Heimstaden publishes preliminary pro forma

Heimstaden AB (publ) (”Heimstaden” or the ”Company”) will as of today, April 1, 2019, commence meetings with selected investors in order to investigate the conditions for the Company to issue hybrid capital securities. In view of these meetings, and given that the Company has recently completed a major acquisition in the Netherlands, transferred properties and projects in Denmark and Sweden to Heimstaden Bostad AB, which are described in the Company's press release as of March 27, 2019, and closed the acquisition of properties from Denmark, which are described in the Company's press release as of December 27, 2018, (together the "Transactions"), the Company intends to, in connection with these meetings, present preliminary pro forma information, which are hereby published. Note that the contemplated issue of hybrid capital securities does not form part of the pro forma information set out herein.

PRELIMINARY PRO FORMA BALANCE SHEET AND INCOME STATEMENT

In order to describe the financial position before and after the Transactions, including the EUR 700 million bond issue by Heimstaden Bostad AB, under its outstanding EMTN program, earlier this year (the "EMTN bond issue"), a preliminary pro forma balance sheet as of December 31, 2018 and a preliminary pro forma income statement for the period January 1, 2018 - December 31, 2018 are presented below. The preliminary pro forma balance sheet is only intended to describe the hypothetical financial position of Heimstaden as if the Transactions and the EMTN bond issue had been completed as of December 31, 2018 and regarding the preliminary pro forma income statement the hypothetical result if the Transactions and the EMTN bond issue had been completed as of January 1, 2018.

Preliminary pro forma balance sheet for 2018

The preliminary pro forma balance sheet is based on Heimstaden's Year-end Report 2018, adjusted for balance sheet accounts as of December 31, 2018 attributable to the companies owning the properties covered by the Transactions and the EMTN bond issue. As part of the financing of the Transactions, a subordinated shareholder loan of SEK 1,025 million from Heimstaden's group parent company Fredensborg AS has been granted and hence included in the pro forma. The EMTN bond issue has been included on a net proceeds basis, i.e. adjusted for repaid loans. In the preliminary pro forma balance sheet, the exchange rates used in the adjustments have been adjusted to actual currency exchange rates as of December 31, 2018.

Preliminary pro forma income statement for 2018

The preliminary pro forma income statement is based on Heimstaden's Year-end Report 2018, which has been adjusted for income statements for 2018 attributable to the companies owning the properties covered by the Transactions and the EMTN bond issue. The historical outcome of the Transactions has thereby been adjusted for financial expenses in order to reflect the interest level and capital structure that Heimstaden has secured in connection with closing of the Transactions. For the EMTN bond issue, the actual interest cost has been used for the adjustment. An interest rate of 2.0% has been charged on the subordinated shareholder loan to Heimstaden AB from its group parent company Fredensborg AS. In the preliminary pro forma income statement, the currency exchange rates used in the adjustments are the average rates for 2018.

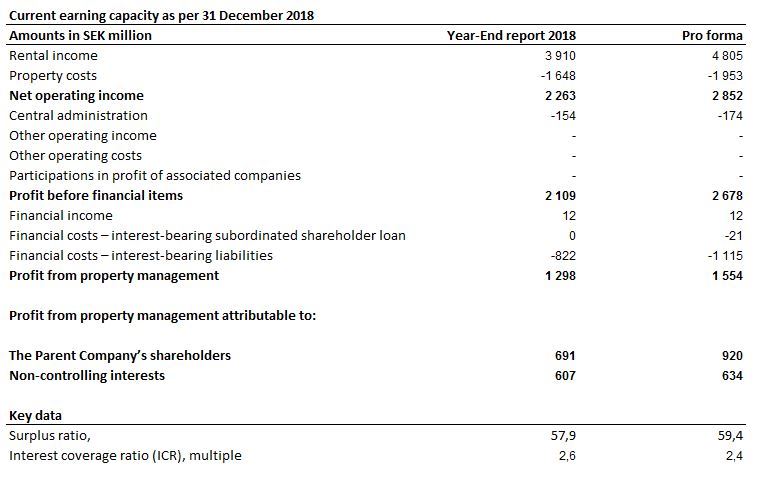

PRELIMINARY PRO FORMA EARNINGS CAPACITY

Below is a preliminary pro forma earnings capacity as of December 31, 2018, for Heimstaden pre and post the Transactions and the EMTN bond issue.

It is important to note that the preliminary proforma adjusted earning capacity should not be considered equal to a forecast for the current year or the next twelve months. The preliminary pro forma earnings capacity includes, for example, no assessment of future rents, vacancies and market interest rates. Furthermore, in the preliminary pro forma earnings capacity, changes in property values and derivatives, which impact Heimstaden's income statement, have not been considered.

The preliminary pro forma earnings capacity is based on the earnings capacity presented in Heimstaden's Year-end Report 2018. Such earnings capacity is based on the properties that were owned as of December 31, 2018 together with financing of such and is based on the property portfolio's, as of December 31, 2018, contracted rental income, current property and administration costs. Costs for interest-bearing liabilities have been based on the Group's average interest rate level on the balance sheet date including the effect of derivatives.

In the preliminary pro forma earnings capacity, historical data for the Transactions have been added to the earnings capacity presented in Heimstaden's Year-end Report 2018. The historical information is adjusted for the expected operational development of the properties covered by the Transactions', given Heimstaden's current management model, the agreed capital structure at the time of acquisition and owner-specific internal transactions. The earning capacity has also been adjusted with the current market interest expense for the EMTN bond issue.

FINANCIAL KEY RATIOS POST AND PRE THE TRANSACTIONS

In order to describe the financial effects of the Transactions, as well as the EMTN bond issue, the selected financial key figures, presented below, are based on the above preliminary pro forma earnings capacity and the preliminary pro forma balance sheet for 2018.

For further information, please contact:

Ingvor Sundbom, CFO +46 707 88 66 50 ingvor.sundbom@heimstaden.com

Adam Lindh, Head of Finance +46 708 83 96 74 adam.lindh@heimstaden.com

This information is such information that Heimstaden AB (publ) is obliged to publish in accordance with the EU Market Abuse Regulation. The information was submitted, through the agency of the above contact persons, for publication on April 1, 2019 at. 08:00 CET.

Heimstaden AB (publ)

Östra Promenaden 7 A

211 28 Malmö

Organisationsnummer 556670-0455, Bolagets säte Malmö

Telefon, växel 0770 – 111 050, www.heimstaden.com

Heimstaden is a leading real estate company in Northern Europe, with a focus on acquiring, refining, developing and managing housing and premises. Through our values, thoughtfulness, innovation and authenticity, we create values for our owners and caring homes for our tenants. Heimstaden has about 39,000 apartments and a property value of approximately SEK 76 billion value. Heimstad's preference share is listed on Nasdaq First North Premier. The head office is located in Malmö. Certified Adviser is Erik Penser Bank aktiebolag, +46 8-463 83 00 and certifiedadviser@penser.se. For more information, see www.heimstaden.com

Tags: