration Office in any such way which would result in a material adverse effect on the Merger or Enlarged Tele2; and

- that no change, matter or event or series of changes, matters or events has occurred that has had or could reasonably be expected to have a material adverse effect on the financial position or operation, including sales, results, liquidity, equity ratio, equity or assets of Com Hem or Tele2 or the Enlarged Tele2, and as a result of which the other party cannot reasonably be expected to complete the Merger.

If the conditions set out in this section have not been satisfied and Completion has not taken place on or before March 31, 2019, the Merger will not be implemented and the Merger Plan shall cease to have any further effect, however that the Merger will only be discontinued and the Merger Plan shall only cease to have any further effect, to the extent permitted by applicable law, if the non-satisfaction is of material importance to the Merger or Enlarged Tele2. The Boards reserve the right to jointly waive, in whole or in part, one, several or all of the conditions above.

The Boards shall, subject to applicable law, be entitled to jointly decide to postpone the last date for fulfilment of the conditions from March 31, 2019 to a later date.

Financing

Tele2 has obtained committed financing for the Merger in the form of a bridge facility from a group of three banks with conditions to drawdown that are usual and customary for this type of facility. The bridge facility has a tenor of up to twenty-four (24) months and is to be used to finance the Merger and will be replaced and/or refinanced by the issuance of capital markets debt or loans with longer tenors.

Due diligence

When preparing for the Merger, the companies have conducted limited, customary due diligence reviews of certain business, financial, commercial and legal information relating to Tele2 and Com Hem, respectively. During such due diligence, each of Tele2 and Com Hem has confirmed that the results for FY 2017 are expected to meet market expectations. During the due diligence reviews, no other information that had not previously been disclosed and which would constitute inside information in Tele2 or Com Hem was shared.

Regulatory process

The Merger is subject to regulatory approval by the relevant competition authorities. The transaction is therefore expected to close during H2 2018. Tele2 will revert with more information on the regulatory timeline and process when it is available. Kinnevik has committed to participate in the European Commission merger control procedure and is prepared to effect pro-competitive measures if required to complete the Merger.

Rulings by the Swedish Securities Council in relation to the Merger

The Swedish Securities Council (Sw. Aktiemarknadsnämnden) has approved an extension of the period for preparing and filing the merger document with the Swedish Financial Supervisory Authority (the “SFSA”) (Sw. Finansinspektionen) from four weeks after the announcement of the Merger to 18 weeks after such date. The reason for the extension is the time-consuming process to prepare additional information pertaining to the filing requirements by the filings at the SEC (see Ruling 2018:01). Tele2 may request an additional extension if necessary. Further, the Securities Council has confirmed that Kinnevik providing a voting undertaking, including undertakings by Kinnevik to participate in the European Commission merger control procedure and be prepared to effect pro-competitive measures if required to complete the Merger, does not affect the possibility to take Kinnevik’s shares into account at the EGMs in Tele2 and Com Hem, respectively, resolving on the Merger Plan (see Ruling 2017:40).

Indicative timetable[17]

January 10, 2018 The Merger Plan is announced and made available to the companies’ shareholders

H2 2018 The Swedish merger document and the US Form F-4 are made public

H2 2018 EGMs in Tele2 and Com Hem

H2 2018 The Swedish Companies Registrations Office registers the Merger (subject toapproval by the relevant competition authorities)

Planned date for Com Hem’s dissolution

Com Hem will be dissolved and its assets and liabilities will be transferred to Tele2 when the Swedish Companies Registration Office registers the Merger. This is expected to occur in H2 2018. The companies will announce the date on which the Swedish Companies Registration office is expected to register the Merger at a later stage.

The last day for trading in the Com Hem shares is expected to be the day that falls two trading days prior to the registration of the Merger by the Swedish Companies Registration Office, and the first day of trading of the newly issued shares is estimated to take place two trading days following the day of the registration of the Merger.

Applicable law and disputes

The Merger shall be governed by and construed in accordance with the laws of Sweden. The Nasdaq Stockholm’s Takeover Rules, and the Swedish Securities Council rulings regarding the interpretation and application of the Takeover Rules, apply in relation to the Merger. In accordance with section V.2 of the Takeover Rules, Tele2 has undertaken towards Nasdaq Stockholm to comply with the Takeover Rules and to submit to any sanctions imposed by Nasdaq Stockholm upon breach of the Takeover Rules. The courts of Sweden shall have exclusive jurisdiction over any dispute arising out of or in connection with the Merger and the City Court of Stockholm shall be the court of first instance.

Advisers

Tele2 has retained Citigroup Global Markets Limited, Nordea Bank AB (publ) and Ondra LLP as financial advisers and Vinge as legal adviser as to Swedish law and Shearman & Sterling LLP as legal adviser as to US law. Com Hem has retained Goldman Sachs International as financial adviser and Linklaters as legal adviser. N M Rothschild & Sons Limited acted as the independent financial adviser to the Board of Directors of Tele2.

Press and analyst conference call

Tele2 and Com Hem will host a press and analyst conference call at 10:00 CET (09:00 GMT/04:00 EST). The conference call will be held in English and also made available as a webcast at Tele2’s website www.tele2.com.

Dial-in information

To ensure that you are connected to the conference call, please dial in a few minutes before the start of the conference call to register your attendance.

Dial-in numbers

SE: +46 (0)8 5065 3942

UK: +44 (0)330 336 9411

US: +1 646-828-8143

Confirmation code: 6272639

For additional information and media

Com Hem

Media

Fredrik Hallstan, Head of PR, Phone: +46 709 48 52 72

Investors

Marcus Lindberg, Investor Relations Manager, Phone: +46 734 39 25 40

Petra von Rohr, Director IR & Corporate Communications, Phone: +46 734 39 06 54

Tele2

Media

Viktor Wallström, VP Communications, Tele2 AB, Phone: +46 703 63 53 27

Malin Selander, Head of Communications, Tele2 Sweden, Phone +46 704 26 40 06

Investors

Erik Strandin Pers, Head of Investor Relations, Tele2 AB, Phone: +46 733 41 41 88

This is information that Tele2 AB (publ) and Com Hem Holding AB (publ) are obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out above, at 07.00 CET on 10 January 2018.

Tele2 in brief

Tele2 offers mobile services, fixed broadband and telephony, data network services, content services and global IoT solutions. Every day Tele2’s approximately 17 million customers across eight countries enjoy a fast and wireless experience through our award-winning networks[18]. Tele2 was founded in 1993, is headquartered in Stockholm and has been listed on the Nasdaq Stockholm since 1996. During the twelve months ended September 30, 2017, Tele2 had net sales of SEK 24.7 billion, reported an adjusted EBITDA of SEK 6.3 billion and an OCF of SEK 4.3 billion[19]. Learn more about Tele2 at www.tele2.com.

Com Hem in brief

Com Hem offers broadband, TV, play and telephony services to Swedish households and companies. Com Hem’s powerful and future-proofed network with speeds up to 1 Gbit/s, covers almost 60 precent of the country’s households, making Com Hem an important driver of creating a digital Sweden. Com Hem brings to its customers the largest range of digital-TV channels and play services via set top boxes as well as on-the-go for tablets and smartphones. Com Hem was founded in 1983 and has approximately 1,100 employees. Com Hem is headquartered in Stockholm and operates through four subsidiaries; Com Hem AB, Boxer TV Access AB, Phonera Företag AB and iTUX Communication AB.

During the twelve months ended September 30, 2017, Com Hem had net sales of SEK 7.1 billion, reported an Underlying EBITDA of SEK 2.9 billion and an OCF[20] of SEK 1.8 billion. Com Hem has been listed on the Nasdaq Stockholm since 2014. Learn more about Com Hem at www.comhemgroup.com.

Appendix

Merger Plan enclosed

For queries, please contact:

Investors

Marcus Lindberg, Investor Relations Manager

Tel: +46(0)734 39 25 40

marcus.lindberg@comhem.com

Media

Fredrik Hallstan, Head of PR

Tel: +46 (0)761 15 38 30

press@comhem.com

About Com Hem Group

Com Hem Group offers broadband, TV, play and telephony services to Swedish households and companies. Our powerful and future-proofed network with speeds up to 1 Gbit/s, covers half of the country’s households, making the Com Hem Group an important driver of creating a digital Sweden. We bring our 1.45 million customers the largest range of digital-TV channels and play services via set top boxes as well as on-the-go for tablets and smartphones. The company was founded in 1983 and has approximately 1,100 employees. Com Hem Group is headquartered in Stockholm and operates through four subsidiaries; Com Hem AB, Boxer TV Access AB, Phonera Företag AB and iTUX Communication AB. In 2016, Group sales totalled SEK 5,665 million. Since 2014 the Com Hem share is listed on Nasdaq Stockholm. www.comhemgroup.com.

[1] The Tele2 board members Cynthia Gordon and Georgi Ganev have not participated in the negotiations and agreement of the Merger Agreement or the Merger Plan as Cynthia Gordon is also a board member of, and Georgi Ganev is the CEO of, Tele2’s and Com Hem’s largest shareholder Kinnevik. The Com Hem board member Thomas Ekman has not participated in the negotiations and agreement of the Merger Agreement or the Merger Plan.

[2] Economic ownership and total cash consideration calculated based on 178,135,344 outstanding Com Hem shares (excluding any shares held in treasury) as of January 9, 2018.

[3] Kinnevik holds in aggregate 30.1 percent of the shares and 47.6 percent of the votes in Tele2, and in aggregate 18.7 percent of the shares and votes in Com Hem.

[4] Number of combined customers calculated as the sum of Tele2 customers and Com Hem consumer and Boxer segment RGUs as per the respective companies’ Q3 2017 reports.

[5] PTS, “The Swedish Telecommunications Market – First half-year 2017”. Market share data as of 30 June, 2017.

[6] The Tele2 board members Cynthia Gordon and Georgi Ganev have not participated in the negotiations and agreement of the Merger Agreement or the Merger Plan as Cynthia Gordon is also a board member of, and Georgi Ganev is the CEO of, Tele2’s and Com Hem’s largest shareholder Kinnevik. The Com Hem board member Thomas Ekman has not participated in the negotiations and agreement of the Merger Agreement or the Merger Plan.

[7] Merger consideration is received for each Com Hem share outstanding at the date of the completion of the Merger.

[8] Economic ownership and total cash consideration calculated based on 178,135,344 outstanding Com Hem shares (excluding any shares held in treasury) as of January 9, 2018.

[9] Based on the thirty trading days volume-weighted average share price of 125.95 per Com Hem share on Nasdaq Stockholm on January 9, 2018, the last trading day prior to the announcement of the Merger.

[10] Based on the closing price of 130.60 per Com Hem share on Nasdaq Stockholm on January 9, 2018, the last trading day prior to the announcement of the Merger.

[11] Number of combined customers calculated as the sum of Tele2 customers, Com Hem consumer and Boxer RGUs and Com Hem unique B2B customers as per the respective companies’ Q3 2017 reports. Tele2 Netherlands was re-classified as discontinued operations by Tele2 in December 2017 following the transaction between Tele2 Netherlands and Deutsche Telekom announced in December 2017 and has hence been excluded from the total number of customers.

[12] Tele2 Netherlands was re-classified as discontinued operations by Tele2 in December 2017 following the transaction between Tele2 Netherlands and Deutsche Telekom announced in December 2017 and has hence been excluded from the operating segments.

[13] The preliminary combined financial information is not financial pro forma information, and has not been audited or otherwise reviewed by the companies’ auditors. Differences in accounting policies or definitions of non-IFRS measures have not been taken into account. Financial information for Tele2 Sweden and Com Hem have been based on unaudited reported financial information. Adjusted EBITDA refers to Tele2’s EBITDA for Sweden and Com Hem’s underlying EBITDA. OCF defined as adjusted EBITDA – capex.

[14] Source: Factset. Based on date range of September 1, 2015 to January 9, 2018 and includes dividend reinvestment. Peer group includes Deutsche Telekom, KPN, Telefonica, Telenor, Telia and Vodafone.

[15] Kinnevik holding based on shares issued

[16] Kinnevik holding based on shares issued

[17] All dates are preliminary and may be subject to change.

[18] Customer numbers and number of countries include Tele2 Netherlands

[19] Tele2 Netherlands was re-classified as discontinued operations by Tele2 in December 2017 following the transaction between Tele2 Netherlands and Deutsche Telekom announced in December 2017 and has hence been excluded from the total number of customers, net sales, adjusted EBITDA and OCF. OCF defined as adjusted EBITDA – capex.

[20] OCF defined as underlying EBITDA – capex.