Loudspring: Half-year review 1 January – 30 June 2021 (unaudited)

Loudspring Oyj

Company release

31 August 2021 at 9:00 (EEST)

The full financial statement bulletin 2021 report in PDF can be found here.

LOUDSPRING IN BRIEF

We manage a portfolio of Nordic growth companies that have the potential of making a big environmental impact globally.Loudspring is an investment group focused on saving natural resources. Our customers saved 125 000 tons CO2 emissions during 2020 using our technology, which equates to the CO2 carbon footprint of 12 000 Finns on average.

Our strategy is to focus on the ownership and governance in Eagle Filters where we see a clear path to a long term profitable and scalable business, and divest more opportunistic higher risk investments, gradually transforming into an industrial company.

INVESTMENTS

Eagle Filters - power plant efficiency technologies - 85,2% ownership

Nuuka Solutions - smart building SaaS company - 42,3% ownership

Sofi Filtration - efficient water filtration technology - 20,5% ownership

Other holdings

Enersize - energy efficiency cloud analytics for heavy industry - 13,2% ownership

Aurelia Turbines - 0,3% ownership

Metgen - 1,1% ownership

Sansox - 10,3% ownership

Swap.com - 15,0% ownership

SUMMARY OF MAIN EVENTS

Figures below are unaudited estimates.

-

The combined non-audited revenue estimate of the core holdings was EUR 2,2 million in H1 2021, 12% increase from H1 2020

-

During the review period Loudspring sold its 24,0% ownership in ResQ Club to a group of private investors

- Net loss for the review period was EUR 957 thousand

- Loudspring description of risks and uncertainties is included at the end of the report.

SUMMARY OF OUTLOOK FOR 2021

- The market outlook for industrial energy efficiency technology is positive, with continuing challenges related to new customer acquisition due to travel limitations

- Eagle Filters’ respirator business provides an opportunity for growth potential, as new cost competitive production technology will be ramped up

- A need for securing additional funding may arise for Loudspring and most of the portfolio companies.

KEY FIGURES

| (In thousands of euros) | 1-6 / 2021 | 1-6 / 2020 | 1-12 2020 |

| Turnover | 90 | 95 | 185 |

| Operational result | -404 | -413 | -820 |

| Result for the financial period | -957 | -499 | -1 338 |

| Cash at the end of the review period | 774 | 612 | 650 |

| Shareholders equity at the end of the review period | 9 258 | 7 558 | 10 215 |

| Equity ratio | 65,0% | 62,1% | -71,2% |

Loudspring does not report consolidated accounts as Loudspring and its subsidiaries is regarded as a minor group in accordance with Finnish Accounting Act chapter 1 § 6 a.At the end of the review period Loudspring had the following financing arrangements and balance sheet items:

-

Cash EUR 1,2 million taking into account EUR 450 thousand (current) untapped credit limit from Nordea

- Receivables from ResQ exit that have been received after the review period totaling EUR 305 thousand

- The company owned listed shares (Enersize Oyj) with a fair value 30.6.2021 of EUR 628 thousand.

*The Enersize shares owned by Loudspring have been given as collateral for Loudspring and daughter company Eagle Filters loans. The consent of the collateral holder is required for the selling of these shares.

HOLDINGS

Loudspring’s effective fully diluted ownerships 30.6.2021.

|

Company |

Ownership (effective fully diluted) | Options | |

| Aurelia | 0,3 % | ||

| Eagle Filters | 85,2 % | ||

| Enersize | 13,2 % | ||

| Metgen | 1,1 % | ||

| Nuuka Solutions | 42,3 % | ||

| Sansox | 10,3 % | ||

| Sofi Filtration | 20,5 % | ||

| Swap.com | 15,0 % |

Eagle Filters Oy, Lumeron Oy and Loudspring Sweden AB were Loudspring’s only subsidiaries at the end of the review period. Ownership is reported as effectively fully diluted except for Enersize, where effective ownership is reported due to Enersize being a listed company. Effective ownership takes into account both direct and indirect ownership in the portfolio firms. Loudspring has indirect ownership through Clean Future Fund (CFF), a Finnish limited partnership. Exit and dividend proceeds from portfolio companies may differ from ownership percentages, both in positive or negative direction, due to different share classes and provisions in shareholder agreements.

CEO’S REVIEW

We have just experienced the hottest summer on record and the need for climate actions that reduce CO2 emissions is urgent and clear. Loudspring’s focus is on reducing CO2 emissions. We have been contemplating our optimal path forward, with a target to build value and operate with our own cash flow. Over the past years we have been steadily increasing our ownership in Eagle Filters. We are now at 85% ownership and have the option to go to 100 %. We have been making this choice as we see that Eagle Filters serves a large market, is technologically advanced and competitive, and can continue to grow for the foreseeable future. This development focus means that Loudspring will become an industrial company with clear undivided focus on Eagle Filters.

Going forward we will also integrate our impact report with our financial reporting so no separate report will be published. Impact reports will focus on CO2 emissions as we can measure these more reliably. To further increase the reliability of impact reporting Eagle Filters has been working together with customers to analyze data on utilization rates and efficiency improvements of their gas turbines.

OVERALL DEVELOPMENT

H1 2021 the markets for energy efficiency technologies developed positively. Energy utilities continued their gas turbine maintenance cycles after several delays in 2020. Nuuka’s SaaS billing continued to increase. However, new customer acquisitions remained challenging with ongoing limitations on physical meetings.

The combined revenue (non audited estimate) of core holdings was 2,2 million EUR, a 12% increase from H1 2020. The increase was due to growth of Eagle Filters. Core holdings include Eagle Filters, Nuuka Solutions and Sofi Filtration.The comments on associated companies are not full descriptions of each of the associated companies’ situations or their risks. Risks are described in more detail in the Risks and Uncertainties section. Loudspring will in this review provide unaudited financial estimates of its core portfolio provided that they are available at the time of this report.

REVENUE DEVELOPMENT FOR LOUDSPRING'S CORE HOLDINGS H1 2016 - H1 2021 (ESTIMATED, NON-AUDITED), EXCLUDING ENERSIZE

Loudspring has provided high and low revenue targets for Eagle Filters for this and the following years. The targets are not financial guidance and will only be in general updated on an annual or semi-annual basis. Deviation from these targets will not trigger a positive or negative profit warning.

Loudspring has previously given targets also for Nuuka Solutions. At the time of reporting, Nuuka is not on track to reach the minimum revenue target set earlier for 2021. Loudspring will continue to report Nuuka’s MRR development which is the most important parameter determining a SaaS company’s valuation but will no longer update targets for Nuuka Solutions, as targets will only be given for subsidiaries in Loudspring’s control.

EAGLE FILTERS

Eagle Filters provides advanced air filtration solutions for energy utilities, which increases the efficiency of gas turbines. The technology significantly reduces CO2 emissions and increases profitability. Eagle’s technology is being used by some of the world’s largest energy utilities. Eagle also produces high-quality respirators to fight the pandemic. Loudspring owns 85% of Eagle and has an option to acquire all remaining shares of Eagle Filters. The option is valid until the end of 2025. The purchase price is tied to the future financial performance of the company, and the target of Loudspring is to use a portion of Eagle’s future dividends for acquiring the remaining shares.

BUSINESS UPDATE

Eagle Filters companies’ revenue H1 2021 was EUR 1,5 million (unaudited estimate), a 18% increase from H1 2020. Eagle Filters companies’ revenue was EUR 2,44 million and EBITDA EUR -1,76 million for 2020 (audited).

Moving the production of industrial products in-house has caused delays in deliveries and moved a part of revenue to H2. Respirator sales volumes were limited during H1. The costs associated with production ramp up as well as delays in revenue recognition have impacted EBITDA negatively. Eagle’s order book is record high, with EUR 3,34 million of accumulated revenue and orders for 2021 at the time of reporting. May and June were slow in order intake. The pipeline of potential new orders remains on a high level. However, Eagle’s current manufacturing capacity limits growth in the near future. Investments to increase the output of industrial products are ongoing.

The key role of gas turbines as part of a clean energy infrastructure is becoming increasingly apparent. As the share of solar and wind energy increases, large quantities of energy storage will be needed to balance out the intermittency of weather dependent power production. Producing hydrogen and synthetic gas with electricity enables storage of large quantities of energy as well as conversion back to electricity with the existing gas turbine infrastructure that accounts for over 20% of world electricity production. A growing number of experts believe that gas turbines will be a long lasting and important part of a CO2 neutral energy infrastructure. Making these turbines run more efficiently is one step closer to achieving an uninterrupted supply of CO2 neutral electricity.

During H1 the company progressed in the development of manufacturing, logistics, quality and internal processes. Eagle’s quality system has been audited by a reputable notified body, and the company is in the final stages of issuance of ISO 9001 and 14001 certifications.

The company has developed new respirator products and ordered new fully automated production equipment to enable improvement of product characteristics while significantly lowering production costs. The new product versions will be launched after their production has been ramped up and CE certification process has been completed. Eagle continued development of new filter media, in order to lower production cost and further improve filtration efficiency of its industrial products.

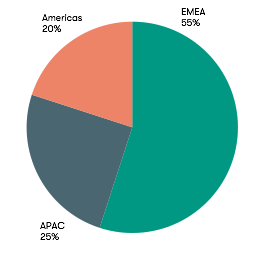

REVENUE SPLIT BY REGION

NON-AUDITED FINANCIALS H1 2021 (unaudited estimate) / H1 2020

|

Revenue H1 2021 |

Revenue H1 2020 | EBITDA H1 2021 | EBITDA H1 2020 |

| 1 546 000 | 1 270 000 | -1 582 000 | -783 000 |

EAGLE FILTERS REVENUE DEVELOPMENT

The semiannual revenue development for Eagle Filter companies is illustrated below.

REVENUE TARGET RANGE

Loudspring’s target range for 2021 and 2022 revenue from industrial products (excluding revenue from respirators) for Eagle Filters is illustrated below. The respirator market is currently volatile and difficult to predict and is excluded from the targets.

|

Targets for Eagle |

2021 | 2022 |

| Revenue low target* | 3 300 000 | 4 500 000 |

| Revenue high target* | 4 500 000 | 6 000 000 |

*The target does not include potential revenue from respirator sales. The above mentioned targets for Eagle Filters are revenue expected from Eagle Filters industrial products. The targets replace any previously given targets.

NUUKA SOLUTIONS

Nuuka is a PropTech company helping major real estate owners and developers, retail chains, and cities to deliver a great indoor climate, save energy, reduce operating costs, and increase property lifetime value. Nuuka’s hardware-independent platform connects to any Building Management System and IOT solution, analyzing and optimizing buildings by using machine learning. Nuuka has already connected 3000 buildings in six countries and strives to save the planet, one building at a time.

BUSINESS UPDATE

Nuuka companies’ revenue H1 2021 was EUR 604 thousand (unaudited estimate). Revenue decreased by 6% from H1 2020. Nuukas revenue was EUR 1,31 million and EBITDA EUR -1,25 million for 2020 (audited).

Nuuka’s SaaS during H1 was EUR 485 thousand, up 34% from H1 2020. Invoiced MRR grew to EUR 85 thousand / month in June, up 17% from June 2020. The decrease in revenue was mainly due to one large customer project being finalized, thus resulting in lower project revenues in 2021. Nuuka continues to concentrate on increasing SaaS revenues. EBITDA was impacted negatively by costs related to investments in growth.

Commercial pilots for Nuuka’s Artificial Intelligence and Diagnostics products were ongoing. Results show improved indoor air quality as well as significant energy savings.

The corona epidemic continues to slow down new customer acquisition. However, the outlook for energy saving technologies in the real estate industry is positive at the time of reporting.

Nuuka’s ongoing customer projects and pipeline provide a solid opportunity to increase Monthly Recurring Revenue (MRR) during H2. The recurring revenue grows gradually as buildings are connected to Nuuka over a period of several months or years in some cases.

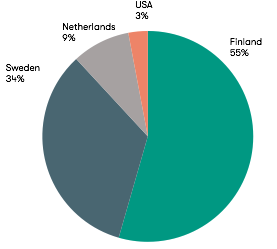

REVENUE SPLIT BY REGION

NON-AUDITED FINANCIALS H1 2021 (ESTIMATE) / H1 2020

|

Revenue H1 2021 |

Revenue H1 2020 | EBITDA H1 2021 | EBITDA H1 2020 |

| 604 000 | 644 400 | -1 066 000 | -504 000 |

NUUKA SOLUTIONS SAAS AND REVENUE DEVELOPMENT

Semiannual SaaS and revenue development for Nuuka Solutions is illustrated below.

SOFI FILTRATION

Sofi Filtration provides efficient water filtration technology. The company’s self-cleaning filter enables cost efficient micro filtration of large amounts of water. The technology can be applied in several industrial applications and enables energy savings and reduced use of freshwater.

BUSINESS UPDATE

Sofi Filtration’s revenues in H1 2021 were EUR 62 thousand (unaudited estimate). Revenues stayed on the same level compared to H1 2020.

After the slowdown the company experienced during the pandemic, Sofi is currently gradually rebuilding its customer pipeline.

The mining, steel and upstream oil & gas markets where Sofi operates are showing positive signs of market recovery.

REVENUE SPLIT BY REGION

NON-AUDITED FINANCIALS H1 2021 (UNAUDITED ESTIMATE) / H1 2020

|

Revenue H1 2021 |

Revenue H1 2020 | EBITDA H1 2021 | EBITDA H1 2020 |

| 62 000 | 60 000 | -252 000 | -279 000 |

SOFI FILTRATION REVENUE DEVELOPMENT

Semi-annual revenue development for Sofi Filtration is illustrated below.

OTHER HOLDINGS

As a Nasdaq First North Growth Market listed company, Enersize reports independently on its developments.

Enersize’s financial reports can be found on https://enersize.com/. Enersize stock owned by Loudspring at the end of H1 2021 had a market value of EUR 628 thousand.

Cleantech Invest SPV 1-6 companies were winded down during the period. The companies have been impaired before the review period and did not hold any value in Loudspring’s balance sheet.

IMPACT

-

Climate Change

-

Water

- Natural resources

For 2020 the estimated overall CO2 reduction impact for Eagle Filters is approximately 125 000 tons CO2. This is the estimated amount of CO2 that was not emitted, but would have been emitted to the atmosphere without deploying Eagle’s technology. The CO2 reduction equates to the annual carbon footprint of 12 000 Finns.

Our core purpose is saving natural resources. All of our portfolio companies provide products and solutions that save energy or water for the customers. To assess our impact, we have estimated the global CO2 impact of our subsidiary, Eagle Filters. We focus on providing an accurate estimate of Eagle Filters because the company’s environmental impact outweighs the rest of the portfolio many fold, and furthermore, as the main owner of the company we can take full credit for its impact and avoid any possible double accounting. We focus on CO2 impact because we can achieve much greater accuracy in our estimates as opposed to more complex calculations related to estimated water savings.

Eagle’s high efficiency air filtration technology significantly increases the fuel efficiency up to 5% and on average appx 2% of gas turbines by keeping the compressor blades clean and avoiding friction caused by fouling. This translates into a vast opportunity for global CO2 emission reduction, since over 20% of world electricity is produced with gas turbines. Natural gas alongside coal and petroleum are the primary sources of CO2 and causes of global warming. The seemingly very large positive environmental impact to revenue ratio of Eagle Filters is explained by the fact that the company is alleviating the problem at its root and cutting emissions at the world’s largest point emitters of CO2.

We provide an estimate of the handprint of Eagle’s products i.e. the CO2 savings achieved by customers by using Eagle’s products each year. Eagle’s own emissions from production, subcontracting and travel are not included as the footprint is insignificant in comparison to the handprint and this would not significantly affect the end result.

To assess the CO2 impact as accurately as possible we have, together with our customers, analyzed the gas turbines’ operational data, and compared performance after installing Eagle filters to the previous baseline performance of the turbines. This gives a very accurate estimate of the real CO2 savings achieved. A small part of the estimated savings is derived from smaller customer cases where data on pressure losses and fuel efficiency has not been analyzed, but we have instead used actual operating hours and utilization rates to estimate the CO2 savings by using conservative factors for efficiency improvement.

INCOME STATEMENT: REVENUE AND RESULT

REVENUE

The company's revenue for the review period 1 January to 30 June 2021 was EUR 90 thousand (1-6/2020: EUR 95 thousand). Loudspring aims to primarily increase revenue in its subsidiaries and associated companies. Loudsprings’ own revenue is small and mainly consists of services provided to Loudsprings’ portfolio companies. The majority of Loudspring’s expenses are operating costs related to increasing the value of subsidiaries and associated companies.

EXPENSES

Personnel costs during the review period 1 January to 30 June 2021 amounted to EUR 143 (172) thousand.

Other operating expenses in the review period 1 January to 30 June 2021 were a total of EUR 309 (296) thousand.

DEPRECIATION, AMORTIZATION AND WRITE-DOWNS

Depreciation, amortization and write-downs of intangible and tangible assets in the review period 1 January to 31 June 2021 was a total of EUR 1 (32) thousand.

OPERATING INCOME/LOSS

The company's operating loss for the review period 1 January to 30 June 2021 was EUR 404 (415) thousand.

FINANCIAL INCOME AND EXPENSES

Financial income in the review period 1 January to 30 June 2021 was a total of EUR 40 (0) thousand, financial expenses a total of EUR 193 (86) thousand.

RESULT FOR THE REVIEW PERIOD

The net loss of the review period 1 January to 30 June 2021 was EUR 524 (499) thousand. Enersize share price development during the review period impacted the result by EUR 399 thousand.

BALANCE SHEET: FINANCING AND INVESTMENTS

At the end of the review period, the balance sheet total stood at EUR 14 239 (12 173) thousand. The shareholders’ equity was EUR 9 258 (7 558) thousand and the equity ratio was 65,0% (62,1%).

The total current liabilities at the beginning of the review period was EUR 1 325 thousand and EUR 1 831 thousand at the end of the review period.During the review period Loudspring negotiated the repayment schedule of the NEFCO loan, delaying the first amortization from May 2021 to May 2022. Repayments for the NEFCO loan are made from May 2022 to November 2025. The interest rate for the NEFCO loan is eight percent p.a. on top of the reference rate (six months’ EURIBOR). The NEFCO loan agreement requires creditors consent (which shall not be unreasonably withheld) for the selling of shares in portfolio companies Eagle Filters, Nuuka Solutions, ResQ Club and Sofi Filtration. The Nefco loan agreement also includes the following financial covenants: minimum 3 month cash runway; and a solidity ratio of not less than 35%.According to its business plan Loudspring grows portfolio companies to increase their value. During 2021 Loudspring plans to secure sufficient financial resources via financing arrangements or exits.

INVESTMENTS/DIVESTMENTS DURING THE REVIEW PERIOD

Eagle Filters: Loudspring has funded Eagle Filters growth with loans totaling EUR 1,75 million.

Enersize Oyj: Loudspring sold shares in Enersize, decreasing Loudspring’s ownership in Enersize from 19,2% to 13,2%.

ResQ Club: Loudspring sold its ownership of 24,0% in ResQ Club to a consortium of Finnish private investors. The sales price was EUR 1,5 million and the impact on the result for the period is EUR -76 thousand. Loudspring received payments for the ResQ shares totaling EUR 1,2 million during the review period and payments totaling EUR 0,3 million after the review period.

PERSONNEL, MANAGEMENT AND ADMINISTRATION

The following members of the board were re-elected at the AGM 23rd of April: Mr. Matti Vuoria (re-elected as Chairman of The Board), Mr. Lassi Noponen, Mr. James Penney, Mr. Johan Strömberg and Mr. Anders Lundström.

Loudspring employed on average 4 persons during the review period.

ANNUAL GENERAL MEETING

The Annual General Meeting of Loudspring was held on the 23rd of April 2021 in Helsinki. The Annual General Meeting adopted the annual accounts for 2020 and resolved that the net loss of EUR 1 338 484,81 be transferred to accrued earnings and that no dividend be paid. The Annual General Meeting discharged the members of the Board of Directors and the CEO from liability for the year 2020. The Annual General Meeting resolved that the members of the Board of Directors be paid EUR 400 per month and that the Chairman of the Board would be granted 25 000 stock options, the Vice-Chairman 20 000 stock options and the other members of the Board of Directors 15 000 stock options as annual remuneration. The remuneration of the members of the Board of Directors is not paid to persons working for the company. The members of the Board of Directors are reimbursed for reasonable travel and lodging costs. Travel and lodging costs will not be compensated to those members of the Board of Directors who reside in the greater Helsinki area when the meetings are held in the greater Helsinki area.

The AGM resolved that five members be elected to the Board of Directors and re-elected the current members of the Board of Directors Mr. Lassi Noponen, Mr. James Penney, Mr. Matti Vuoria, Mr. Johan Strömberg and Mr. Anders Lundström as members of the Board of Directors for a term ending at the closing of the Annual General Meeting of year 2022.The Annual General Meeting resolved that the auditor’s fees are paid according to the auditor’s invoice approved by the company. The Annual General Meeting elected auditing firm KPMG Oy Ab as the company’s auditor. KPMG Oy Ab has informed that the principal auditor will be Mr. Petri Kettunen, Authorised Public Accountant.Three main authorizations were given: 1) authorizing the Board of Directors to decide on issuance of shares, 2) authorizing the Board of Directors to decide on issuance of options and 3) authorizing the Board of Directors to decide on acquisition of the company’s own shares.The AGM decisions are available in detail on the company website at: https://www.loudspring.earth/resolutions-of-loudspring-plc-s-annual-general-meeting,c3332502

OUTLOOK 2021

Due to the increased urgency on reducing CO2 emissions the market outlook for industrial energy efficiency technology is positive, with continuing challenges related to new customer acquisition due to travel limitations.

Eagle Filters’ respirator business provides an opportunity for growth potential, as new cost competitive production technology will be ramped upA need for securing additional funding may arise for Loudspring and most of the portfolio companies.

EVENTS AFTER THE REVIEW PERIOD

After the review period the following events have taken place:

-

Anders Lundström left Loudspring Oyj board of directors

RISKS AND UNCERTAINTIES

Loudspring Oyj (the “Company”) and its portfolio companies (the “Portfolio Companies”) are associated with a number of risks and uncertainties including but not limited to the following:

The Portfolio Companies of the Company are start-up and growth companies and Company’s value depends heavily on the future development of these companies and the Company’s ability to realize the value of its investments. The Company and the Portfolio Companies are associated with significant risks and uncertainties including but not limited to: 1) risks related to financial position and availability of additional financing that they dependent on, 2) risk related to Portfolio Companies’ acquisitions, expansions and ability to sustain growth, 3) risks related to competition and technological development, 4) risks related to protection of intellectual property rights, 5) dependence on a limited number of key employees, 6) various business related risks, such as dependence on a limited number of clients, technical and warranty risks, credit loss risk and currency fluctuation risk, 7) insurance risks and 8) economic, political and regulatory risks in various markets.

There can be no assurance that the Company or its Portfolio Companies will become profitable, which could impair the Company's and the Portfolio Companies’ ability to sustain their operations or obtain any required additional financing. Even if the Company or its Portfolio Companies would become profitable in the future, they may not necessarily be able to deduct the previous losses in taxation and sustain profit in subsequent periods.

Amendments to the laws and regulations and interpretations of laws and regulations relating to the Company's or Portfolio Company’s business may involve negative effects to the Company or to the Portfolio Company in question. In the event of any litigation, authoritative or administrative proceedings, risks related to financial sanctions and/or limitation of business opportunities may occur. Any acts or alleged acts in conflict with the positive societal values, reliability and good quality of the Company or its Portfolio Companies, may damage the Company’s or its Portfolio Companies’ reputation, long-term profitability and value.

In addition, the Company is associated with inter alia the following risks that relate to its business operations as a development and investment company:

The Company’s ability to make profit fully depends on the potential exit proceeds and cash flows it may receive from its Portfolio Companies and all acquisitions and disposals of assets are subject to uncertainty. There is a risk that the Company will not succeed in selling its holdings in the Portfolio Companies at the price the shares are being traded at on the market at the time of the disposal or valued at in the balance sheet. Furthermore, the Company may be affected by liquidity risk if liquidity will not be available to meet payment commitments due to the fact that the Company cannot divest its holdings quickly or without considerable extra costs.

The Company does not independently control its Portfolio Companies, other than its daughter company Eagle Filters Oy, and there may occur potential interest conflicts with the other shareholders and stakeholders exercising influence over each respective Portfolio Companies' operations or the information provided by a Portfolio Company to the Company may not be accurate or adequate. Furthermore, an investment in a Portfolio Company may be affected by the existence of shareholders agreements or articles of associations containing provisions restricting transferability of the Portfolio Companies' shares or otherwise having an impact on the value of said shares.

Covid-19 pandemic may cause severe negative effects to the Company and Portfolio Companies. These negative effects may include, but not be limited to, effects on operations, financing as well as negative effects on customers, suppliers and partners. Furthermore, the pandemic may cause completely unforeseeable negative effects.

FINANCIAL COMMUNICATION 2021

Loudspring Oyj Q3/2021 quarterly summary, which is not a financial performance report or a fully comprehensive report of all events, will be published 29.10.2021. The 2022 financial information release schedule will be published by the end of 2021. Loudspring’s releases, including semiannual and annual financial reports are available at https://www.loudspring.earth/releases.

SHARE

At the end of the review period the company had a total of 43 261 691 shares, divided into 4 308 594 series K shares each having 20 votes at shareholders’ meetings, and 38 953 097 series A shares each having one vote at shareholders’ meetings. At the end of the review period the company had options that give a right to subscribe 2 495 680 class A-shares (of which 1 439 680 options are pending registration with the Finnish Patent and Registration Office).

During the review period 355 300 K shares were converted into A shares.

Loudspring board members and the management team owned on 30.6.2021 a total of 6 557 358 Series A shares, 3 331 110 Series K shares and 1 024 886 options (of which 549 886 are pending registration with the Finnish Patent and Registration Office) that give a right to subscribe class A-shares taking into account all shares and options owned directly and indirectly through companies controlled or influenced by them or through their family members.The shares owned by board members and the management team represent approximately 22,9% of the company's all outstanding shares registered on 30.6.2021 in the trade register and 58,5% of the voting rights of the shares.

Loudspring had 4 820 registered shareholders according to the share register on 30.6.2021. Euroclear Finland had 3 684 shareholders and Euroclear Sweden 1 136 shareholders.

The number of class A shares, which are traded on Nasdaq First North Growth Market, at the end of the financial period was 38 953 097 and the market cap on 30.6.2021 EUR 11,3 million. When taking into account class K shares, which are not subject to multilateral trading, the market cap was EUR 12,6 million. Closing price of the company’s class A share on 30.6.2021 was 0,29€ per share on Nasdaq First North Growth Market Finland. During the review period the highest price paid for the company’s class A share on Nasdaq First North Growth Market Finland was 0,46€, the lowest 0,27€, and the volume-weighted average 0,38€ per share.

The company has a liquidity provision agreement with Pareto Securities that fulfils Nasdaq Stockholm AB’s Liquidity Providing (LP) requirements. Loudspring’s shares traded on Nasdaq First North Growth Market Finland are not covered by the liquidity provision agreement.

DEFINITIONS

| Equity ratio (%) | Total equity x 100/ Total assets |

| Number of shares | Total number of shares at the end of the period |

| Weighted average number of shares | Issue and conversion-adjusted weighted average number of shares |

| Diluted number of shares | Total number of shares at the end of the period added by outstanding warrants |

| Weighted average number of shares, Diluted | Issue and conversion-adjusted weighted average number of shares added by outstanding warrants |

| Basic earnings per share (€) | Result for the (financial) period / Issue and conversion-adjusted weighted average number of shares |

| Diluted earnings per share (€) | Result for the (financial) period / Issue and conversion-adjusted weighted average number of shares added by outstanding warrants |

ACCOUNTING PRINCIPLES OF THE SEMI-ANNUAL ACCOUNTS

Semiannual accounts have been prepared following generally accepted accounting principles and applicable laws. The half-year figures for 2020 and 2021 have not been audited. The full year figures for 2020 of the profit and loss statement, balance sheet and statement of cash flows are audited. The figures presented are rounded.

FINANCIAL INFORMATION

PROFIT AND LOSS STATEMENT

|

EUR '000 |

1 - 6 / 2021 | 1 - 6 / 2020 | 1 - 12/ 2020 |

| Turnover | 90 | 95 | 185 |

| Materials and services | -46 | -10 | -11 |

| Personnel expenses | -143 | -172 | -327 |

| Depreciation and impairment charges | -1 | -32 | -33 |

| Other operating expenses | -304 | -296 | -634 |

| Operating loss | -404 | -413 | -820 |

| Financial income | 40 | 0 | 377 |

| Financial expenses | -193 | -86 | -896 |

| Result before taxes | -957 | -499 | -1 338 |

| Taxes | 0 | 0 | 0 |

| Result for the financial period | -957 | -499 | -1 338 |

| Basic earnings per share | -0,02 | -0,02 | -0,04 |

| Diluted earnings per share | -0,02 | -0,01 | -0,04 |

BALANCE SHEET

| EUR '000 | 30/6/2021 | 30/6/2020 | 31/12/2020 |

| Assets | |||

| Non-current assets | |||

| Intangible assets | 0 | 0 | 0 |

| Tangible assets | 12 | 14 | 12 |

| Holdings in group undertakings | 5 531 | 1 771 | 5 415 |

| Holdings in participating interests | 4 931 | 5 188 | 6 618 |

| Other shares and similar rights of ownership | 628 | 1 812 | 1 336 |

| Total non-current assets | 11 101 | 8 785 | 13 418 |

| Current assets | |||

| Accounts receivables | 179 | 187 | 161 |

| Loan receivables from participating interests | 0 | 1 130 | 40 |

| Loan receivables from group undertakings | 1 272 | 1 350 | 0 |

| Other receivables | 369 | 63 | 56 |

| Deferred assets | 4 | 10 | 12 |

| Cash and cash equivalents | 774 | 612 | 650 |

| Total current assets | 3 138 | 3 388 | 922 |

| Total assets | 14 239 | 12 173 | 14 340 |

| Equity and liabilities | |||

| Shareholders equity | |||

| Share capital | 80 | 80 | 80 |

| Reserve for invested non-restricted equity | 22 962 | 19 465 | 22 962 |

| Revaluation reserve | 1 958 | 1 958 | 1 958 |

| Retained earnings | -14 786 | -13 447 | -13 447 |

| Result for the financial period | -957 | -499 | -1 338 |

| Total shareholders equity | 9 258 | 7 558 | 10 215 |

| Liabilities | |||

| Non current | |||

| Deferred tax liability | 0 | 0 | 0 |

| Bank loans | 3 150 | 3 800 | 2 900 |

| Current liabilities | |||

| Bank loans | 1 242 | 500 | 1000 |

| Accounts payable | 31 | 22 | 50 |

| Other current liabilities | 445 | 302 | 67 |

| Accruals | 114 | 63 | 108 |

| Total liabilities | 4 981 | 4 615 | 4 125 |

| Total equity and liabilities | 14 239 | 12 173 | 14 340 |

STATEMENT OF CASH FLOWS

| EUR '000 | 1 - 6 / 2021 | 1 - 6 / 2020 | 1 - 12 / 2020 |

CASH FLOW FROM OPERATING ACTIVITIES |

|||

|

Result before taxes |

-957 | -499 | -1 338 |

| Taxes | 0 | 0 | 0 |

| Adjustments | 254 | 125 | 380 |

| Depreciation | 1 | 32 | 33 |

| Change in receivables, increase (-), decrease (+) | -323 | 47 | 78 |

| Change in current liabilities, increase (+), decrease (-) | 365 | -99 | 59 |

| Cash flow from operating activities | -660 | -394 | -788 |

CASH FLOW FROM INVESTING ACTIVITIES |

|||

| Investments in tangible and intangible assets | 0 | 0 | -30 |

| Investments in group undertakings | 0 | -100 | -2 875 |

| Investments in shares of participating companies | -21 | -613 | -1 396 |

| Returns received for participating companies | 1 644 | 0 | 22 |

| Dividend income from shares | 0 | 0 | 0 |

| Loans granted to participating companies | 0 | -560 | -150 |

| Loans granted to group undertakings | -1 750 | -450 | -117 |

| Repayment of loan receivables | 10 | 100 | 185 |

| Loan receivables from others | 0 | 0 | 3 |

| Cash flow from investing activities | -117 | -1 623 | -4 359 |

CASH FLOW FROM FINANCING ACTIVITIES |

|||

| Share issue against payment | 0 | 1 450 | 4 947 |

| Increase in non- current liabilities | 0 | 800 | 1 000 |

| Increase in current liabilities | 900 | 0 | 0 |

| Decrease in interest bearing liabilities | 0 | -70 | -600 |

| Dividends and other profit distribution | 0 | 0 | 0 |

| Cash flow from financing activities | 900 | 2 180 | 5 347 |

CHANGE IN CASH AND CASH EQUIVALENTS |

123 |

163 |

200 |

| Cash and cash equivalents at the beginning of the period | 650 | 450 | 450 |

| Cash and cash equivalents at the end of the period | 774 | 612 | 650 |

STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY

| EUR '000 | Share capital | Revaluation reserve | Reserve for invested non-restricted equity | Retained earnings | Result for the financial period | Total shareholders’ equity |

|

Shareholders’ equity January 1, 2021 |

80 | 1 958 | 22 962 | -14 786 | 0 | 10 214 |

| Share issue | 0 | 0 | 0 | 0 | 0 | 0 |

| Revaluation reserve | 0 | 0 | 0 | 0 | 0 | 0 |

| Reserve for invested non-restricted equity | 0 | 0 | 0 | 0 | 0 | 0 |

| Result for the financial period | 0 | 0 | 0 | 0 | -957 | -957 |

| Shareholders’ equity June 30, 2021 | 80 | 1 958 | 22 962 | -14 786 | -957 | 9 258 |

| Shareholders’ equity January 1, 2020 | 80 | 1 958 | 18 015 | -13 447 | 0 | 6 607 |

| Revaluation reserve | 0 | 527 | 0 | 0 | 0 | 527 |

| Reserve for invested non-restricted equity | 0 | 0 | 1 450 | 0 | 0 | 1 450 |

| Result for the financial period | 0 | 0 | 0 | 0 | -499 | -499 |

| Shareholders’ equity June 30, 2020 | 80 | 1 958 | 19 465 | -13 447 | -499 | 7 558 |

|

Shareholders’ equity January 1, 2020 |

80 | 1 958 | 18 015 | -13 447 | 0 | 6 606 |

| Share issue | 0 | 0 | 4 947 | 0 | 0 | 4 947 |

| Revaluation reserve | 0 | 0 | 0 | 0 | 0 | 0 |

| Reserve for invested non-restricted equity | 0 | 0 | 0 | 0 | 0 | 0 |

| Result for the financial period | 0 | 0 | 0 | 0 | -1 338 | -1 338 |

| Shareholders’ equity December 31, 2020 | 80 | 1 958 | 22 962 | -13 447 | -1 338 | 10 214 |

Contact information:

Jarkko Joki-Tokola, CEO, Loudspring Oyj. Tel. +358 40 637 0501, jarkko@loudspring.earth

Erik Penser Bank AB, Certified Adviser. Tel. +46 8 463 83 00, certifiedadviser@penser.se

Loudspring in brief

Loudspring is an investment company focused on saving natural resources. We own and operate Nordic growth businesses that are fighting climate change and making a big environmental impact. We have a diversified business portfolio with technologies that save energy, water and materials in industry, real estate and in everyday life.

The company group is listed on First North Growth Market Finland under the ticker LOUD and on First North Growth Market Stockholm under the ticker LOUDS.

LinkedIn: https://www.linkedin.com/company/loudspring/

Twitter: @loudspring

FB: @loudspringco