Ikano Bank AB (publ) Interim Report 2018-06

We are building for the future

“2018 began with growth in most markets. The work to ensure long-term profitable growth and customer benefit continued, with related costs negatively affecting our result for the period. The result for 2018 was also positively affected by a portfolio sale. We work with improving our cost efficiency and profitability, while at the same time building new ways to strengthen our future competitiveness. Concluding, I note that we have good customer offerings, business volume has increased and we see potential to grow in all our markets. With that as a base, we build for the future.”

Håkan Nyberg, MD

Results for the first half-year 2018

(Comparative figures in brackets are as of 30 June 2017 unless otherwise stated)

- Business volumes increased by 5 percent to SEK 69,272 m (65,732)

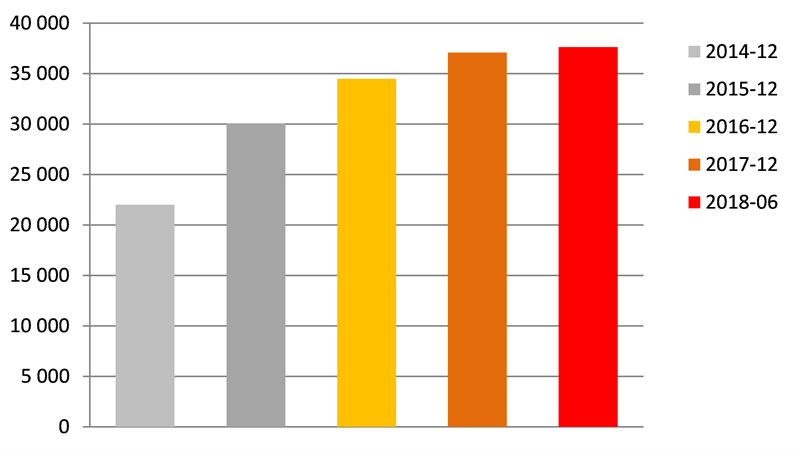

- Lending including leasing increased by 6 percent to SEK 37,621 m (35,523)

- Deposits from the public rose by 4 percent to SEK 26,311 m (25,285)

- Operating profit decreased by 35 percent to SEK 235 m (361)

- Net profit for the period decreased to SEK 122 m (265)

- Net interest income decreased marginally, totalling SEK 978 m (982)

- Return on equity was 6.5 percent (10.4)

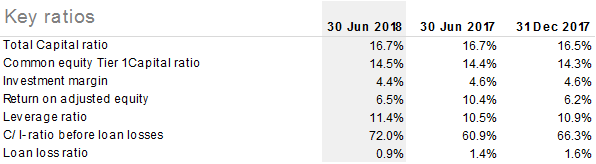

- The common equity Tier 1 capital ratio was 14.5 percent (14.4) and the total capital ratio was

16.7 percent (16.7) - The liquidity reserve was SEK 2,404 m (2,557) and the total liquidity portfolio amounted to

SEK 5,583 m (5,506)

Outlook for the remainder of 2018:

We expect continued growth on our markets and our comprehensive work with outsourcing our IT-services will continue. We have so far seen results in terms of increased stability. We are continuing to invest in our technical platform to secure sustainable and profitable growth and customer benefit. Our strategy to act and grow in the UK market as a branch also after Brexit remains.

For definitions of alternative indicators used to describe the Bank's activities see the Bank's Annual Report for 2017, available on the Bank's website www.ikanobank.se/om-banken/ekonomisk-information

Lending including leasing, SEK m Deposits from the public, SEK m

Ikano Bank's interim report is available on the bank's website:

www.ikanobank.se/om-banken/ekonomisk-information

This is information that Ikano Bank AB (publ) is required to disclose in accordance with the EU Market Abuse Regulation and the Securities Market Act. The information was submitted for publication on 31 August 2018 at 09:00 CET.

For more information

Håkan Nyberg, MD, tel: +46 70 397 0904

About Ikano Bank

Ikano Bank offers simple and attractive savings and loan products for consumers, sales support services for retailers, and leasing and factoring solutions for corporate customers. Ikano Bank has a presence in Sweden, Denmark, Finland, Norway, the UK, Poland, Germany and Austria.

About Ikano

Ikano is a multinational group with operations in banking, real estate, production, insurance and retail. The Ikano Group was founded in 1988 and is owned by the Kamprad family. For more information, go to www.ikanogroup.com

Taggar: