Swedbanks´s Interim report third quarter 2020

Swedbank´s President and CEO Jens Henriksson comments: “Swedbank delivered another strong quarter in uncertain times”

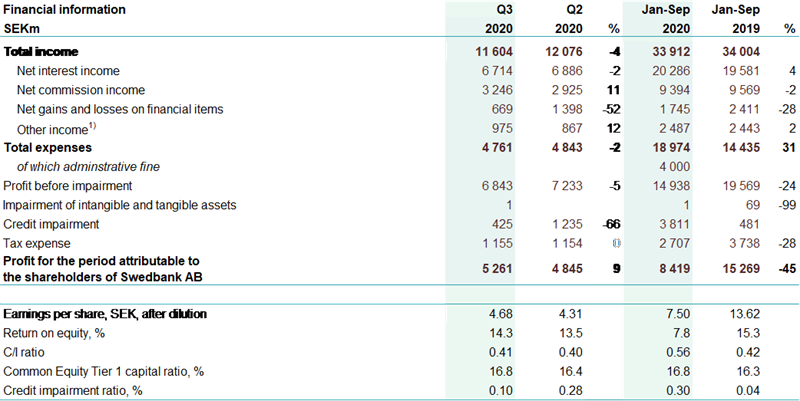

Third quarter 2020 compared with second quarter 2020

- Lower net interest income due to lower market rates

- Stronger income from cards and asset management positively affected net commission income

- Stabilised net gains and losses on financial items after a volatile first half of the year

- Low investigation-related expenses due to Covid-19

- Lower provisions for potential credit impairments related to the effects of Covid-19

- Solid capital and liquidity buffers

1) Other income includes the items Net insurance, Share of profit or loss of associates and joint ventures and Other income from the Group income statement.

Contact:

Annie Ho Unni Jerndal

Head of Investor Relations Head of Group Press Office

annie.ho@swedbank.com unni.jerndal@swedbank.com

+46 70 343 7815 +46 73 092 1180

Swedbank AB (publ) is required to disclose this information pursuant to the Swedish Securities Markets Act (2007:528), the Swedish Financial Instruments Trading Act (1991:980) and/or the regulatory framework of Nasdaq Stockholm). This information was sent to be published on 20 October at 07:00 CET.

Swedbank encourages a sound and sustainable financial situation for the many households and businesses. As a leading bank in our home markets of Sweden, Estonia, Latvia and Lithuania, Swedbank offers a wide range of financial services and products. Swedbank has over 7 million retail customers and around 600 000 corporate customers and organisations with 160 branches in Sweden and 92 branches in the Baltic countries. The group is also present in other Nordic countries, the US and China. Read more at www.swedbank.com

Tags: