Tradedoubler Interim Report January - March 2019

The first quarter January – March 2019

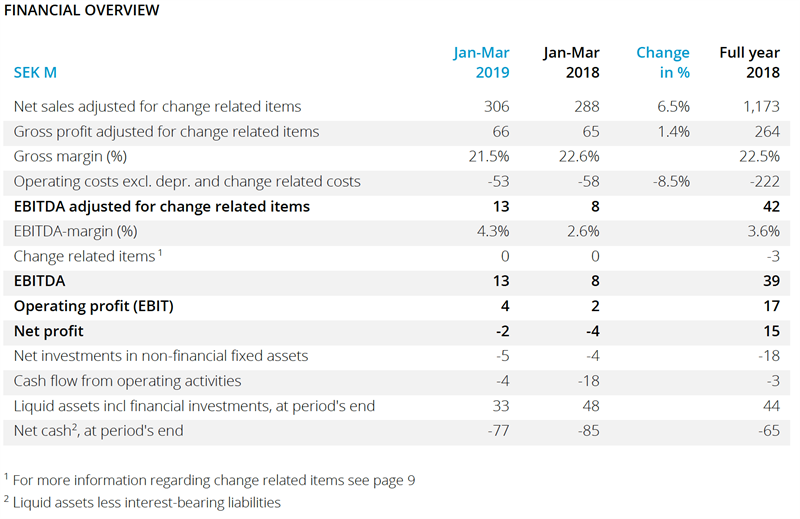

- Net sales amounted to SEK 306 M (288), an increase of 7% or 2% adjusted for changes in exchange rates.

- Gross profit was SEK 66 M (65), an increase of 1% or a decrease of 3% adjusted for changes in exchange rates. Gross margin was 21.5% (22.6).

- Operating costs excluding depreciation and change related items were SEK 53 M (58), a decrease of 9% or 11% adjusted for changes in exchange rates.

- EBITDA amounted to SEK 13 M (8). Adjusted for change related items, EBITDA was SEK 13 M (8).

- Activated expenses for product development were SEK 5 M (4).

- Cash flow from operating activities was SEK -4 M (-18) and the sum of cash and interest-bearing financial assets was SEK 33 M (48) at the end of the first quarter. Net cash in the first quarter decreased by SEK 12 M to SEK -77 M.

- Earnings per share, before and after dilution were SEK -0.05 (-0.08).

- As of 1 January 2019, the company applies IFRS 16 regarding the group’s leasing agreements. The restatement has impacted EBITDA for the period by SEK 3.9 M, net profit by -0.2 M, cash flow from operating activities by SEK 3.7 M and cash flow from financing activities by SEK -3.7 M. The effect on the balance sheet amounted to SEK 41 M. Comparative figures have not been restated.

CEO Matthias Stadelmeyer’s comments

“Tradedoubler´s results in the first quarter 2019 are within our expectations and reflect the continued positive trend of our business.

The growth rate of net sales improved to 7% in the year-on-year comparison and follows the trend of the last four quarters, where we improved net sales growth rates continuously from -14% in Q1 2018 to -8% in Q2, -2% in Q3, 5% in Q4 and now 7% in Q1 2019 (all non-currency adjusted). Contributing reasons for growth of net sales are new client wins and the fact that we generally win more business than we lose.

Due to the changes in the client portfolio and linked changes in the product mix our gross margin declined to 21.5% and the growth of gross profit was therefore smaller than the growth in net sales.

Costs are on the same level as recent quarters but lower than in Q1 2018 which results in an EBITDA of SEK 13 M and an improved EBITDA margin of 4.3%. EBITDA has been impacted by the change of reporting standard to IFRS 16. Without the adjustment for IFRS 16 EBITDA is SEK 9.4 M which is an increase of 10% vs Q1 last year.

As announced before we released a new publisher interface on 20 March and received very positive feedback form the market about the usability and functionality. As these new interfaces are all API based we are now able to develop new functionalities agile and quick and have been able to release some more added tools in the meantime already. This helps our partners and us to make connections quicker and drive growth.

All business areas develop to plan, and we continue on our mission to continuously improve our business by creating growth for our clients and partners.”

Contact information

Matthias Stadelmeyer, President and CEO, telephone +46 8 405 08 00

Viktor Wågström, CFO, telephone +46 8 405 08 00

E-mail: ir@tradedoubler.com

Other information

This information is information that Tradedoubler AB is obliged to make public pursuant to the EU Market Abuse Regulation and the Swedish Securities Markets Act. The information was submitted for publication, through the agency of the contact persons set out above, at 08.00 CET on 15 May 2019. Numerical data in brackets refers to the corresponding periods in 2018 unless otherwise stated. Rounding off differences may arise.