Tradedoubler interim report January – September 2017

Improved development

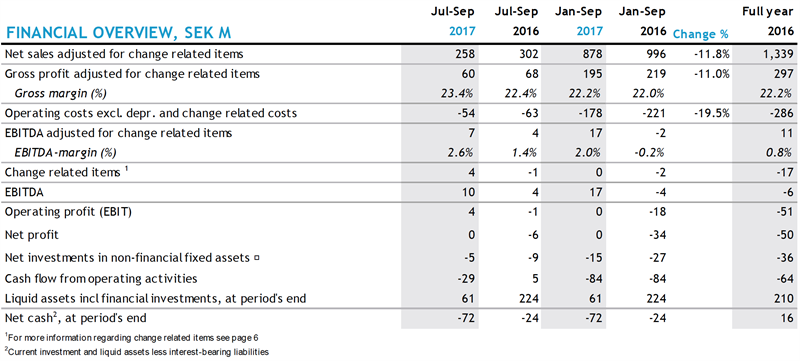

THE THIRD QUARTER JULY – SEPTEMBER 2017

- Net sales amounted to SEK 258 M (304). Net sales adjusted for change related items were SEK 258 M (302), which was a decrease of 15%.

- Gross profit adjusted for change related items was SEK 60 M (68), a decrease of 11% or 10% adjusted for changes in exchange rates. Gross margin adjusted for change related items was 23.4% (22.4).

- Operating costs excluding depreciation and change related items were SEK 54 M (63), a decrease of 15%.

- EBITDA amounted to SEK 10 M (4). Adjusted for change related items, EBITDA was SEK 7 M (4).

- Capitalised expenses for product development were SEK 5 M (9).

- Cash flow from operating activities was SEK -29 M (5) and the sum of cash and interest-bearing financial assets was SEK 61 M (224) at the end of the third quarter. Net cash in the third quarter decreased by SEK 37 M to SEK -72 M.

- Earnings per share, before and after dilution were SEK 0.00 (-0.15).

- In July Tradedoubler acquired the Swedish technology company Metapic.

THE INTERIM PERIOD JANUARY – SEPTEMBER 2017

- Net sales amounted to SEK 878 M (998). Net sales excluding change related items were SEK 878 M (996), which was a decrease of 12%.

- Gross profit excluding change related items was SEK 195 M (219), a decrease of 11% or 12% adjusted for changes in exchange rates. Gross margin excluding change related items was 22.2% (22.0).

- Operating costs excluding depreciation and change related items were SEK 178 M (221), a decrease of 20%.

- EBITDA amounted to SEK 17 M (-4). Excluding change related items, EBITDA was SEK 17 M (-2).

- Capitalised expenses for product development were SEK 15 M (27).

- Cash flow from operating activities was SEK -84 M (-84).

- Earnings per share, before and after dilution were SEK 0.00 (-0.80).

- In May Tradedoubler repurchased SEK 61 M of the nominal value of its own bond.

CEO MATTHIAS STADELMEYER’S COMMENTS

“In Q3 we continued the progress to lead Tradedoubler to profitability and financial independency. The decrease in gross profit slowed down while EBITDA and net profit improved again compared to the same period last year.

The improved gross profit trend is the result of the phase out of previously lost business and improvements in the underlying core business that we both communicated before. Both effects are expected to impact the GP trend positively in the coming quarters.

As the lost business had lower margins, the GP trend improved more than the revenue trend and the gross margin increased to 23.4%.

Operational costs decreased by 15% compared to Q3 last year which still is a result of the improvements in the management and service structure in the company we did during 2016. Operational costs in Q3 are usually lower than in other quarters due to seasonal reasons, but as we have finalised all larger improvement projects costs will continue on current levels.

Cash flow in the interim period was impacted by changes in working capital of SEK -73 M which is mainly explained by reduced prepayment amounts from customers when changing to other payment terms. We expect changes in working capital to be neutral going forward.

Because of a revaluation of the purchase price for R-Advertising we had a positive one-time impact on EBITDA of SEK 6 M.

In July we acquired the Swedish technology company Metapic (metapic.se). Metapic provides tools for influencers to create and post collages and links recommending products for advertisers being paid on CPC. It will help us to increase our business with influencers and publishers across all markets and strengthen our network.

In the coming quarters we will make further progress to improve our business continuously to realise our plans for 2017."

Contact information

Matthias Stadelmeyer, President and CEO, telephone +46 8 405 08 00

Viktor Wågström, CFO, telephone +46 8 405 08 00

E-mail: ir@tradedoubler.com

Other information

This information is information that Tradedoubler AB is obliged to make public pursuant to the EU Market Abuse Regulation and the Swedish Securities Markets Act. The information was submitted for publication, through the agency of the contact persons set out above, at 08.00 CET on 7 November 2017. Numerical data in brackets refers to the corresponding periods in 2016 unless otherwise stated. Rounding off differences may arise.

Tags: