Swedbank's Year-end report 2017

Swedbank's President and CEO comments: “To be more competitive and increase customer value, we have decided to accelerate the pace of investment and devote more resources to digitisation and automation of daily banking services.”

Interim report for the fourth quarter 2017

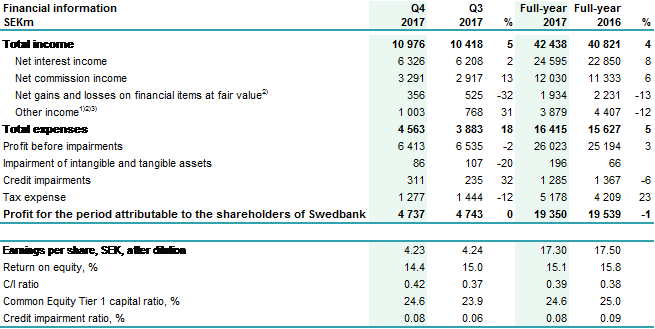

Fourth quarter 2017 compared with third quarter 2017

- Increased mortgage volumes lifted net interest income

- Net commission income benefited from a bullish stock market and PayEx

- FX effects and slow fixed income and currency trading weighed down net gains and losses on financial items

- Restructuring reserve increased costs

- Good credit quality

- Stronger capitalisation

- Proposed dividend per share of SEK 13.00 (13.20)

1) One-off income from sale of Hemnet of SEK 680m in first quarter 2017.

2) One-off income from VISA of SEK 2 115m in second quarter 2016, of which Net gains and losses on financial items at fair value SEK 457m and Other income SEK 1 658m.

3) Other income in the table above includes the items Net insurance, Share of profit or loss of associates, and Other income from the Group income statement.

For further information:

Gregori Karamouzis, Head of Investor Relations, Telephone +46 72 740 63 38

Josefine Uppling, Press Officer, Telephone +46 76 114 54 21

This announcement involves the disclosure of inside information

Swedbank AB (publ) is required to disclose this information pursuant to Regulation (EU) No 596/2014 on market abuse, the Swedish Securities Markets Act (2007:528), the Swedish Financial Instruments Trading Act (1991:980) and the regulatory framework of Nasdaq Stockholm. This information was sent to be published on 6 February 2018 at 7.00 CET.

Swedbank promotes a sound and sustainable financial situation for the many people, households and companies. Our vision is to contribute to development “Beyond Financial Growth”. As a leading bank in the home markets of Sweden, Estonia, Latvia and Lithuania, Swedbank offers a wide range of financial services and products. Swedbank has over 7 million retail customers and around 647 000 corporate customers and organisations with 220 branches in Sweden and 134 branches in the Baltic countries. The group is also present in other Nordic countries, the US and China. As of 24 October, 2017 the group had total assets of SEK 2 460 billion.

Read more at www.swedbank.com

Tags: